Uniswap Explained – A Super-Detailed Guide on Uniswap by NOWPayments

NOWPayments, cryptocurrency payment gateway, is thrilled to support UNI! In the spirit of this development, let us present a complete and thorough guide on this token and the project behind it!

Uniswap is the leader in the decentralized exchange space. It is quite popular among DeFi enthusiasts as well as with many crypto traders. It was created by Hayden Adams, and his inspiration came from an equation! Yeah, an equation.

The equation came from none other than Vitalik Buterin, and the equation is X * Y = K. This equation is a market maker equation. So, what did Hayden Adams do with this equation? He went ahead and put it in implementation, and that’s how Uniswap protocol was started.

What is Uniswap?

Source: Uniswap

Uniswap exchange is an Ethereum-based DEX. It consists of two smart contracts and is an on-chain market maker. Anyone can use Uniswap to swap ERC20 tokens. It also allows one to get ERC20 tokens through ETH and vice versa.

Do you want to earn commissions from Uniswap? They have got you covered. You can do that by contributing to Uniswap liquidity pools. They accept any ERC20 tokens as liquidity and they will share a part of the exchange fees with you.

Uniswap Liquidity Pools – How Does it Work?

There’s one key difference between how a centralized exchange and Uniswap derive the price of a crypto asset. Any guesses?

In Centralized exchanges, the price of an asset is determined by two factors: the highest and the lowest price at which a trader wants to buy or sell the asset. Contrary to that, Uniswap relies on exchange contracts.

All Ethereum tokens along with the ERC20 tokens are kept in the exchange contracts. When users swap ETH on Uniswap for a ERC20 token, their tokens are sent to the exchange contract pool, and from there, they are sent to the user. So, with Uniswap, a user doesn’t have to worry about their prices matching the seller’s desired prices or wait for anyone interested in selling their crypto asset.

The Uniswap protocol is also beneficial for many companies and individuals that are launching a new token.

Uniswap Features

Uniswap holds a prominent position in the world of decentralization today, and its features play a crucial role in its further development.

#1. Swapping

The first interesting feature of Uniswap is its routine technology. The thing with Uniswap is that it doesn’t restrict trade across any trading pairs.

Do you want a particular ERC20 token but there’s no available trading pair for it on Uniswap? No worries, Uniswap’s routing technology will take care of it. Uniswap is designed to assess the liquidity available in its pool.

#2. Oracles

The one thing that is very crucial for the success of decentralized platforms is the external data. For obvious reasons, DEX platforms cannot depend on centralized sources for external information. Uniswap accesses pricing data, in such a way that it cannot be tampered with or manipulated, as it is resistant to it.

#3. Innovative Flash Swapping

Are you not content with the upfront costs while withdrawing your tokens? There’s a way for you to avoid them! This may sound unbelievable but it is true. Try the flash swap method. It makes multi-step transactions on Uniswap free of all constraints.

Uniswap V1 vs Uniswap V2 – What’s the Difference?

The features we described above are the recent additions and were introduced along with Uniswap V2. Learn the difference between Uniswap V1 and Uniswap V2 in the Uniswap’s blog.

UNI – The Governance Token of Uniswap

Source: NOWPayments

Uniswap came out with a governance token a few days ago, and it is known as UNI. The reason behind coming out with a governance token is that the Uniswap team wants its users to have a say in how the protocol proceeds ahead. They will be able to contribute to the Uniswap ecosystem’s usage and development soon. The Uniswap team has described UNI in their blog in the following manner:

“UNI officially enshrines Uniswap as publicly-owned and self-sustainable infrastructure while continuing to carefully protect its indestructible and autonomous qualities.”

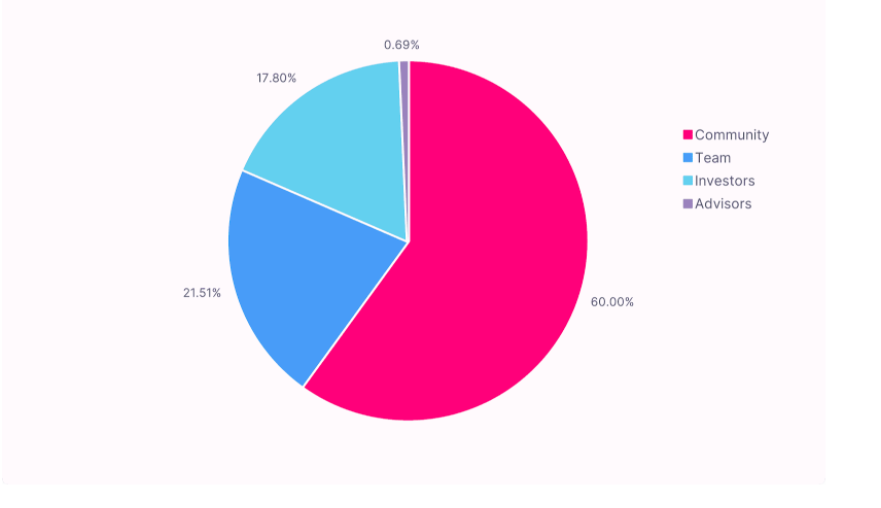

One billion UNI has already been minted, and it will be distributed over the next four years. See its distribution below:

Initial Liquidity Mining

The Uniswap team announced in their blog that their initial liquidity mining program will last from 18.09.2020 till 17.11.2020. It will only focus on Uniswap V2’s four pools. These are ETH/DAI, ETH/USDC, ETH/USDT, and ETH/WBTC.

Are There any Risks When it Comes to Uniswap?

It is of utmost importance that you know about the negatives of Uniswap. You will find many illegitimate projects that are mimicking the legitimate projects on Uniswap.

The first and major risk concerns fake projects. It stems from fake smart contracts. They aim to attract investors by impersonating legitimate ERC20 tokens. So, always use Etherscan to double-check the address of these tokens. High Gas Fee and Phishing are also among the potential risks.

Conclusion

Uniswap has played a monumental role in the growth of DEXs. Most of its growth came in 2020, and other decentralized exchanges soon followed suit.

Regardless of all the benefits that Uniswap offers, you should still be aware of things to keep an eye on when it comes to Uniswap – check the legitimacy of tokens.

With a new governance token, Uniswap has proved that they are serious about decentralization. In time, they will let the Uniswap community take the charge of Uniswap protocol’s future. As per the Uniswap Info website, the current volume of Uniswap stands at $343,727,250. It will increase further as Uniswap has established its dominance in the DEX space after Sushi failed in overtaking Uniswap protocol. It will definitely be interesting to see how Uniswap progresses ahead.

Start accepting payments in UNI NOW!

Disclaimer: This is a paid post and should not be considered as news/advice.