Will Bitcoin start 2024 with a bull rally?

- Bitcoin’s Open Interest reached an all-time high on the 27th of November.

- BTC was down by 1.2% last week, but metrics were mostly bullish.

Bitcoin [BTC] underwent a bull run over the last 30 days, with its price rallying 9% over this time frame. But the king coin’s fortunes soon turned, as BTC’s movement turned sideways over the last week.

According to CoinMarketCap, BTC was down by over 1.2% in the last seven days. At the time of writing, it was trading at $36,897.06 with a market capitalization of over $721 billion.

This is what Bitcoin’s metrics suggest

But investors should not lose hope, as AMBCrypto found that Bitcoin has been up to something all this while. Notably, CryptoCon pointed out in a tweet that BTC has hit the 3.5 Advance/Decline Ratio (ADR) level for the first time in this cycle.

For the first time this cycle, #Bitcoin has hit the 3.5 ADR level.

This means two things:

1. This is the still only the start of a move in the shorter-term

2. This is the very beginning of the bigger picture

The differences between the cycles are shown yet again.

BitTime… pic.twitter.com/7TFTtWD9py

— CryptoCon (@CryptoCon_) November 26, 2023

The advance-decline ratio (ADR) is a popular market-breadth indicator used in technical analysis. It compares the number of stocks that close higher against the number of stocks that close lower than the previous day.

Historically, Bitcoin’s ADR hitting these levels has always been a precursor to a bull rally.

It was interesting to know that while Bitcoin’s ADR hit 3.5, its Open Interest reached an all-time high as well. High Open Interest usually indicates higher liquidity for an asset.

This implies that there will be less discrepancy between an asset’s asking price and what another trader is willing to pay.

Is BTC actually preparing for a rally?

AMBCrypto then took a look at Bitcoin’s on-chain metrics to better understand whether the coin was preparing for another bull rally.

Our analysis of CryptoQuant’s data revealed that BTC’s exchange reserve was decreasing, meaning that the coin was not under selling pressure at press time.

Is your portfolio green? Check out the BTC Profit Calculator

The king coin’s Binary CDD was also green, implying that long-term holders had not made many moves over the last seven days. Thus, LTHs were willing to hold their assets.

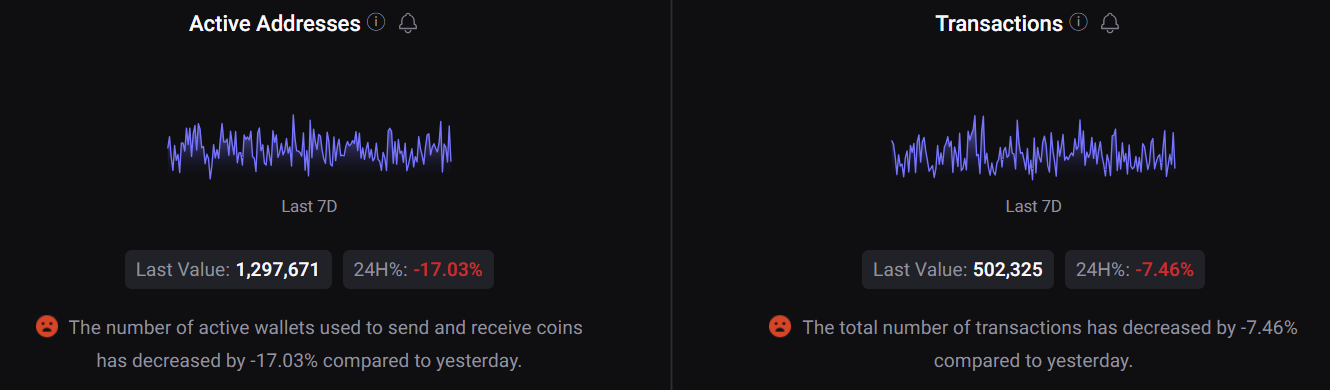

However, BTC’s Active Addresses and Transactions plummeted, signaling a potential decline in daily trade — a concerning sign.