Zcash, BTG, Bitcoin SV price: Altcoins struggle to stay afloat

The cryptocurrency market was propelled by a wave of stability recently, with the collective market cap climbing to $174 billion after the great fall on 12-13th March. However, despite the fact that these altcoins posted some recoveries over the past two weeks, there have been some corrections as well; most recently after Bitcoin dropped to $6100 from $6600.

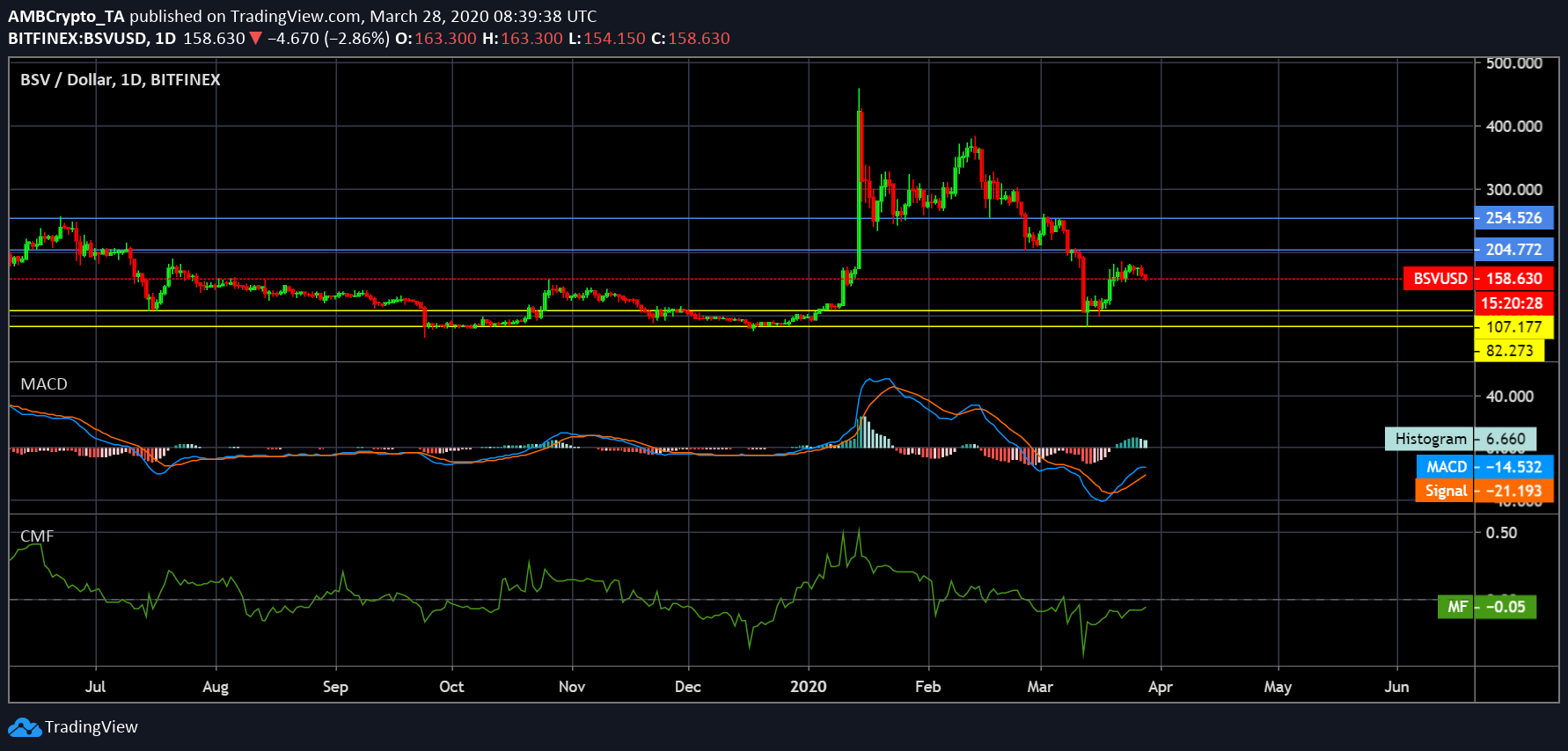

Bitcoin SV [BSV]

After rallying by double-digits, the fork coin failed to pick up the necessary momentum required to breach the first resistance which stood at $204. Its second resistance point stood at $254, while its support was found at $107 and $82.2.

At press time, Bitcoin SV was trading at $158.5, while it held a market cap of $2.91 billion. Additionally, BSV registered a 24-hour trading volume of $2.03 billion after a drop of 8.47% over the last 24-hours.

For the most part, BSV has been engulfed in bad press. The latest controversy alluded to an anonymous miner controlling over 55% of the BSV hash rate at a time when the block reward reduction is less than a fortnight away. Despite the fork coin’s present price action and the contentious mining activity, the indicators have a different story to tell.

MACD Indicator: The signal line was below the MACD after a bullish crossover in the third week of March. This pointed to a positive price movement in the near-term.

Chaikin Money Flow: The CMF appeared to be navigating in the bearish territory; however, it also noted a mild uptick. This could potentially signal an upcoming bullish phase for the coin.

Source: BSV/USD on TradingView

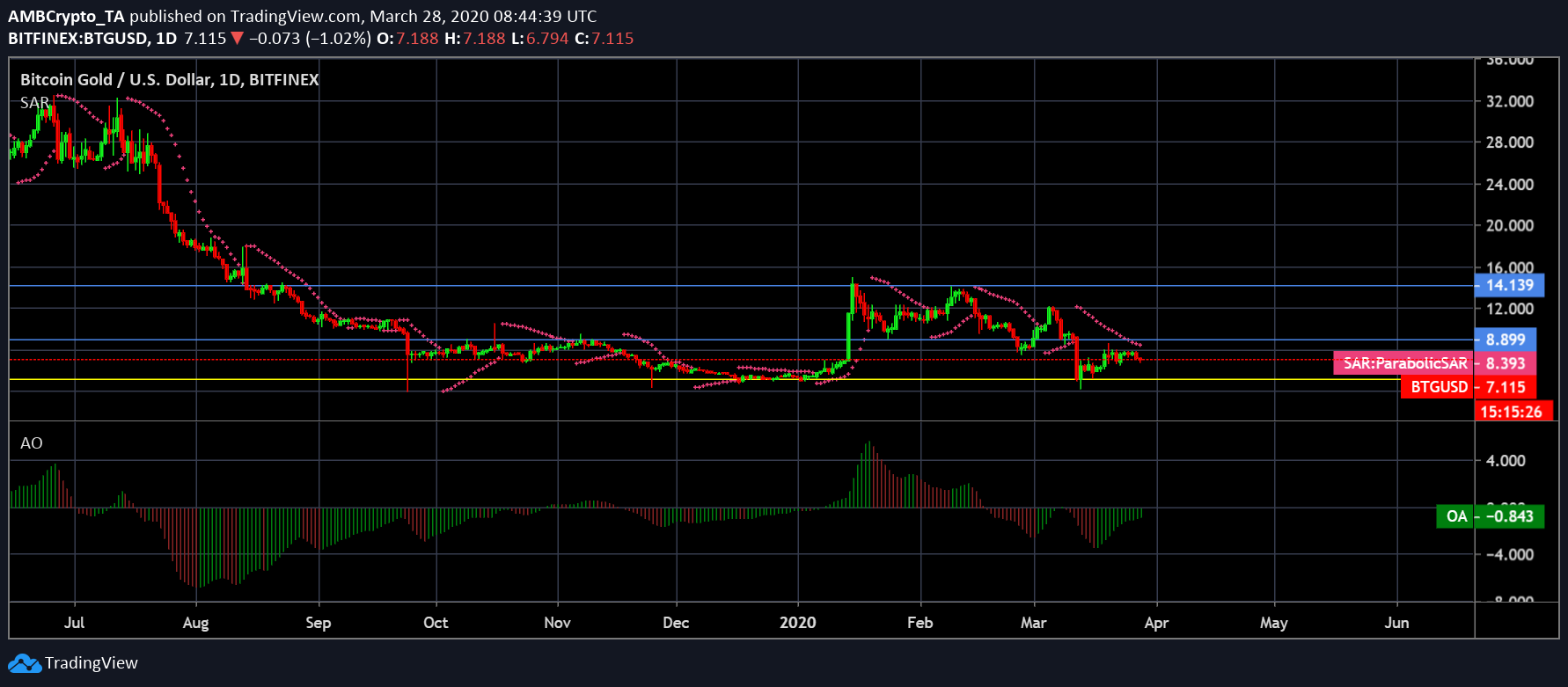

Bitcoin Gold [BTG]

Another fork coin, BTG, and its bulls have tried to make a headway upwards in an attempt to recover the losses the coin sustained earlier this month. After a bullish start to the year, the coin started making headlines after suffering a 51% attack for the second time, one in which the attacker was able to siphon off 1,900 BTG and 5,176 BTG via two separate transactions on 23 and 24 January, respectively.

In fact, the coin has been in troubled waters for some time now. It went down by 7.32% over the last 24-hours. Additionally, the coin was priced at $7.01 and registered a market cap of $112.8 million, at press time. The immediate resistance points for the daily chart were found at $8.8, $14.13, with the supports standing firm at $5.09

Parabolic SAR: The dotted markers above the BTG price candles indicated a bearish phase for the coin.

Awesome Oscillator: The AO indicator, however, suggested bullish momentum for the coin in the near-term, something that was evident with the green closing bars.

Source: BTG/USD on TradingView

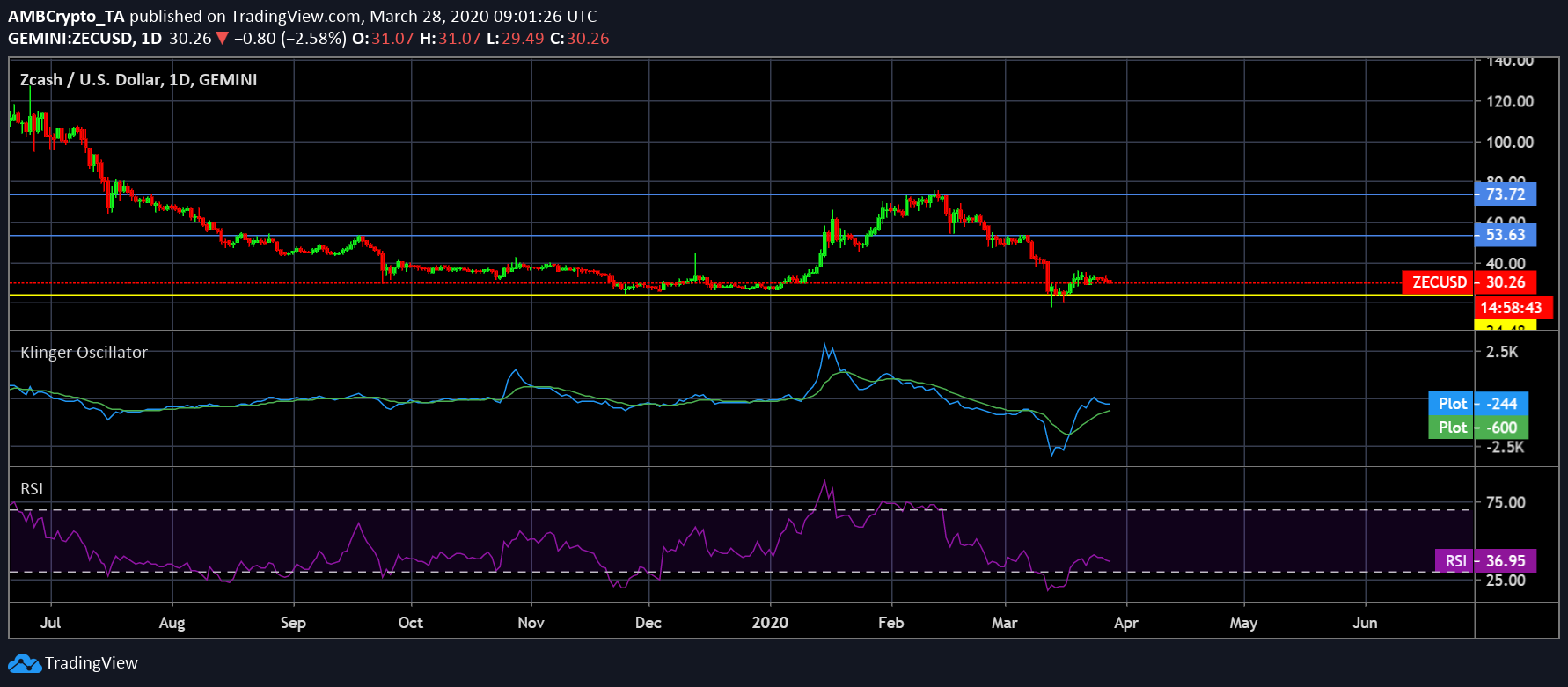

ZCash [ZEC]

The privacy coins space has seen major regulatory hurdles over the past one year. One of them, Zcash, has shown significant positive sentiment lately, outperforming its peers over the first part of 2020.

On the development front, the Electric Coin Company recently announced a major upgrade for Zcash called “Heartwood,” with an aim to improve the interoperability, as well as to allow miners to receive their mining rewards directly as a shielded transaction.

On its price side, however, the coin was trading close to its support. The resistance for the coin stood at $53.6 and $73.72, while its support stood at $24.4.

At press time, ZEC held a market cap of $289.9 million and a 24-hour trading volume of $356.4 million. After dropping by 7.60% in the last 24-hours, ZEC was valued at $29.94.

Klinger Oscillator: The signal line was below the leading line. This was indicative of a bullish phase for the coin in the near future.

RSI: Despite a hint of a revival above the lower band of RSI, the privacy coin was still struggling just over the underbought zone.

Source: ZEC/USD on TradingView