Polygon’s network activity surges amid talks of an ‘internal strategy’

- Polygon’s volume and active addresses increased.

- The sentiment around the token is negative but the price may recover soon.

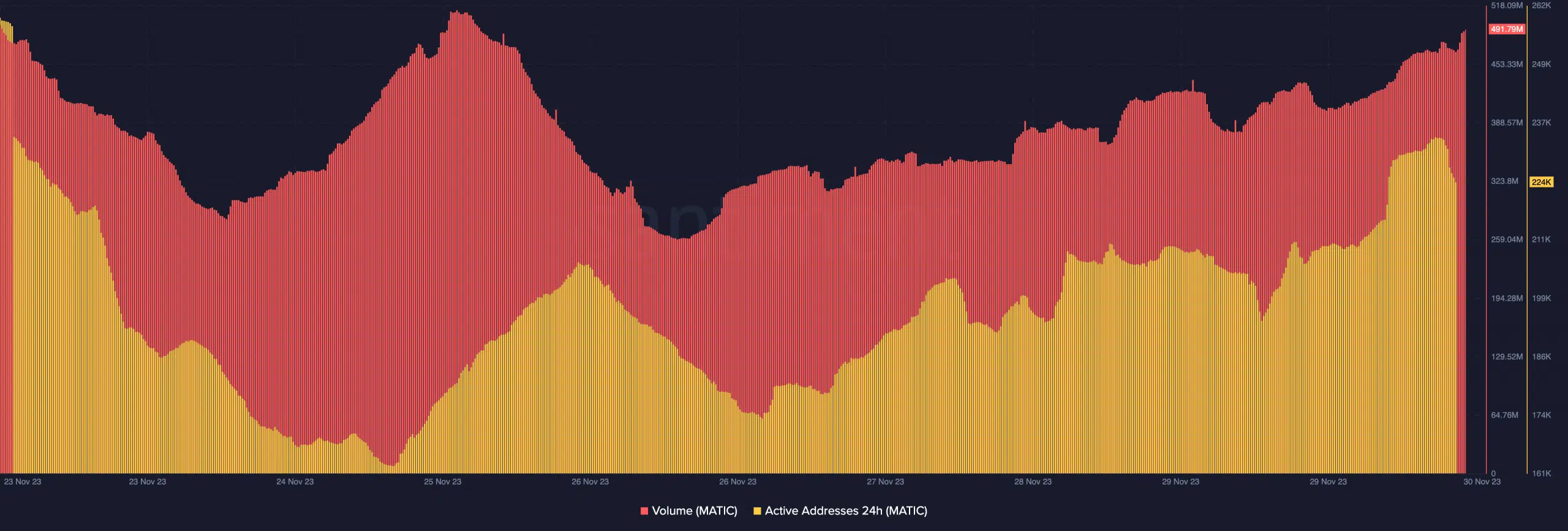

According to AMBCrypto’s analysis of Santiment, Polygon’s [MATIC] network activity has been rising.

At press time, the 24-hour active addresses had increased to 224,00. Active addresses are a good indicator of network usage.

So, the increase implies that many market players have been involved in transactions on the Polygon network.

Similarly, MATIC’s volume also followed the active addresses trend. At the time of writing, the volume had increased to 491.79 million. The rise in volume is proof that MATIC tokens have mostly been involved in the transactions on Polygon.

MATIC is involved in closet operations

The rise in network activity was surprising. This is because there have been allegations that the jump in MATIC’s value was not connected to increased demand.

In fact, AMBCrypto reported this opinion put together by Joao Wedson. Wedson, in his analysis, noted that the period MATIC rose above $0.90 coincided with the time the reserves held by exchanges increased.

The analyst noted that it was possible that demand for MATIC was not by common market players. However, the upward momentum could be the result of internal buying pressure from some exchanges.

He explained that:

“An intriguing phenomenon stands out—the apparent decoupling between the inflow and outflow on exchanges and the public interest in Polygon. While reserves on exchanges reach new heights, there seems to be no clear correlation with a proportional increase in public interest or organic demand.”

The analyst’s opinion sounded like huge allegations. So, AMBCrypto looked at a possible divergence between the MATIC price increase and interest in the cryptocurrency.

The negative pressure might soon dwindle

According to our findings, MATIC’s Weighted Sentiment climbed to 4.14 on 15th November. The jump in the metric implies that market players were bullish on the price action at that time.

But a day later, the Weighted Sentiment dropped to -0.306. This drop suggests that it did not take long for the bullish perception to turn bearish.

While the data is no confirmation of the claim, the movement of the metric suggests that there is a possibility. At the time of writing, the Weighted Sentiment was still in the negative region. This indicates that the perception of MATIC was pessimistic.

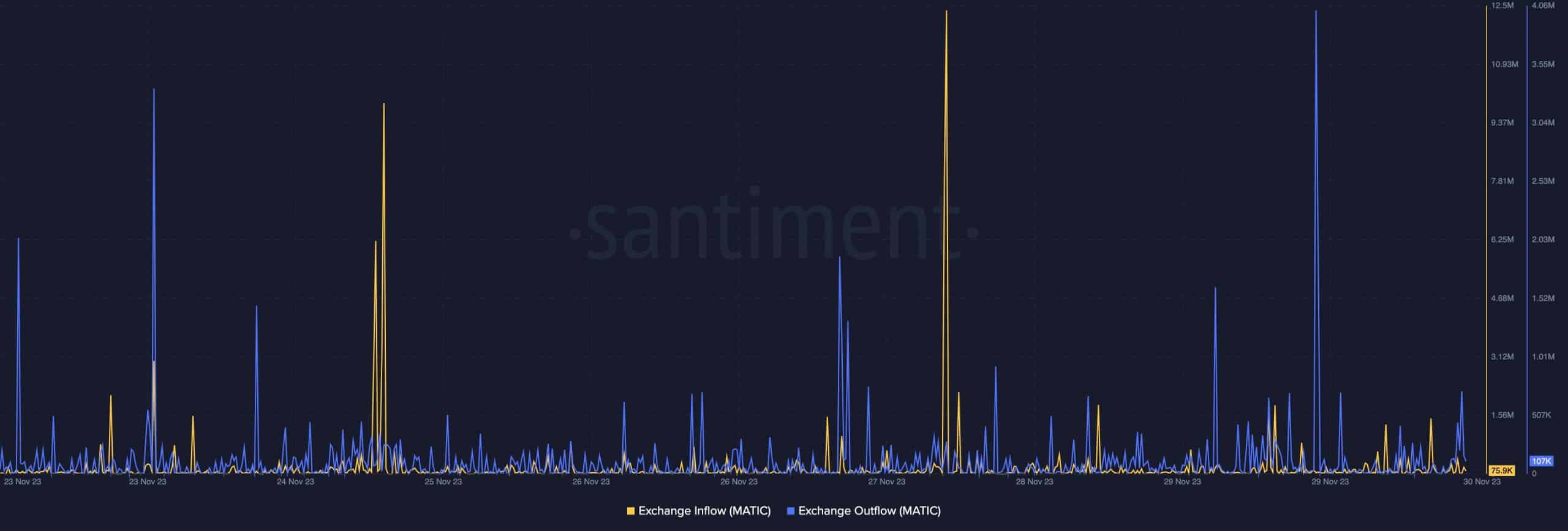

Per the exchange inflow and outflow, Santiment data showed that there has been more of the latter than the former. At press time, the exchange outflow was 107,000. This metric shows the number of tokens withdrawn from exchanges.

It also suggests that market participants have committed to keeping MATIC for the long term. For the exchange inflow, it was 75,000 MATIC tokens.

Read Polygon’s [MATIC] Price Prediction 2023-2024

When compared with the exchange outflow, the inflow implies that the selling pressure was not as much as the accumulation.

If this goes on for the next few days, MATIC’s price may recover, and the first target could be $0.80.