Analysis

XRP stays on track for massive gains in the imminent future

Ripple announced yesterday that it had set up a global regulatory office in Washington D.C. As a payments company working with blockchain, this is a big move for Ripple, especially considering the current regulatory scenario surrounding cryptocurrencies and blockchain. Although Ripple and XRP are not technically related except for their products, this move by Ripple is an added bonus for XRP.

The price of XRP has slowly climbed higher ever since it hit the 400+ day support at $0.22. In the previous article, it was mentioned that XRP was showing a vastly bullish outlook, and the price had a chance of hitting a high of up to 90%. That prediction, like most prophecies, is still on track to becoming a reality.

The important question here is, “Will the prophecy manifest into reality or will it be a failed revelation?”

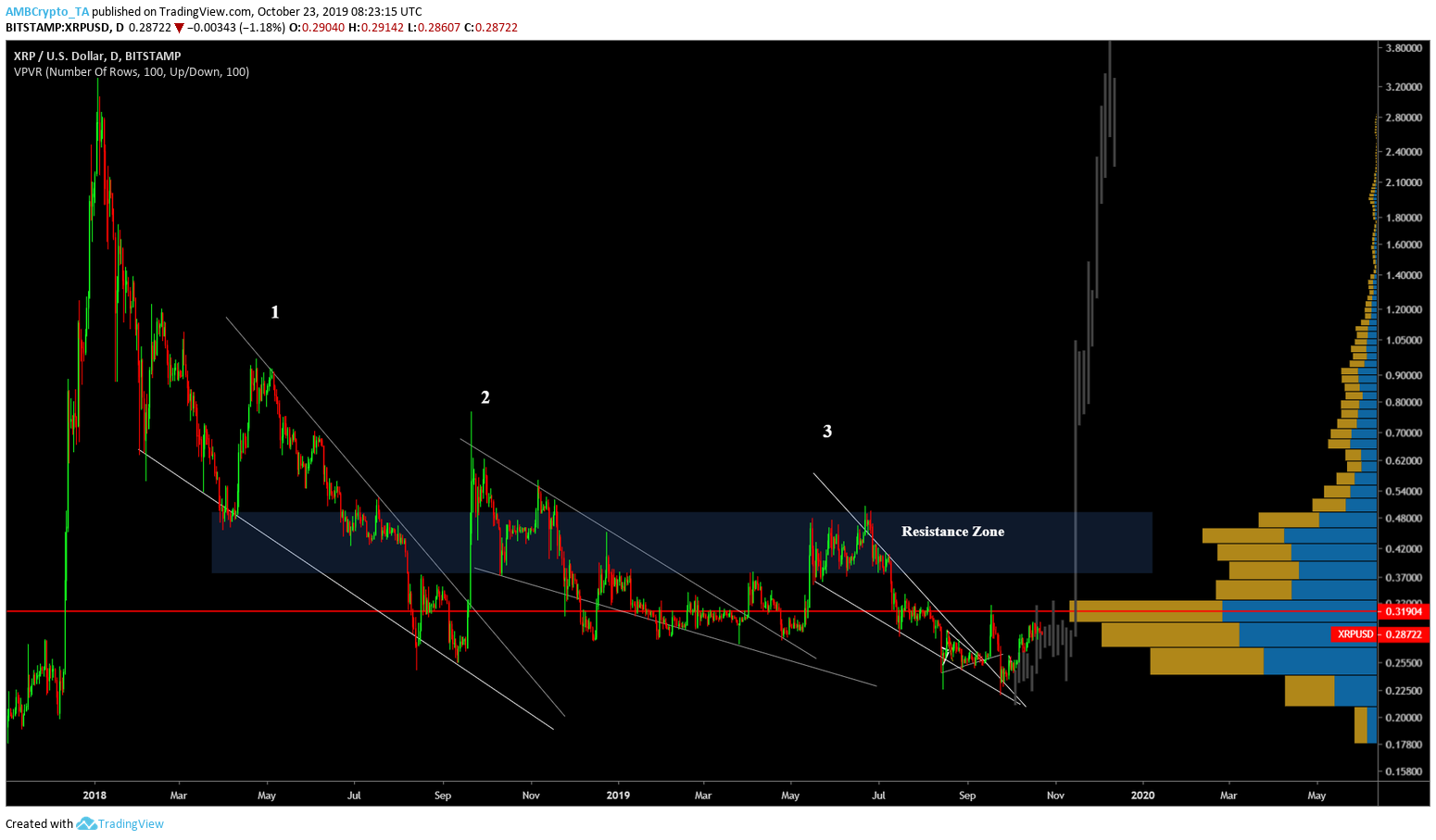

Source: XRP/USD on TradingView

The one-day chart for XRP showed the fractal formation of recurring falling wedges throughout 2018 and 2019. However, towards the end of 2019, the falling wedge fractals ended and the price had about two months before it was supposed to pull a Hail Mary out of the blue and surge as high as $4.

As seen above, the price is adhering to the predicted bar pattern [in gray]. The pattern still has about a month to reach the humungous long candle which is supposed to take the price to new highs. As outlandish as this sounds, this is a possibility, and the chances of it happening are probabilistic in nature. For the price to actually reach those levels, it has to first reach a fat resistance zone that ranges from $0.37 to $0.50. Only after breaching this would the price proceed higher.

Moreover, there are chances of the price getting stuck in this zone, as there is a huge amount of trading that’s taking place in this region, as indicated by the VPVR indicator.

Targets

- $0.37 to $0.50

- Breaching the above would cause the price to pullback and consolidate

- $0.72 to $1

- $1.5

Conclusion

The prediction for XRP looks to be on track. However, there are chances of it collapsing on itself for being a little too overt. As mentioned above, the price might get stuck at any of the above-mentioned target levels and not proceed higher.