What next for MATIC as bulls are forced to take a back seat

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC was unable to defend the $0.9 and $0.76 support levels.

- The bounce to $0.78 on 22nd November could be a retest of the resistance before another move southward.

Polygon [MATIC] reached a high of $0.983 on the 14th of November but fell by 26.7% to reach $0.721 on 21st November. The token had scaled the $0.9 resistance zone with relative ease ten days earlier and was expected to slowly climb past $1.

Yet the recent selling pressure saw these expectations upended. The large amount of MATIC moved to Binance was part of the FTX liquidation of its crypto assets.

The higher timeframe support and the market structure were both beaten

On 21st November, MATIC saw a one-day trading session close at $0.72, well below the $0.7595 support.

Moreover, this was below the recent higher low at $0.772 on 12th November. Therefore, the D1 market structure was bearish. The bounce of the past few hours retested the $75-$77 zone as resistance and was likely to fall lower.

There was a chance that it was a deep liquidity hunt after the Binance news broke and that MATIC could recover once again.

But this was unlikely because the bulls fought valiantly to hold on to $0.8 over the past week but finally succumbed. This was reflected in the On-Balance Volume when a former resistance was flipped to support, but demand couldn’t keep the uptrend going.

Alongside the market structure, the RSI was also below neutral 50 to warn bulls that the trend has begun to shift. To the south, the $0.7 and $0.65 levels could serve as support.

The drop in the MVRV ratio could be a good development for buyers

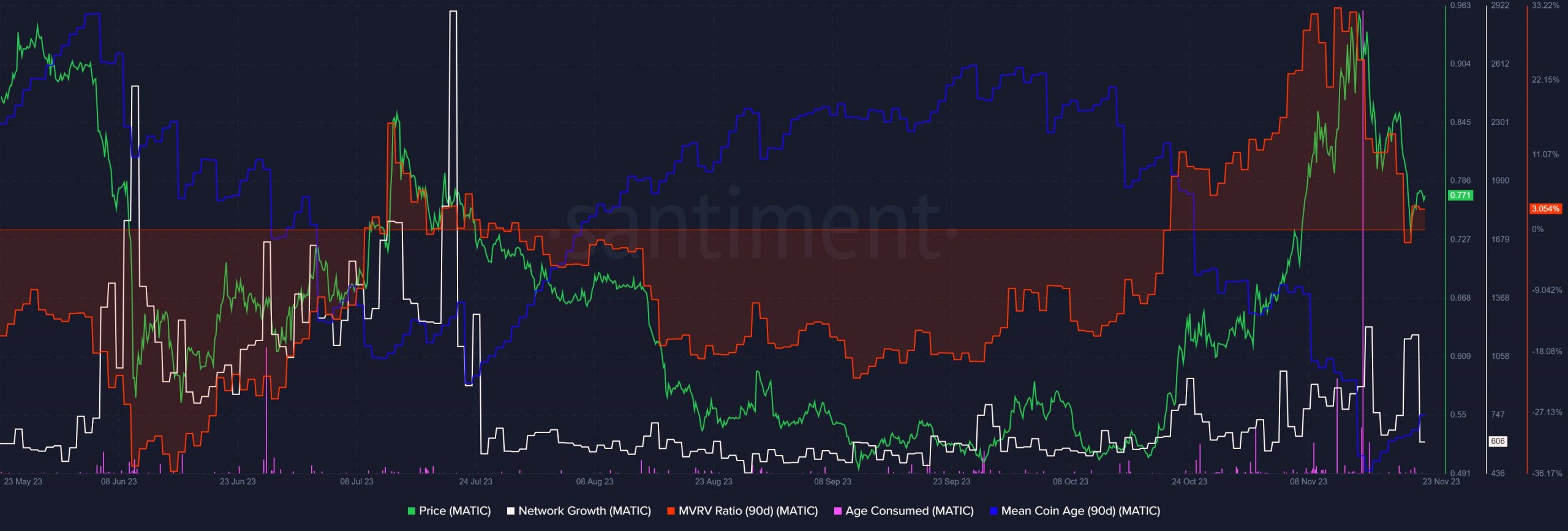

Source: Santiment

The outlook from the price charts had a bearish tinge. So did some of the on-chain metrics.

The mean coin age has trended downward since late September even as prices surged higher. This pointed toward network-wide distribution as the price rallied, and showed a lack of confidence that MATIC could break $1 and make significant gains.

The past two weeks saw the skyrocketing MVRV values fall as holders booked profits.

Is your portfolio green? Check the MATIC Profit Calculator

This was accompanied by a large uptick in the age consumed metric, which indicated a large amount of previously stagnant MATIC had been moved, as reported earlier.

The positives were the MVRV and strong network growth in the past ten days. Yet, they do not point toward bullish strength on their own.