Grayscale reports tripled inflows; offshore institutional investors in majority

Grayscale Investments recently made headlines for becoming the first firm to get FINRA’s approval on its Digital Large Cap Fund (DLC) offering. Providing deeper insights into the company’s workflow, Grayscale released its latest Q3 2019 report through a tweet, which read,

“Our Q3 2019 Grayscale Digital Asset Investment Report highlights investment activity and performance across the Grayscale family of products in the third quarter of the year. Spoiler alert: it was a record-breaking quarter.”

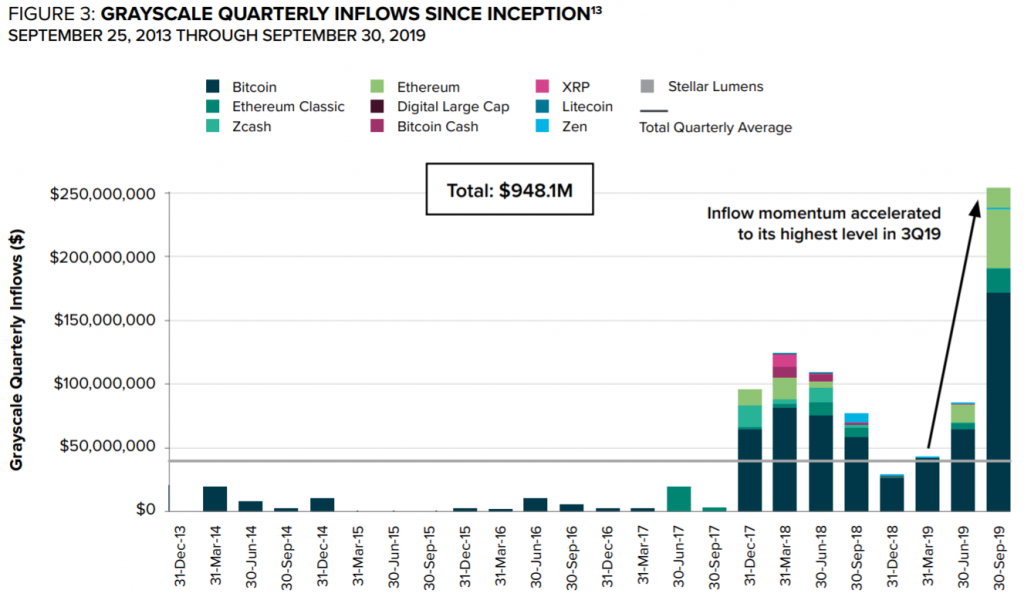

Grayscale reported that its investment inflows tripled quarter-over-quarter, “from $84.8 to $254.9 million, despite recent declines in digital asset market prices” across its entire product line. As part of Digital Currency Group, Grayscale investment products currently including the publicly quoted Bitcoin Trust (OTCQX: GBTC), Ethereum Trust (OTCQX: ETHE), Ethereum Classic Trust (OTCQX: ETCG), and its FINRA approved flagship product, Grayscale Digital Large Cap Fund (DLC).

Source: Grayscale Investments

Based on the above graphical representation, the dollar-denominated inflows from Q3 2019 inflows accounted for nearly 27% of total cumulative inflows to Grayscale products since inception. Grayscale raised $254.9 million over the last three months, averaging weekly investment across all products this quarter to $19.6 million. The report highlighted,

“Furthermore, 67% of inflows this quarter were into Grayscale Bitcoin Trust and 33% were into Grayscale Products ex Bitcoin Trust. This is a bit more balanced that what we’ve seen over the trailing twelve-months.”

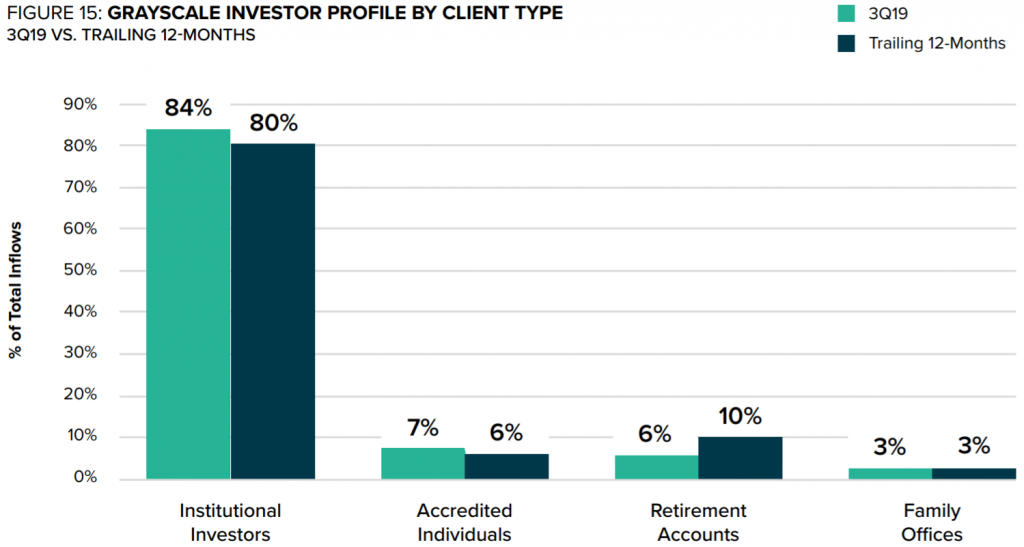

Source: Grayscale Investments

Primarily due to the ongoing regulatory challenges, Grayscale’s investment portfolio is dominated by the U.S. and offshore institutional investors, of which more than 50% of investors were located offshore. While the above findings may not be an accurate description of the overall cryptocurrency market, Grayscale intends to “provide a unique perspective on digital asset investment activity that is distinct from what may be commonly understood.”