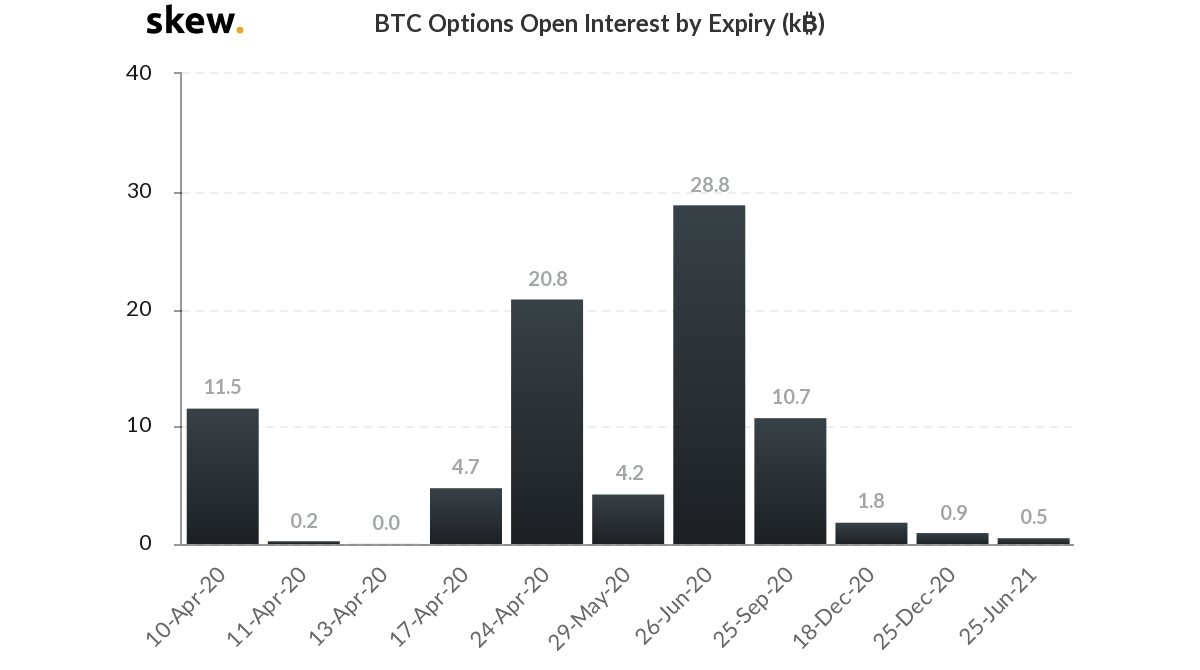

Bitcoin Options contract of 11.5k BTC expires as implied volatility drops

The Bitcoin Options market will see a large weekly expiration on 10 April. According to data provided by Skew, 11.5k BTC options were executed which might have influenced the spot price. Bitcoin was already slipping from its $7k value and was down to $6,922.31, at press time. The devaluation of over 6% once again pushed the price under $7k, and the options expiration could have just added to the dropping price.

Source: Skew

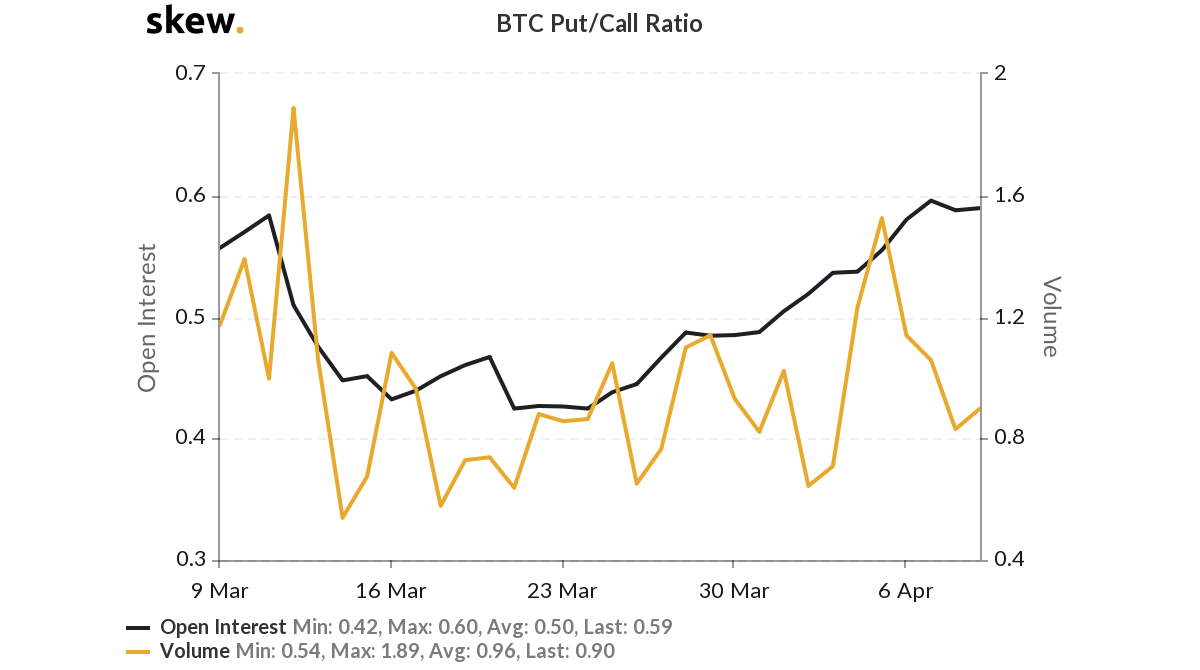

With regard to BTC’s Put/Call Ratio, the same dropped from 1.53 on 5 April to 0.90 9 April. However, the Open Interest has been on the rise as it recorded a value of 0.59 on 9 April, compared to 0.55 on 5 April.

Source: Skew

The growing gap in the volume and OI indicates that even though there was fewer Options contract, there were bulk orders set for expiration on 10 April. The dropping ratio also was a sign of increasing buying pressure as traders were choosing call options or the right-to-buy contracts in opposition to put options, or right-to-sell contracts.

The OI for puts over calls has been significantly rising. On 21 March the ratio was 0.42 and since then it increased by 114%. The total BTC option volumes on Deribit and OKEX on 10 April was noted to be 180 BTC.

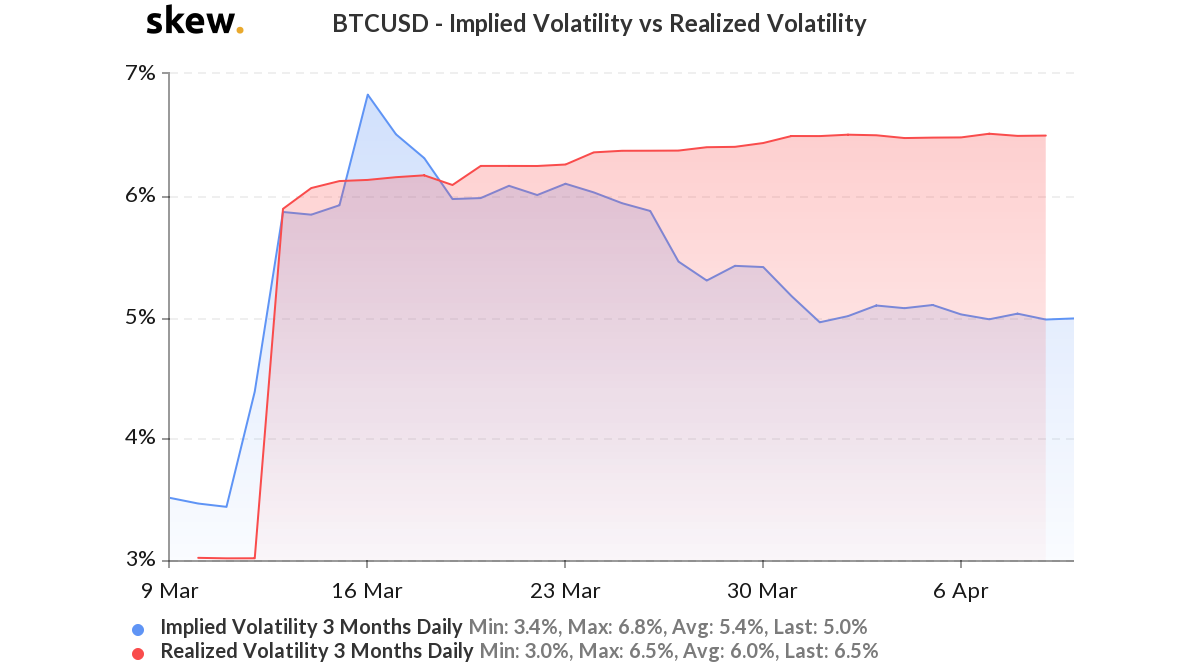

Whereas, the implied volatility has been noted to dip, indicating the market predicted volatility to drop in the future.

Source: Skew

According to Skew, the implied volatility and the realized volatility shot up when BTC fell on 12 March. The implied volatility spiked and crashed between 15 March to 19 March, after which it started its downtrend. This was when the price of BTC started its recovery effort and as the price started its ascent, the implied volatility reduced. On 9 April the 3 months daily Implied volatility was at 5%, whereas the realized volatility rested at 6.5%.