XRP inches closer towards a 90% upside profit zone with every passing day

XRP recorded one of the most astounding breakouts during the 2017 bull run. It exploded from a mere $0.22 to $3.30 i.e., a 1400% increase in a matter of ~20 days. Since then, XRP’s fanatics have been longing for a pump similar to the aforementioned run, as their bags are getting heavier, despite the fact that the price remains stagnant.

Short Term

Source: TradingView

The short-term chart for XRP (4-hour) shows that the price is stuck in a parallel channel with higher highs and higher lows. The channel is fresh, which means the price will move in the channel a little longer, before breaking out of it. The 50 and 100 moving average have expanded to hold the price between them. The price was recently supported by the 50 moving average and the lower part of the channel. However, it is yet to rise to the top of channel where it will face resistance from the 100 moving average.

The RSI indicates a similarity with price. However, the MACD suggests sideways or neutral movement for XRP.

Long Term

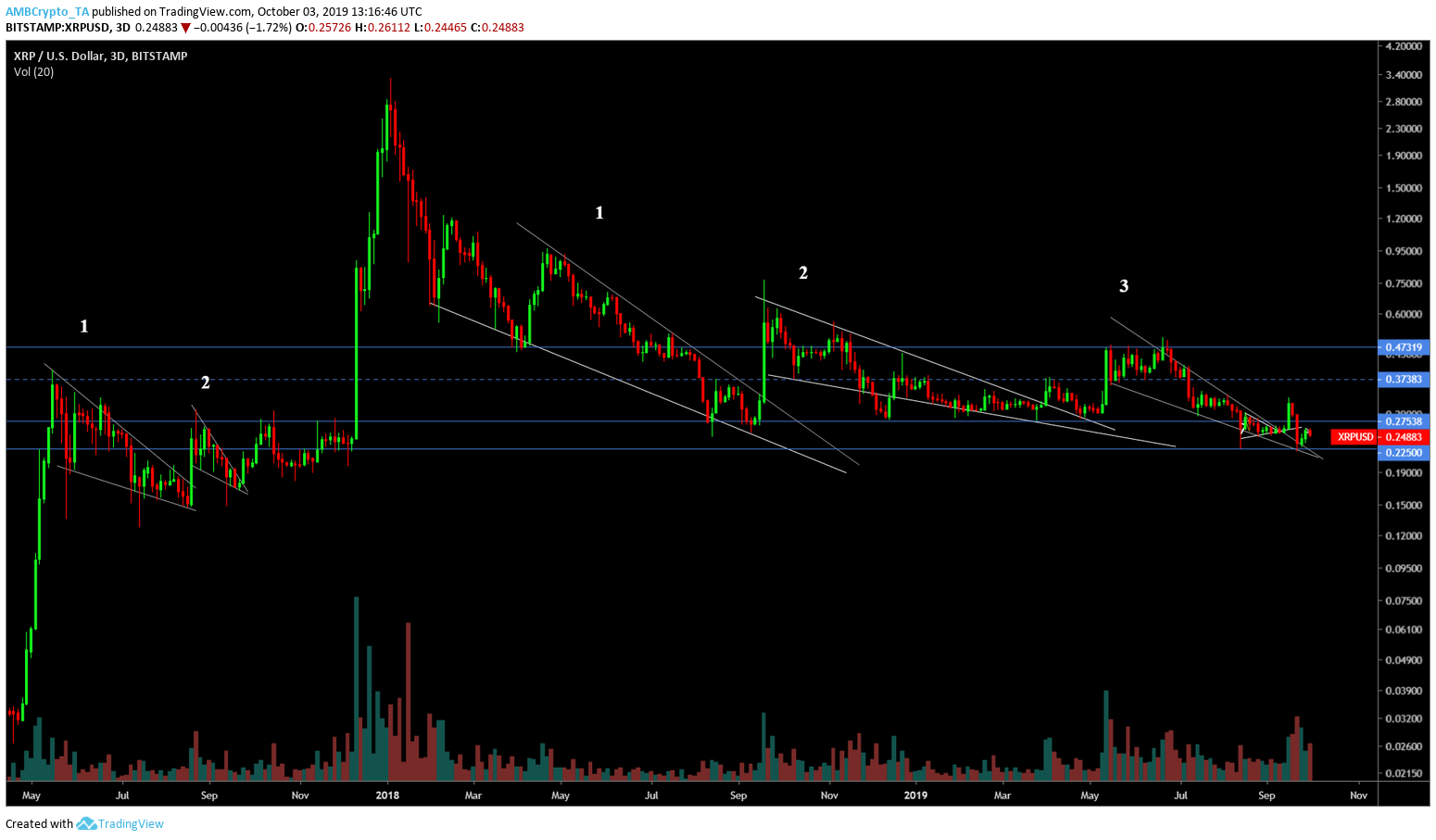

Irrespective of what’s happening on the short-term chart, the long-term prospects for XRP look quite bullish. The XRP chart indicates the formation of a combination of falling wedge fractals that were last seen just before the 2017 bull run.

Source: TradingView

Pre-2017 bull run, the price underwent two massive falling wedges and following the price moving sideways for a while, XRP saw a humungous spike of 1400%. As of now, the price has undergone three such falling wedge fractals and the price has hit lows last seen before the bull run. So, assuming something similar happens, the upside for XRP looks quite bullish.

If the price shoots up in a similar fashion, it might not be long before we see XRP breach $3 and beyond.