With under 2.434 million Bitcoin left to mine, how much should a newbie invest in BTC?

Bitcoin demand is not only expanding among individual traders and crypto enthusiasts, but has also managed to attract institutions, hedge funds, and corporates. Many traditional financing institutions have included Bitcoin in their portfolios and are increasing their hold on Bitcoin. Now that there is less than 2.434 million Bitcoin left to mine, the race to have more bitcoin in one’s portfolio is on.

Galaxy Digital founder and CEO Mike Novogratz recently shared his views on the same in an interview with CNN’s Julia Chatterley. Novogratz who had earlier advised that investors should allocate roughly 1% of their net worth to BTC, increased the value to 3% by November. However, according to his recent interview, this value has increased to 5%. Novogratz said:

“I think a new investor could put 5% into Bitcoin. Bitcoin’s not going back to zero […] It could certainly trade back to $14,000 — you could lose 30-40%, but you’re not losing 80-90% of your money.”

The CEO arrived at this value by looking at Bitcoin’s stability. He stated that bitcoin’s categorization from a frontier asset has changed to a macro asset and it has been proving to be a store of value. While talking about his investment in crypto, Novogratz stated that his “overall crypto exposure is probably 50%.”

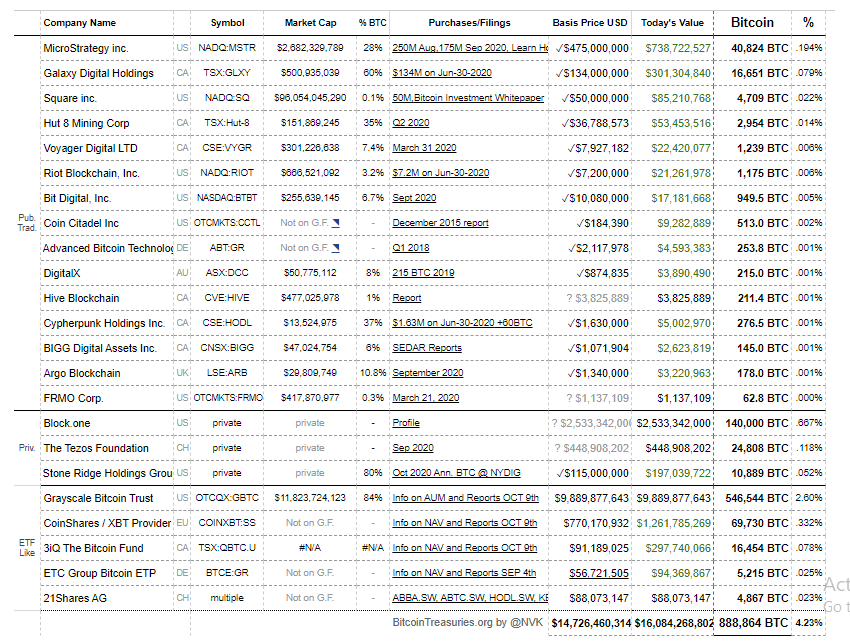

Novogratz is not the only one to include crypto in his portfolio. Recently, Microstrategy also added an additional $400 million investment round to purchase more BTC. It currently owns almost $800 million in bitcoin. Whereas, Galaxy Digital has an estimated net worth of $700 million.

Source: Bitcoin Treasuries

Bitcoin’s performance has changed the minds of many non-believers. The list included Bernstein Research’s co-head of portfolio strategy, Inigo Fraser-Jenkins who had stated in 2018 that Bitcoin had no space in an investment portfolio, who later said that he had changed his mind. With the Dollar facing one of its worst years and COVID-19 pandemic changing the policy environment, debt levels, and diversification options for investors, Bitcoin has emerged as an attractive asset.

As Bitcoin is making its mark, Novogratz believes that Ether [ETH] could also prove to be an investment worth one’s net worth and noted that ETH had a “venture flare.”