SBI Holdings offers XRP as shareholders’ benefit

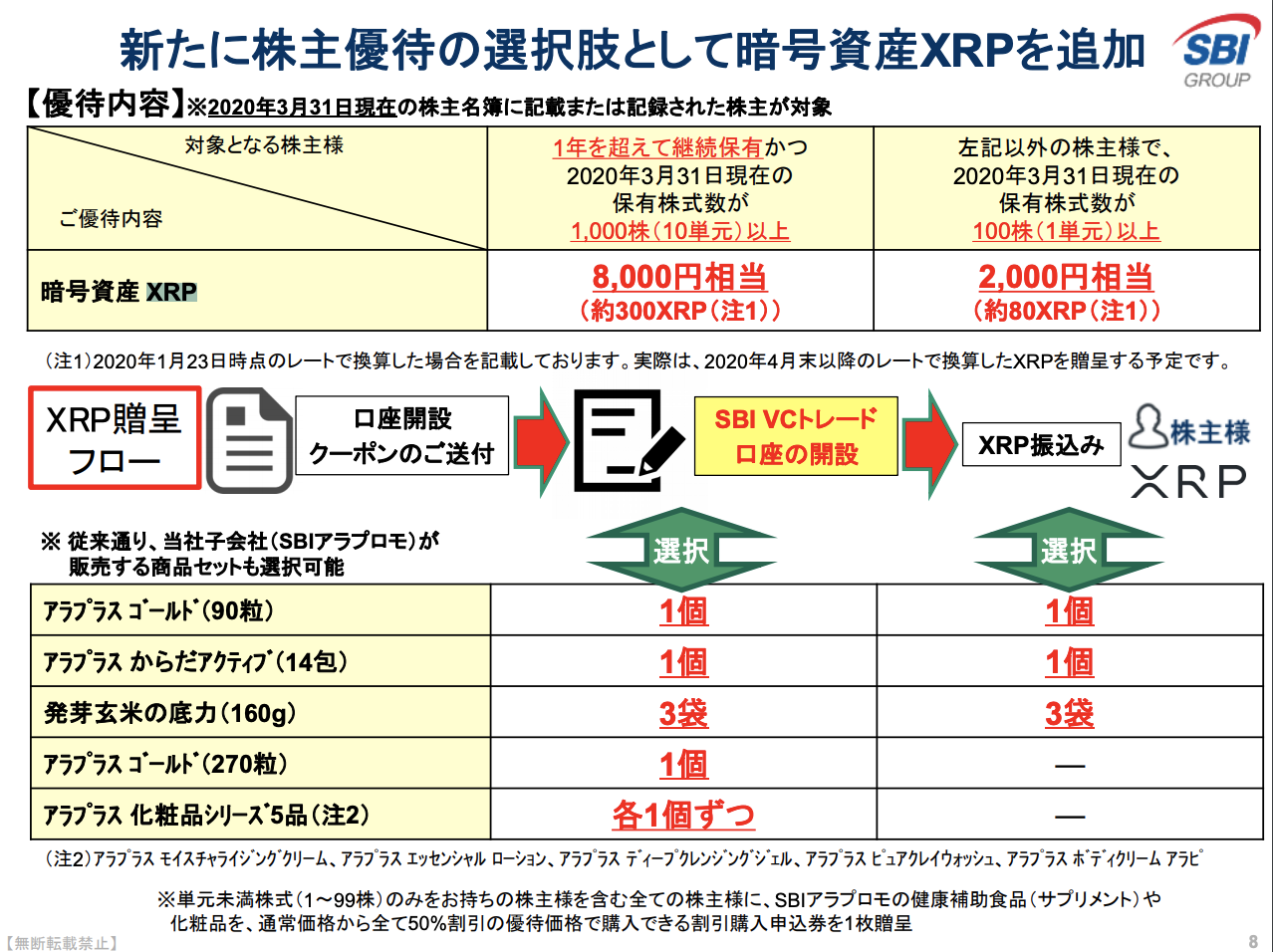

Japan’s largest bank SBI Holdings, released its financial results, which noted increasing the use of the digital asset, XRP. The report released on 31 January, stated that XRP will be added to its shareholders’ benefit option and listed special offers for holders who held over 100 and 1000 shares.

Source: SBI Report

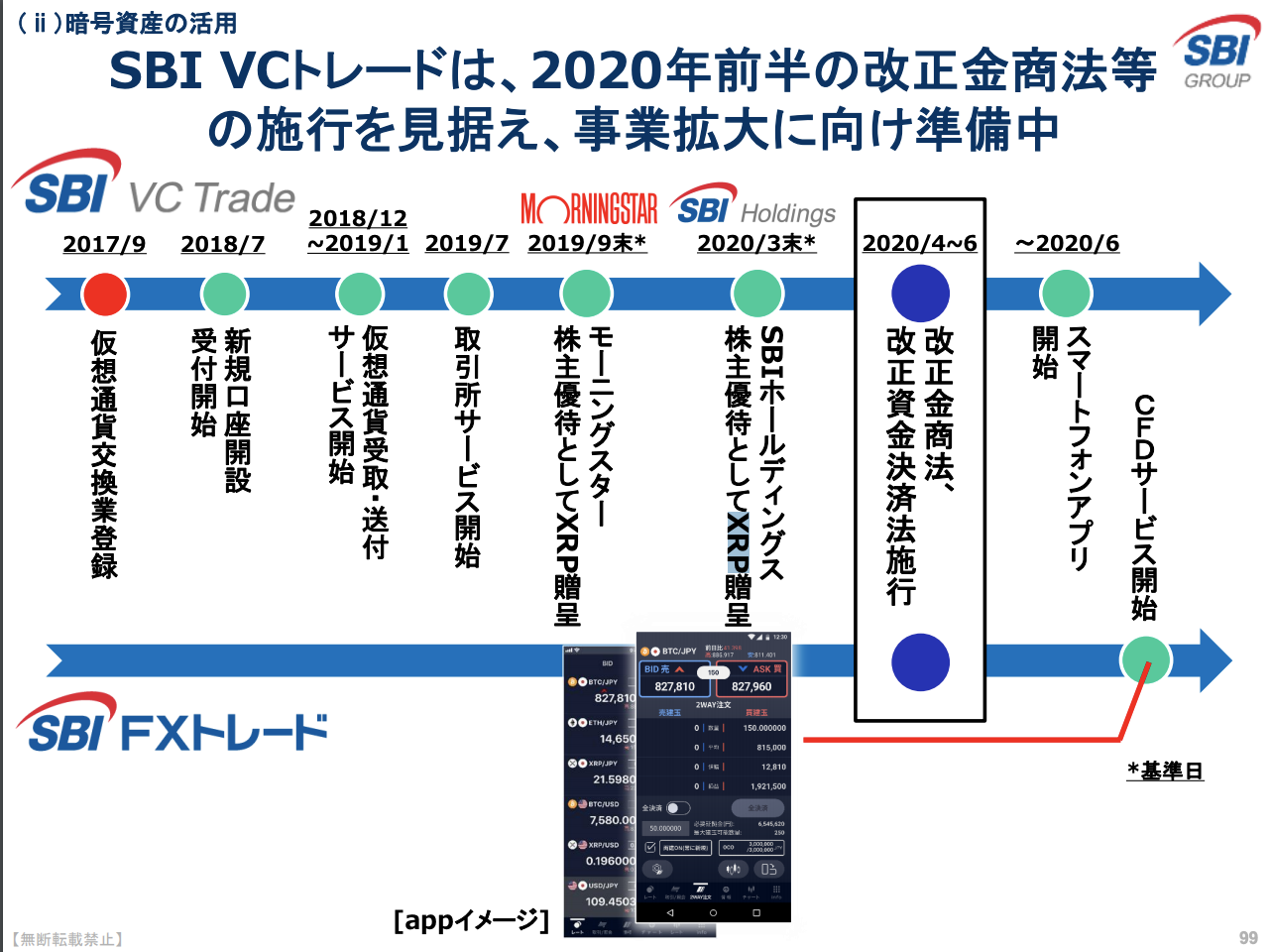

The largest bank in Japan had also prepared an expansion plan that included a revised business law and enforcing the Fund Settlement Act, scheduled for sometime in April. Following this, the company aimed to begin the Consumer Financial Decision [CFD] services.

Source: SBI report

The report elaborated on holdings of some shareholders and stated that going forward each company listed on the SBI group will be added to shareholder benefits.

SBI has been making crucial announcements in the past couple of days. On 30 January, it announced a collaboration with Japan’s second-largest bank, Sumitomo Mitsui Banking Corporation [SMBC] to build a financial services platform for businesses and individuals using a blockchain. The second-largest bank will invest in MoneyTap to increase the utilization of DLT within the trade-finance sector and personal bank remittance sector. MoneyTap has been marked as Ripple and SBI Holdings’ flagship product and used DLT to process transactions.

On 31 January, SBI Holdings announced an investment in OpenLegacy, a software developing firm. It develops and sells API integration software that built microservices-based APIs. SBI claimed that OpenLegacy will provide an easier way to connect with MoneyTap’s API. It added:

“As the SBI Group actively engages in regional revitalization, it encourages the use of its API platform, which facilitates digitization of regional banks, and will revitalize regional banks.”