Bitcoin

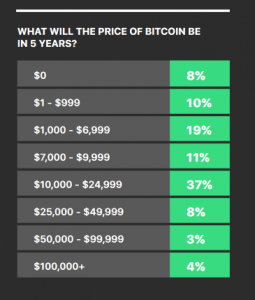

37% believe Bitcoin’s price will range between $10k-$25k by 2024, according to this survey

Exactly 5 years ago, Bitcoin was valued at $233 on January 16th, 2015 and over the course of the last 1827 days, the registered growth at press time is 3666.83 percent, valued at $8651.

A lot has changed over the past five years and with a substantial presence in the current market, Bitcoin’s next half a decade has been deemed to reach new heights in terms of adoption and utility.

Source: Coinstats

However, the price may not follow the same trajectory.

According to Bitwise’s 2020 Benchmark Survey on attitude towards crypto assets, a group of 395 financial advisors responded on what Bitcoin’s price would be in 5 years.

Source: Bitwise

A majority of 37 percent advisors believed that Bitcoin’s price would vary between $10,000 to $24,999 in January 2024. A dominant 64 percent of advisors believed Bitcoin’s price will be higher than its current valuation but interestingly 8% of the total advisors also cited a prediction that BTC will slump down to $0.

The survey also indicated that despite its recent failures with SEC, Exchange-traded funds or ETFs were the preferred option by the advisors to acquire digital assets in the market. Hedge Fund industry was the least favorite option of the list and a mere 16 percent believed that direct acquisition of coins is the most feasible alternative.

In terms of investment strategy in crypto, 45 percent of the advisors believed an actively managed fund is the most suited course of action. An actively managed fund is usually controlled by a management team that decides how to invest the fund’s money. It has a higher risk versus a higher reward value.

A diversified index fund was the preferred strategy for 43 percent of the advisors, which mostly follows multiple asset portfolio structures. A diversified fund holds multiple securities, often in multiple asset classes and the investors have better control than an actively managed fund. However, it is important to note it has low expense ratios.

The survey stated,

“It will be interesting to see how the market evolves in the next 12 months. After all, the number of advisors explicitly looking to allocate to crypto is expected to double in the next year.”