This Bitcoin metric predicts 2017’s bull run for 2020

Bitcoin’s recovery in the market has been slow but it has been witnessing escalating interest from users. As traders look at the low price of BTC as a perfect opportunity to hold, some old metrics have been suggesting that the bull-run might not be that far away.

As the on-chain metric gains strength, Bitcoin’s short-term holder metric was also suggesting great promise.

Source: Twitter

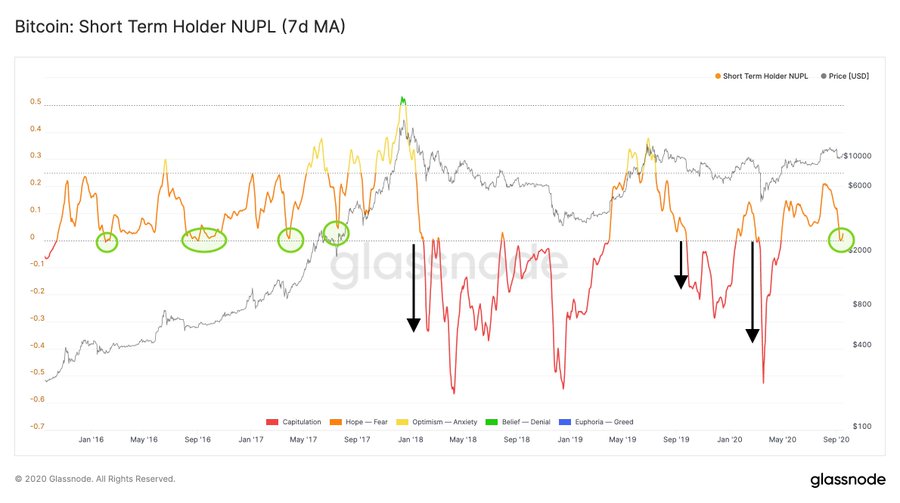

As per the above Glassnode chart, BTC’s Net Unrealized Profit/Loss [NUPL] was reporting a bullish signal. The CTO of Glassnode, Rafael Shultze-Kraft, explained that this was an important bounce from 0-line observed for the first time since 2017.

The above chart circled the period during which the short-term NUPL bounced from the 0-line and was followed by a sharp upward move for Bitcoin’s price. Before the final rally leading to a BTC peak in 2017, this metric had carried the price from the ‘Hope-Fear’ zone to the ‘Optimism-Anxiety’ zone. As the short-term NUPL bounced sharply from the 0-line it was adhering to the characteristics of a previous bull market. This price point has also proved to be a good buying opportunity.

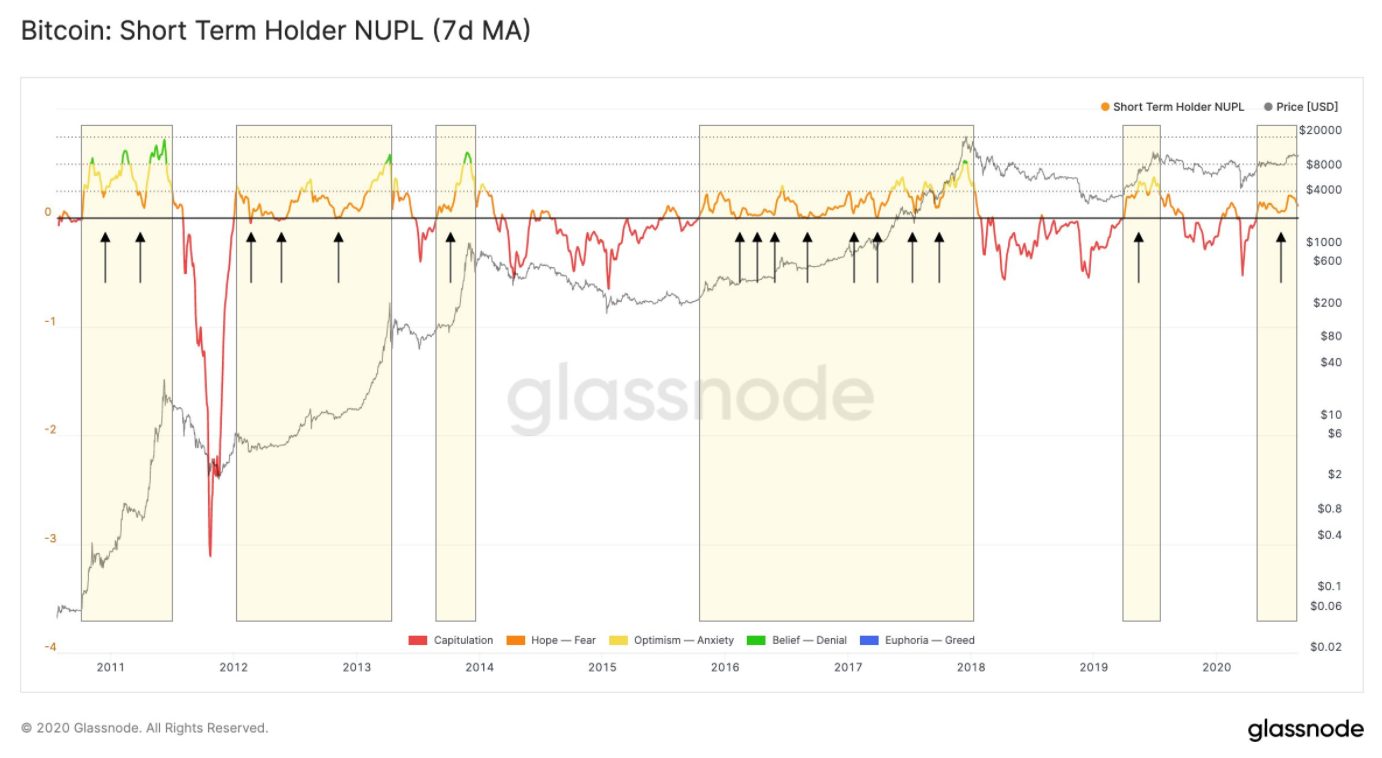

Previously, the same metric had held a positive position during the last four months, akin to a bullish market. This could mean that if history repeats itself, Bitcoin may be in its ‘pre-bull run’ phase.

Source: Twitter

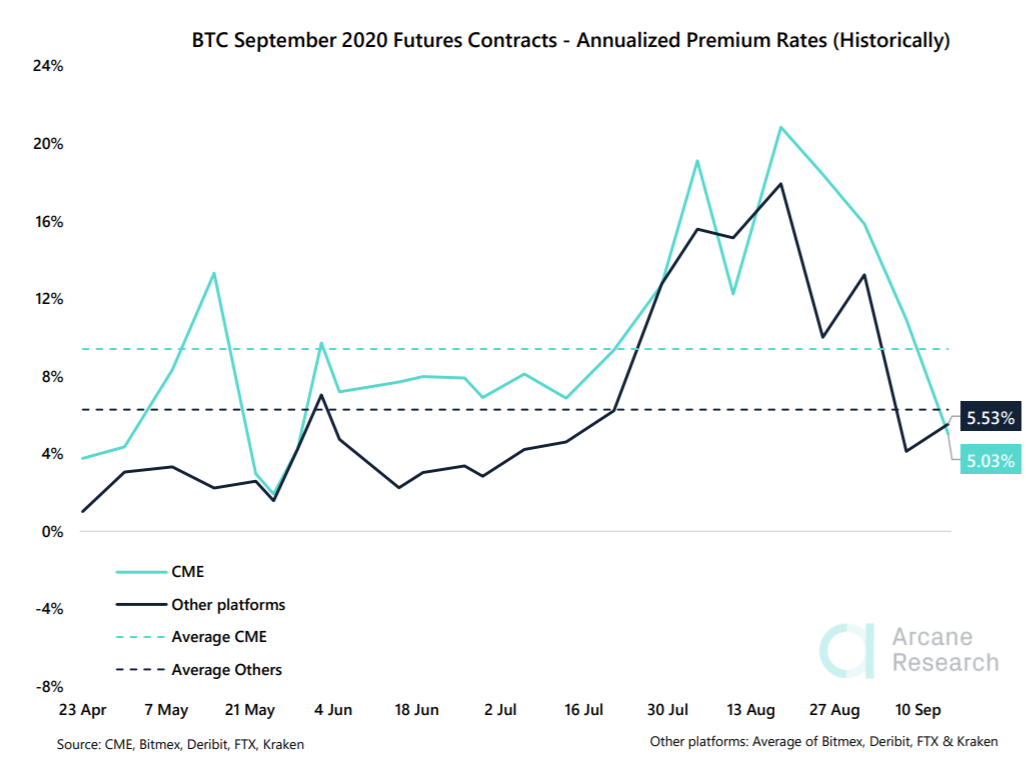

Despite a bullish outlook, the premium rates on the short-term contracts on CME were falling since topping above 20% on 18 August. The short-term contracts were also aligning with the retail-focused platform, but CME traders appeared bullish on the longer-term contracts relative to the retail platforms.

Source: Arcane Research

December contracts on CME were trading at a 2.47% premium, whereas retail platforms recorded the average premium of 1.54%. However, as the price reaches closer to $11k, the interest among retail and institutional traders may witness an uptrend.