Bitwise Report: Bakkt aside, don’t count out CME Bitcoin Futures just yet

CME Bitcoin Futures don’t look down and out just yet.

In the immediate aftermath of the Intercontinental Exchange’s launch of Bakkt, the Bitcoin market was unfazed. Moving down and not up, the underwhelming response might not look so good for the cryptocurrency industry by-and-large, but one market participant is certainly grinning.

Chicago-based CME Group, the harbinger of the Bitcoin bull run of December 2017, and until now, the institutional gateway into Bitcoin, albeit in contractual form, is wary no more. The CME Group’s cash-settled Bitcoin Futures looked set to take a beating from Bakkt’s physically delivered Bitcoin derivatives. However, on first impression, it did not turn out to be so.

With CME’s resolute nature being tested and successful, it does put in perspective the depth and importance of the regulated Futures exchange to both Bitcoin’s institutional hopes and its spot price. Bitwise Asset Management, the Bitcoin ETF hopeful, aimed to address just that in its latest report presented before the U.S Securities and Exchange Commission [SEC].

FUTURES ON THE UP-and-UP

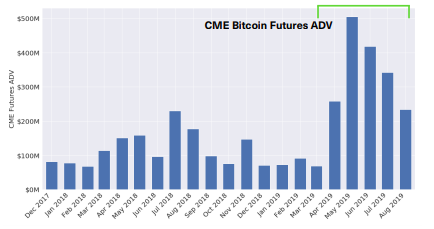

Source: Bitwise Report

Owing to Bitcoin’s massive ascent in the second quarter of the year, coupled with lack of competitors as the CBOE dropped out of the XBT race in March, CME volumes have been skyrocketing. According to Bitwise, CME Bitcoin Futures average daily volume [ADV] stood at over $500 million in May, while June and July saw slumping but substantial figures of over $400 million and over $330 million, respectively. August saw an ADV of $243 million, an almost 50 percent drop from its figure three months prior.

In late June, Bitcoin topped $13,800 and then began a steady descent, leading to the formation of a pennant. However, despite the price drop, the volumes fared comparatively better, even in light of Bakkt’s announcement.

Bitwise added that the decision by the CME Group’s crosstown rival, the CBOE, to forfeit the Bitcoin Futures market has not largely impacted the former’s trend. The CBOE volume barely contested the CME’s, and with the CBOE’s last set of contracts expiring in June, the Bitcoin Futures market was completely handed over to the CME.

FUTURES STANDS FIRM TO SPOT

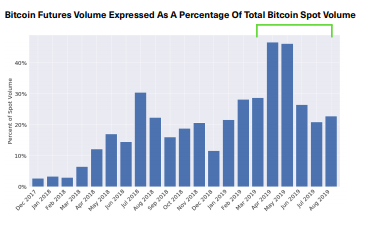

Source: Bitwise Report

While the spot BTC price looks to be on a downward tumble, the Futures performance on a head to head basis looks “significant,” according to Bitwise. The report stated that in April and May, thanks to the massive increase in the price of Bitcoin within a short period, the Futures volume expressed as a percentage of total Bitcoin spot volume broke the 40 percent mark.

To put that figure into perspective, the highest Futures volume against spot was 30 percent back in July 2018. However, the April – May figures immediately dropped to just under 30 percent in June, as the prices stabilized. August’s relative volume was just above 20 percent, and seemed to slump further.

When looking at the Bitcoin market from the point of view of the actual spot market for the top cryptocurrency, the Futures market does not look that dwarfed. Based on August 2019 figures, the actual spot volume is around $1 billion, while Futures volume is a little less than one-fourth the same at $234 million. Back in March, the Futures volume was one third its spot equivalent, at $91 million.

FUTURES: Ripe for the taking

The CME Group was expected to be humbled by Bakkt, particularly because of the backing of ICE. However, initial responses look bleak. With the market caught in a flux, Bitcoin trading below the $10,000 mark and breaking out of the pennant, the Bakkt news did the opposite of what it was suppose to, from a price perspective at least.

With Bitwise’s report detailing the depth of the Futures market and the CME Group’s grip on the same, the onus is firmly on the regulated Futures exchange to take hold of the market, before Bakkt does.