Bitcoin Futures rolls into positive premiums as $7,000 left in the wake

With the halving less than 20 days away, it’s crunch time. Bitcoin, after playing push and pull with the $7,000-mark, broke out on the eve of 23 April and now with bullish momentum behind it, derivative traders are expecting the premier cryptocurrency to move up, not only till the supply schedule shift, but beyond it as well.

According to data from Skew markets, traders, on exchanges across the Bitcoin Futures market, are more optimistic about the price. The rolling basis for Futures contracts on both a monthly and a quarterly basis are moving up, and are out of negative premium valuations.

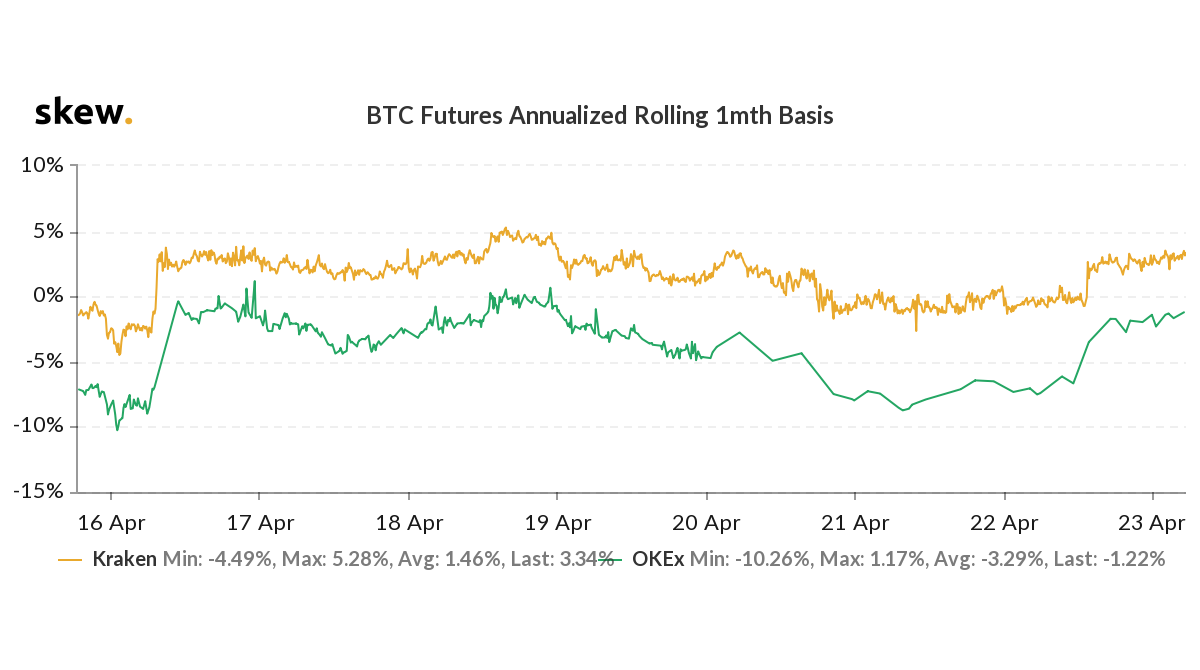

OKEx and Kraken BTC Futures rolling basis 1-month | Source: skew

On the short-term scale, exchanges like Kraken and OKEx offering one-month Futures contracts have seen a significant jump in their rolling basis. The American exchange saw its basis jump from -0.74 percent to 2 percent, in less than 2 hours, and at press time, the basis was at 3.49 percent, its highest in over a week.

Further, OKEx’s jump was more significant in comparison as it had a rolling basis of -8.43 on 21 April, a figure which less than 48 hours later rose to -1.22 percent. Despite being in the negative and given the swift nature of the premium turnaround, a move over 0 is imminent.

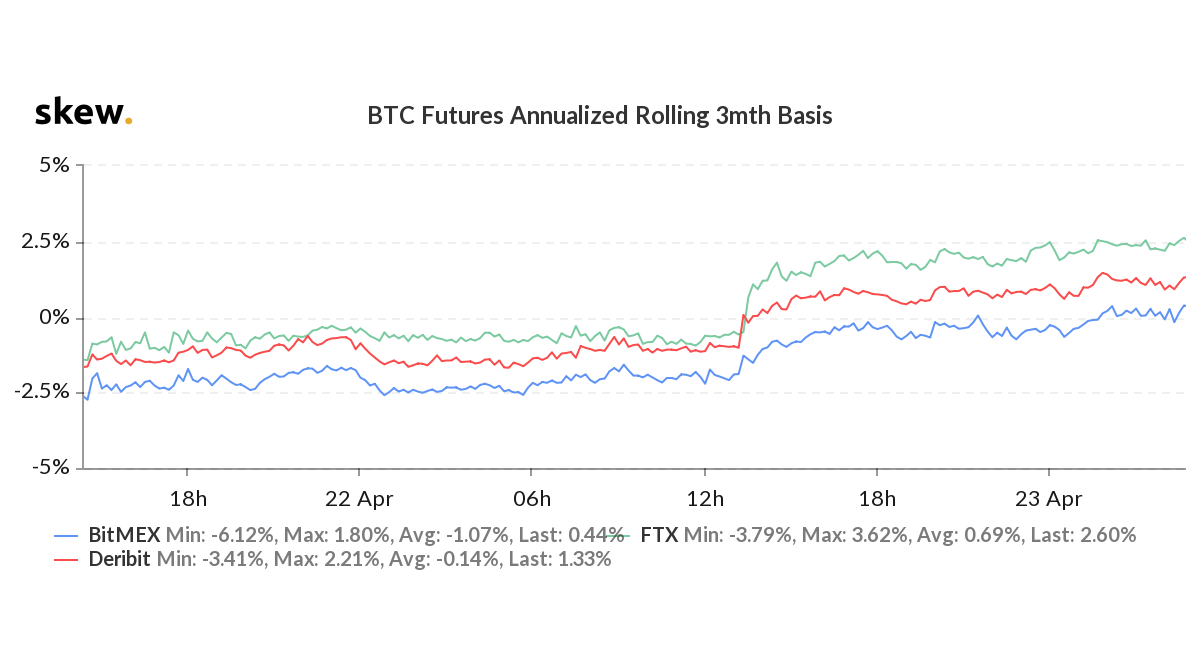

Looking ahead, in terms of the expiry period of Futures contracts, the spread is even more optimistic as one goes further away from the May 2020 halving. The quarterly contracts traded on BitMEX, Deribit, and FTX showed massive movement on 22 April as Bitcoin was poised to break the $7,000 mark. FTX saw the greatest relative movement, pushing up from -0.5 percent a day ago to 2.62 percent at press time. It seemed to be inclined to go higher based on the trend, at the time of writing.

BitMEX, Deribit, and FTX BTC Futures rolling basis 3-month | Source: skew

On the other hand, BitMEX and Deribit recorded more gradual change. The Seychelles-based exchange had a very bearish quarterly rolling basis value of -2.21 percent, which, in less than 24-hours, rose to 0.38 at press time, with traders on one of the largest Bitcoin derivatives exchanges expecting buying pressure to push the price up. The Panama-based exchange, Deribit, saw its rolling basis increase from -0.97 percent to over 1.3 percent, within the same 1-day time frame.

While this comes at an important time for the derivatives market, looking ahead, its also been a month since the 12 March crash, allowing time for traders to get back into hedging using Futures and Options. Looking at exchange performance, out of the top exchanges, only FTX and Binance managed to recover their lost Open Interest while exchanges like BitMEX, OKEx, and Huobi only registered a marginal increase from their post-plummet positions.