XRP long-term Price Analysis: 18 November

There is a sense of bullish urgency in every top digital asset at the moment, and XRP is no different. After taking a back seat for much for the rally, XRP breached above $0.254 on 13th November, and over the past-24 hours, it tested $0.30. XRP is currently consolidating near the present high and collectively, it should continue to attain further top positions.

XRP 1-hour chart

Source: XRP/USD on Trading View

XRP’s 1-day chart indicated a period of major consolidation between September and Mid-November. The price oscillated between $0.254 and $0.230 for most periods. A minor re-test at $0.22 was also witnessed. However, over the past week, the asset has performed well to pick up the pace, registering a re-test at $0.30 for the first time since September 2nd.

While the candles hovered over the 50-Moving Average, the rally is somewhat unstable at the moment. A period of correction will definitely take place over the next few weeks but the overall trend should remain bullish. With the trading volume maintaining decent levels in the chart, XRP has active movement at press time. Additionally, the asset maintained its position above the uptrend since July as well, albeit a minor drop recently(shaded region).

Rationale

Source: XRP/USD on Trading View

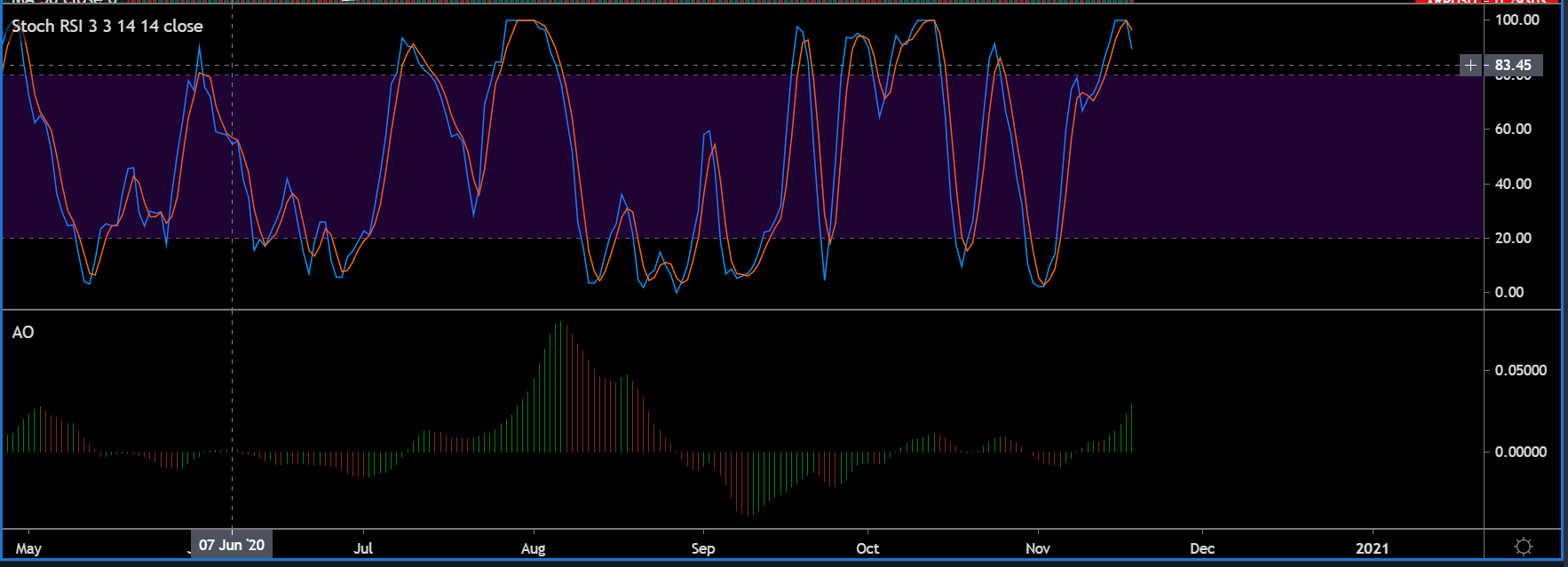

The market indicators suggested that the correction period for XRP may facilitate soon enough. The Stochastic RSI exhibited a bearish crossover between the orange and blue line at the over-bought region. XRP’s valuation should drop down with respect to the indicator but a complete nullification of the rise would be highly detrimental.

Awesome Oscillator continued to indicate the rise of bullish momentum, which is currently evident in the charts.

Important Range

Resistance: $0.304, $0.32, $0.347

Support $0.254, $0.275

Entry Position for Long Trade: $0.275

Stop Loss: $0.254

Take Profit: $0.347

Risk/Reward Ratio: 3.43x

Conclusion

As per the necessary range, XRP should drop down to $0.275 before re-testing 2020’s high of $0.347. While the re-test may happen over the next week as well, an ideal scenario would see the asset drop first and then, register new highs for the year.