Here’s what Bitcoin’s 3 consecutive bearish weekly candles signify

Bitcoin has not seen a bull run for almost 3 years now. With the last bull run ending on December 17, 2017, most people are yet to witness a bull run. This is an extended bear market and a pre-bull run phase, where the price has the least volatility.

Perhaps, this extended bear run is due to adoption, increased liquidity, and institutional investment. With more money coming in, volatility might reduce, but then again, this is speculation as adoption/liquidity isn’t enough to get a Bitcoin ETF approved. However, a simpler explanation is that the Bitcoin cycles are lengthening with each bull and bear run.

Regardless, the important thing is the pre-bull run phase which is characterized by its low volatility.

Pre-bull run phase

As mentioned in a previous article, volatility and inaction of price is reminiscent of the year 2016, when the price was about to start its historic rally. Even though this is being addressed as the pre-bull run phase, there is still a small drop to come. As of today, a new weekly candle has started, however, the last four weekly candles have all seen a lower close, indicating a bearish touch.

BTCUSD TradingView

However, what’s interesting is the 3 consecutive weekly bearish candles formed in tandem with the descending triangle pattern. For BTC, descending triangles have a history of flash crashes. Since 2018, BTC has seen two descending triangles, all of which have ended in flash crashes; however, the recent crash wasn’t as drastic as the first. Even the third descending triangle is much smaller than the 2nd or the 1st; hence, the drop will not be as drastic as the prior crashes.

Additionally, 21 WMA [orange] has acted as a support during bull runs and resistance during bear runs; currently, it is supporting the price, but considering the bearish pattern, there might be a retest as soon as the price drops.

The retest of 21 WMA at $8,274 coincides with 200 DMA on a daily time frame, which supports the theory of this level being strong support. Hence, an assumption that a bounce from here would be the best place to start the much-anticipated bull run, could be more than a whim.

CME Gap

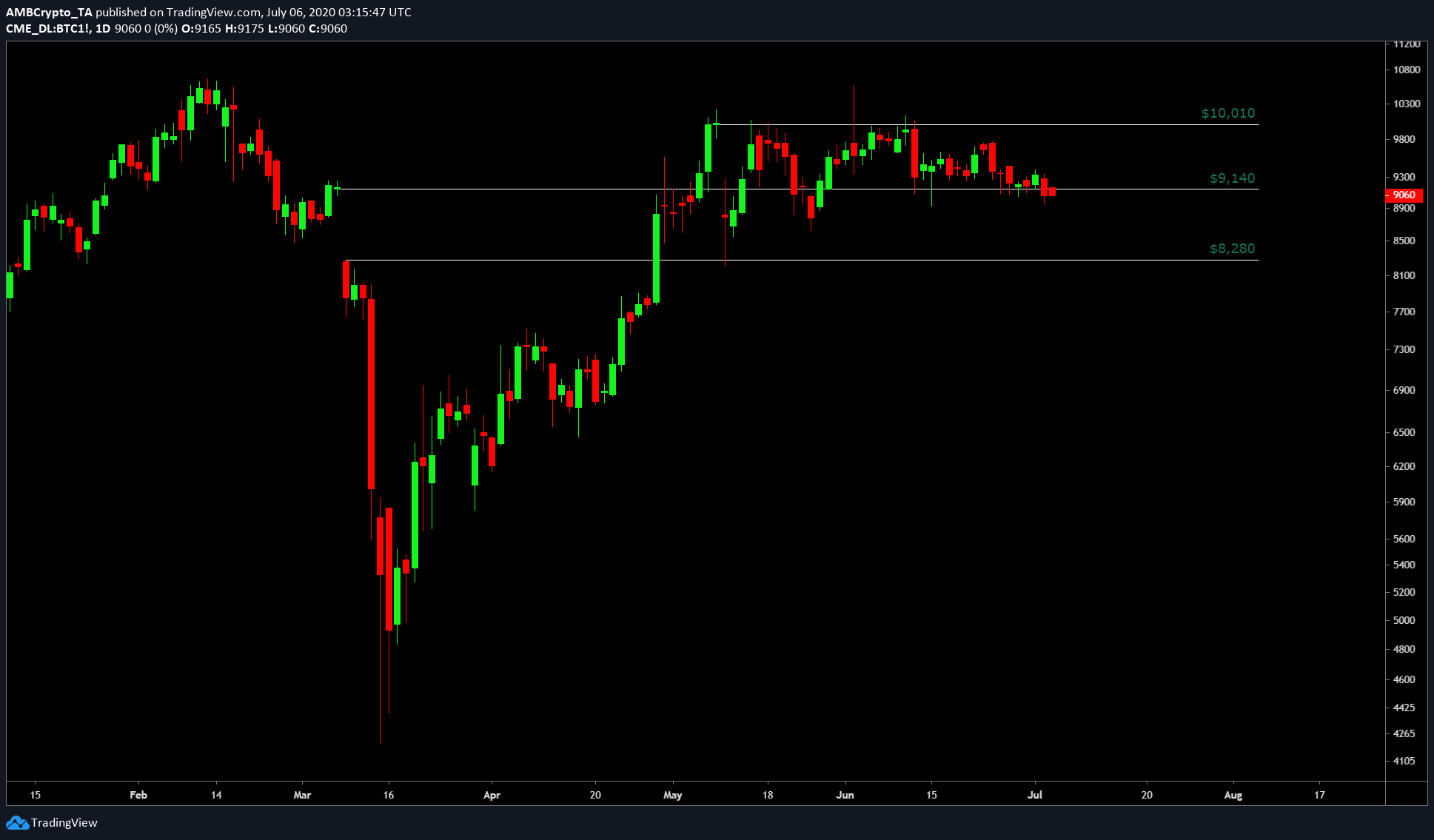

BTC1! TradingView

CME gap that extends from $8,280 to $9,140 also coincides with this drop, hence further supports the theory of an incoming drop.