Crypto News

70% of Bitcoin spends use highest precision of 1 Sat

Can Bitcoin ever become a unit of account?

This age-long debate seems to have found no respite. While there is no denying that merchants accepting Bitcoin and other cryptocurrencies have increased, most of these entities price their products in fiat. Be it business calculation, employer’s wage almost every asset in the world is denominated in fiat.

A new research claimed that the “Bitcoiner dream of achieving unit of account status is nowhere in sight, at least for now”.

According to BitMEX Research’s latest release, currently, more than 70% of Bitcoin output use the highest available degree of precision [one satoshi], as opposed to 40% in 2012.

BitMEX evaluated close to 1.3 billion Bitcoin outputs which had non-zero values since the launch of Bitcoin network. This represented a “total value of over 5.4 billion bitcoin of spend, worth over $12 trillion”. These transaction outputs were then placed into buckets based on the degree of precision [ 1 sat].

BitMEX stated,

“We analyse the degree of precision [round numbers] in Bitcoin spending, which has maintained a strong upward trajectory. Today 70% of spends use the highest precision [1 sat], compared to 40% in 2012.”

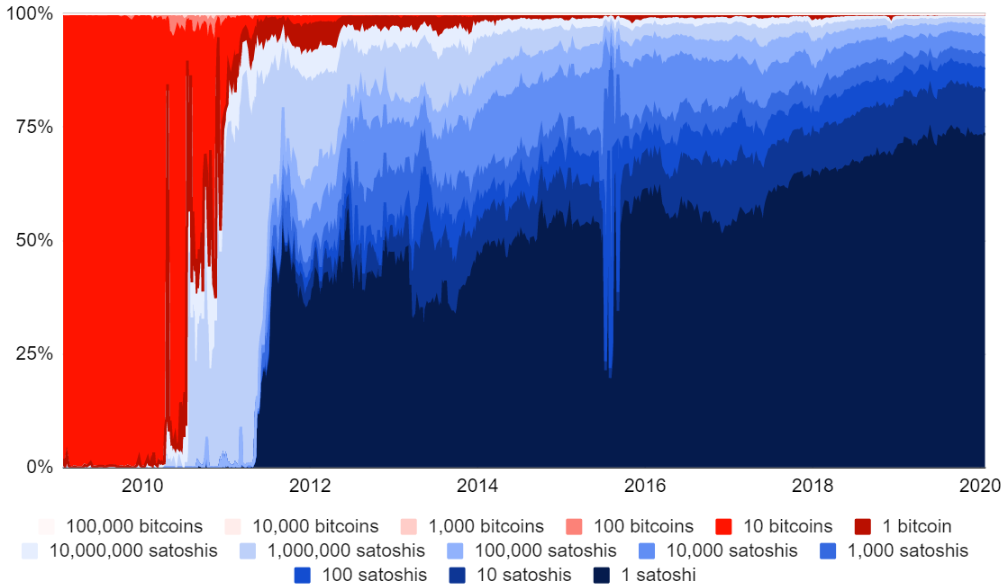

Source: BitMEX Research | Proportion of Bitcoin outputs by value precision bucket

In 2012, 10% of outputs spend an “integer number” of Bitcoin. This figure dropped in 2019 only 0.6% of outputs spend an integer number of Bitcoin. BitMEX Research noted,

“Our data shows a marked increase in precision in the last 10 years, which surprisingly continued even beyond 2018. Currently over 70% of Bitcoin outputs use the highest available degree of precision [one satoshi], considerable growth since the c40% level in 2012. Since 2019 only 0.6% of outputs spend an integer number of bitcoins, compared to over 10% in 2012.”

Source: BitMEX Research | Number of bitcoin outputs by level of precision [All of Bitcoin history]

The research’s concluding remark was if the ‘unit of account’ status is achieved or becomes more prevalent, then presumably the degree of precision should reduce rather than increase. But the above indicated that Bitcoin is “moving in the opposite” direction, with the average degree of precision still increasing. BitMEX Research noted

“This may indicate a violation of the unit of account thesis, at least up until this point.”