Bitcoin fees note 170% hike as market health turns green on multiple fronts

After lagging behind Ethereum for most of April, Bitcoin turned up the heat in the last week of April after the world’s largest digital asset ended up as the best performing crypto-asset in the industry.

According to Coinmetrics’ latest State of the Network report, Bitcoin’s market cap rose by 17 percent over the last week, with its active addresses having risen to 928k addresses, a registered hike of 12.2 percent.

However, the most impressive statistic was the hike recorded by Bitcoin transaction fees. BTC fees were up by 170 percent week over week, a finding that indicates that network demand is operating at an extremely high level, at the moment.

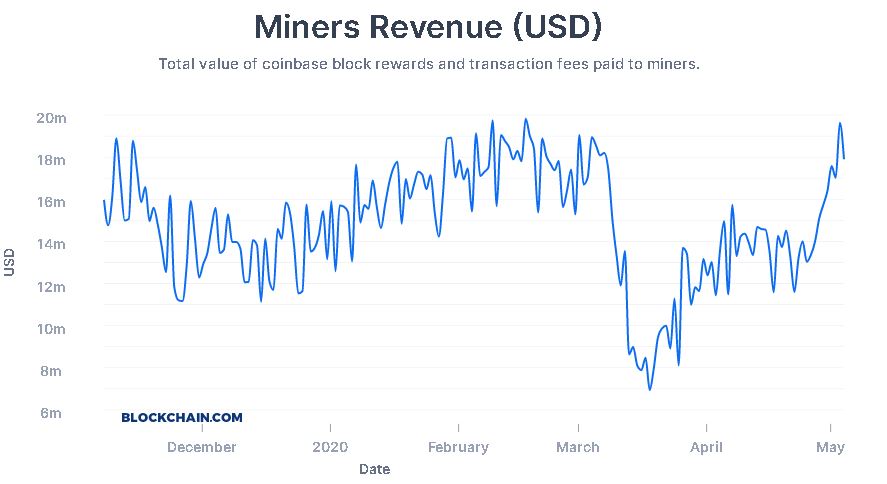

Source: Blockchain

Data from blockchain.com confirmed that the aforementioned hike in Bitcoin fees as miners revenue on 3 May attained yearly high levels of $19.63 million on the charts. Hence, this led to a high BTC fee-to-revenue ratio of 6 percent over the last week, a figure that is at its highest level since June 2019.

A higher BTC fee-t0-revenue ratio is a key indicator of a healthy market.

Bitcoin’s MVRV ratio above 1

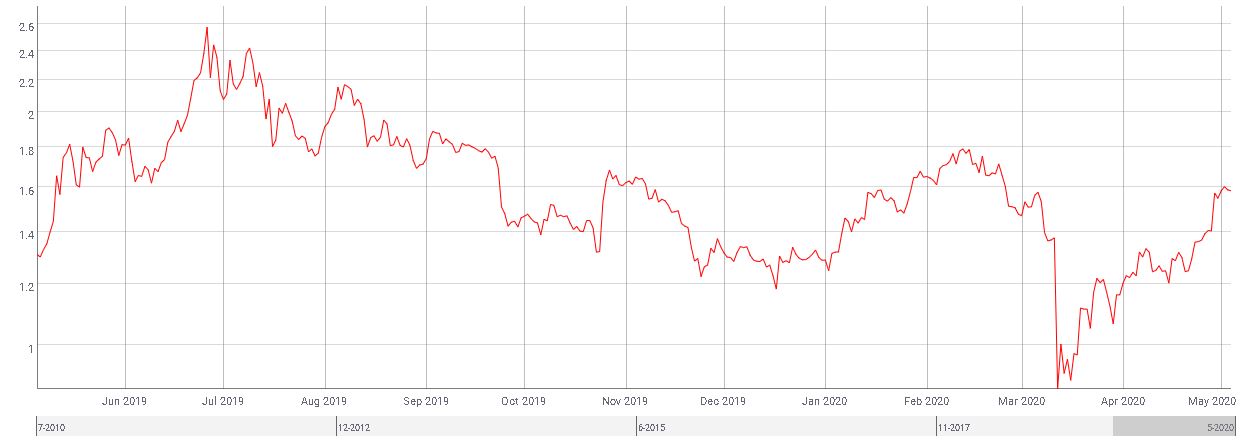

Source: Coinmetrics

Further, according to Coinmetrics’ chart, the MVRV ratio of Bitcoin has spiked above normal levels as well. MVRV is simply the ratio comparing the two i.e. MVRV = Market Cap/Realized Cap. It registers a sense of when the exchange-traded price is below “fair value” and is also quite useful for spotting market tops and bottoms.

A higher ratio indicates that Bitcoin is currently incurring a higher market value, when compared to its realized value in the ecosystem.

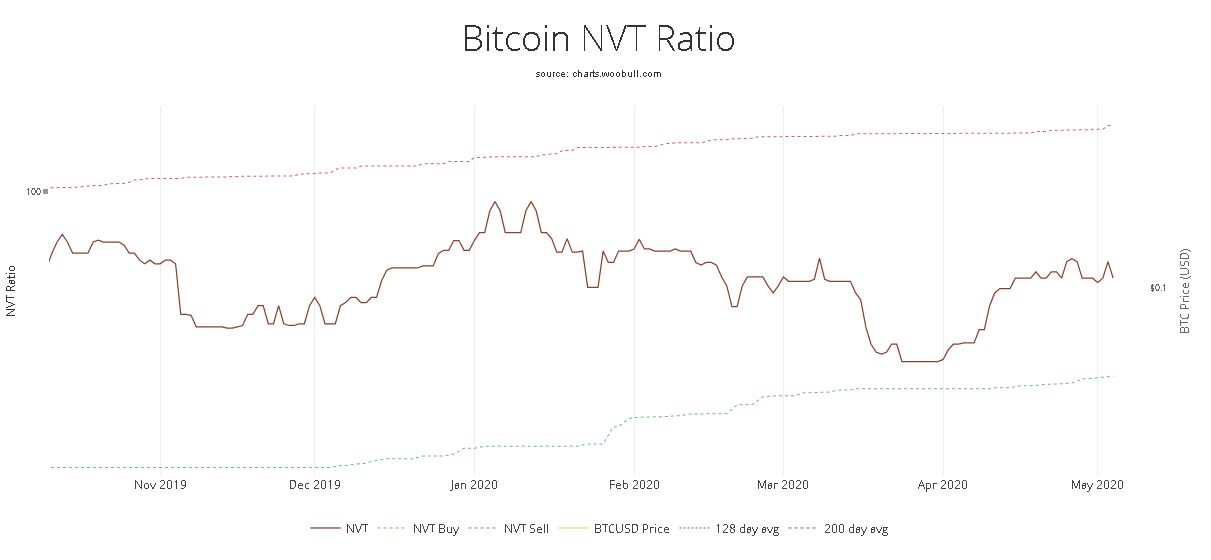

Source: woobull.charts

Bitcoin’s NVT ratio was high as well, following the drop below 1 during the March collapse. The higher NVT ratio could be a result of higher network usage as its network valuation is outstripping the value being transmitted on its payment network. A higher Bitcoin NVT ratio also transpires when investors view the crypto-asset as a high return investment.

With important metrics turning green all across the ecosystem, a strong case can be made for Bitcoin’s improving network health in the current market. Although price volatility remains relatively high, a sense of stability is presently being reciprocated by Bitcoin’s blockchain.