TRB teeters on the edge as whales start dumping

- Three whale wallets dumped nearly 230,000 coins in the market.

- TRB pumped 47% over the last week.

Decentralized oracle protocol Tellor [TRB] tumbled more than 30% over the last four days, snapping the multi-week uptrend that saw the token rise to its all-time highs (ATH).

Evidently, TRB fell sharply on the 9th of November, reversing the gains made up until then significantly. At press time, TRB was exchanging hands at $81.97, according to CoinMarketCap.

But the big question remained — Who, or what, led to this dramatic drop in price?

Whales exit the market

TRB’s price movement, like that of other small-cap cryptos with less liquidity, was influenced by a handful of powerful investors.

According to Lookonchain data, the actions of whale investors exerted significant downward pressure on TRB’s price. Three whale wallets, holding nearly 230,000 coins, went on a selling spree.

Out of the three, two addresses sold at a profit, with one selling for almost $4.5 million. The third one incurred losses of roughly $4 million through the sale.

The downtrend may continue

There was a possibility of further downsides as well. Data revealed that 20 wallets, holding 42.5% of TRB’s total supply, were yet to liquidate their holdings. Out of these, 14 wallets were profitable at the press time market price, with a combined unrealized profit of about $47 million.

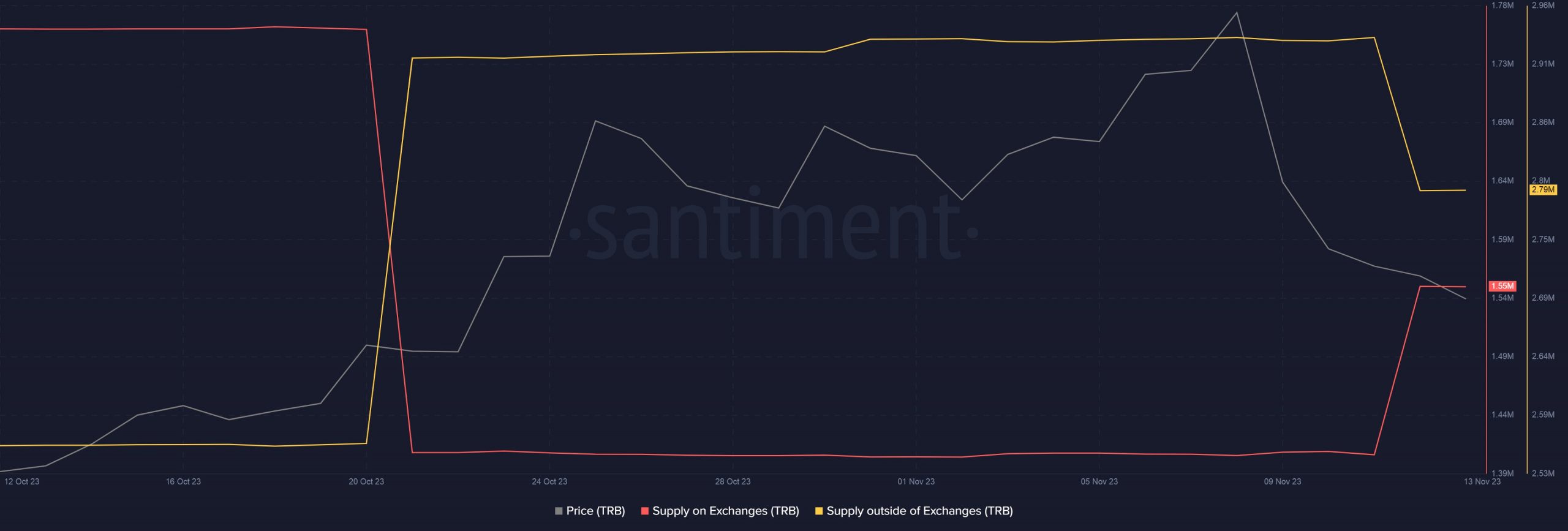

This narrative was strengthened after AMBCrypto examined the liquid supply of TRB using Santiment’s data. As indicated below, there has been a marked rise in the Supply on Exchanges recently, in contrast to the drop in Supply outside of Exchanges.

Spikes in exchange supply are generally seen as a precursor to a rise in short-term sell pressure.

While whale movements are often seen as a precursor of what to expect in the future, it’s always advisable to tread with caution and DYOR.

Realistic or not, here’s TRB’s market cap in BTC’s terms

Negative sentiment strengthens

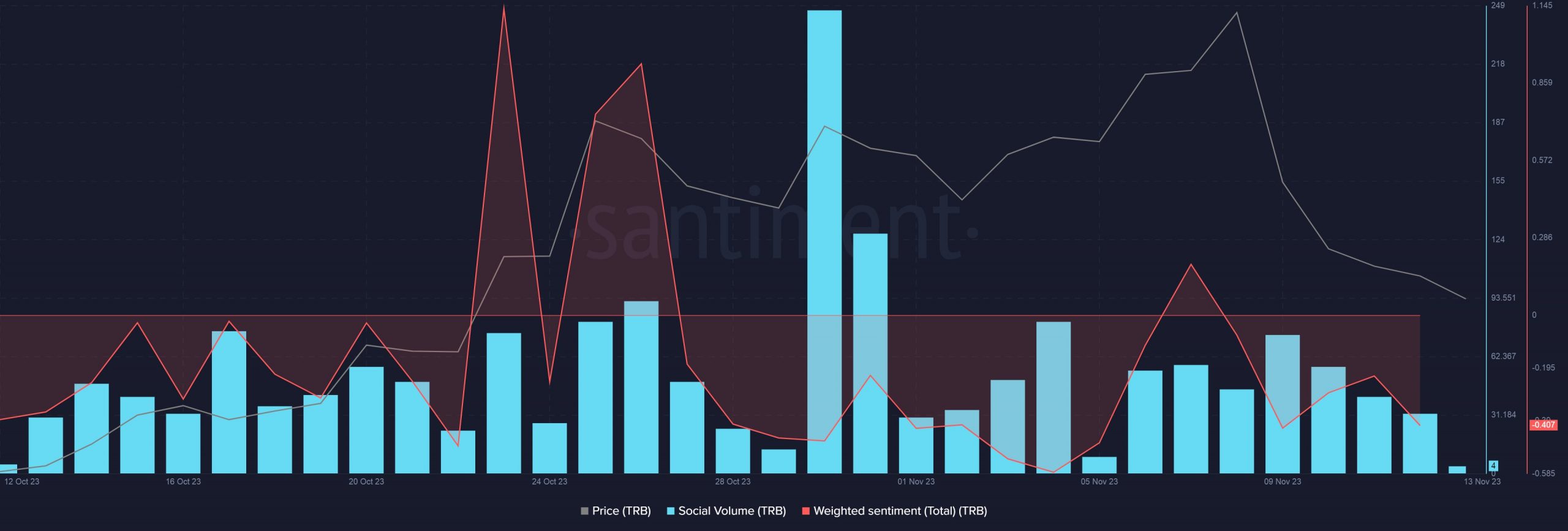

The fall in TRB’s price made investors pessimistic, as evidenced by the negative weighted sentiment indicator.

Moreover, discussion around the coin in crypto social circles dipped sharply, reflected in the falling social volume. This was a matter of slight concern, as TRB benefited from the positive talk about the coin in the past.