Upcoming Solana airdrops may have this effect on the network

- Some projects developed under Solana are planning to reward users.

- Demand for SOL may lead the price back to $65.

According to Messari, Solana’s [SOL] airdrop season is here, and, the impact on the network could be different from what has been happening in the last few months. Crypto airdrops are popular in the ecosystem.

New projects see it as a model of retaining users by rewarding some participants who meet certain requirements with tokens. In recent times Solana-based Pyth Network [PYTH] did the same for its early adopters when it launched on mainnet.

Messari, in its report, noted that there are upcoming airdrops. Some of these include Jupiter, Zeta, and Drift among others.

It's airdrop season for @solana DeFi.

With only one official airdrop to date, and more coming along the way from Jupiter, Marginfi, Drift, Zeta, and JitoSol, we can expect an increase in liquidity and user engagement. pic.twitter.com/BZn3WiUT4j

— Messari (@MessariCrypto) November 30, 2023

More rewards, more liquidity for Solana

The crypto market intelligence noted that the forthcoming events could bring more liquidity for Solana. AMBCrypto’s analysis of the Solana ecosystem showed that there has been a surge in its DEX volume.

For instance, DefiLlama showed that the Total Value Locked (TVL) in Drift had a 30-day 88.69% increase. Jito’s TVL was $401.80 million, indicating a 96.89% increase within the same period.

The TVL measures the number of tokens locked in a protocol. If the metric increases, it means market participants perceive the protocol to be trustworthy.

Also, the TVL increase infers an increase in deposits with players expecting a yield from the locked assets.

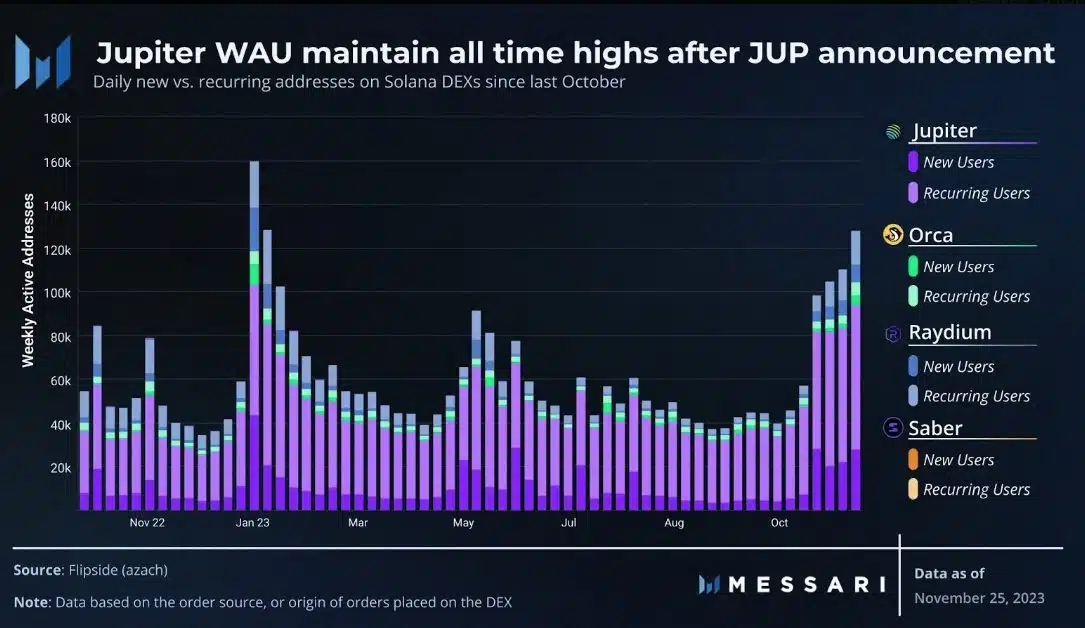

Assuming the TVL decreased, it would have implied a decrease in assets locked. Messari also considered the number of active users on Jupiter. According to the data, new addresses have been increasing on the network.

The increase in new addresses is a sign of traction. Compared with projects like Radium and Orca, Jupiter had a large dominance. This could be because users are expecting an airdrop from Jupiter.

Meanwhile, Orca and Radium did not reveal any plan to reward their users.

Besides a potential rise in active users, the airdrops could also impact the SOL price action. This is because the rise in activity could lead to increased demand for SOL.

SOL’s rise is again, nearby

At press time, SOL’s value was $60.81. Furthermore, the SOL/USD 4-hour chart showed that the Relative Strength Index (RSI) had reached 64.42.

On 27th November, the RSI reading was down 31.98, indicating that SOL had undergone a lot of selling pressure.

Therefore, the rise in the RSI reading implies that buying momentum has returned. Should the buy orders continue coming in, then SOL may hit $65. But this would only happen as long as sellers do not take control of the market.

Read Solana’s [SOL] Price Prediction 2024-2025

Another indicator backing the bullish thesis is the Exponential Moving Average (EMA). At the time of writing, the 9-day EMA (blue) had crossed over the 20 EMA (yellow).

This indicates that SOL might increase from $60 in the short term.