The truth about hodling Bitcoin at $18,000

We have heard it countless times over the past few months. “Bitcoin HODLing has reached a new-high and accumulation is at its peak”; true but the reality is, there is a fine line between understanding such a sentiment and accepting its facts.

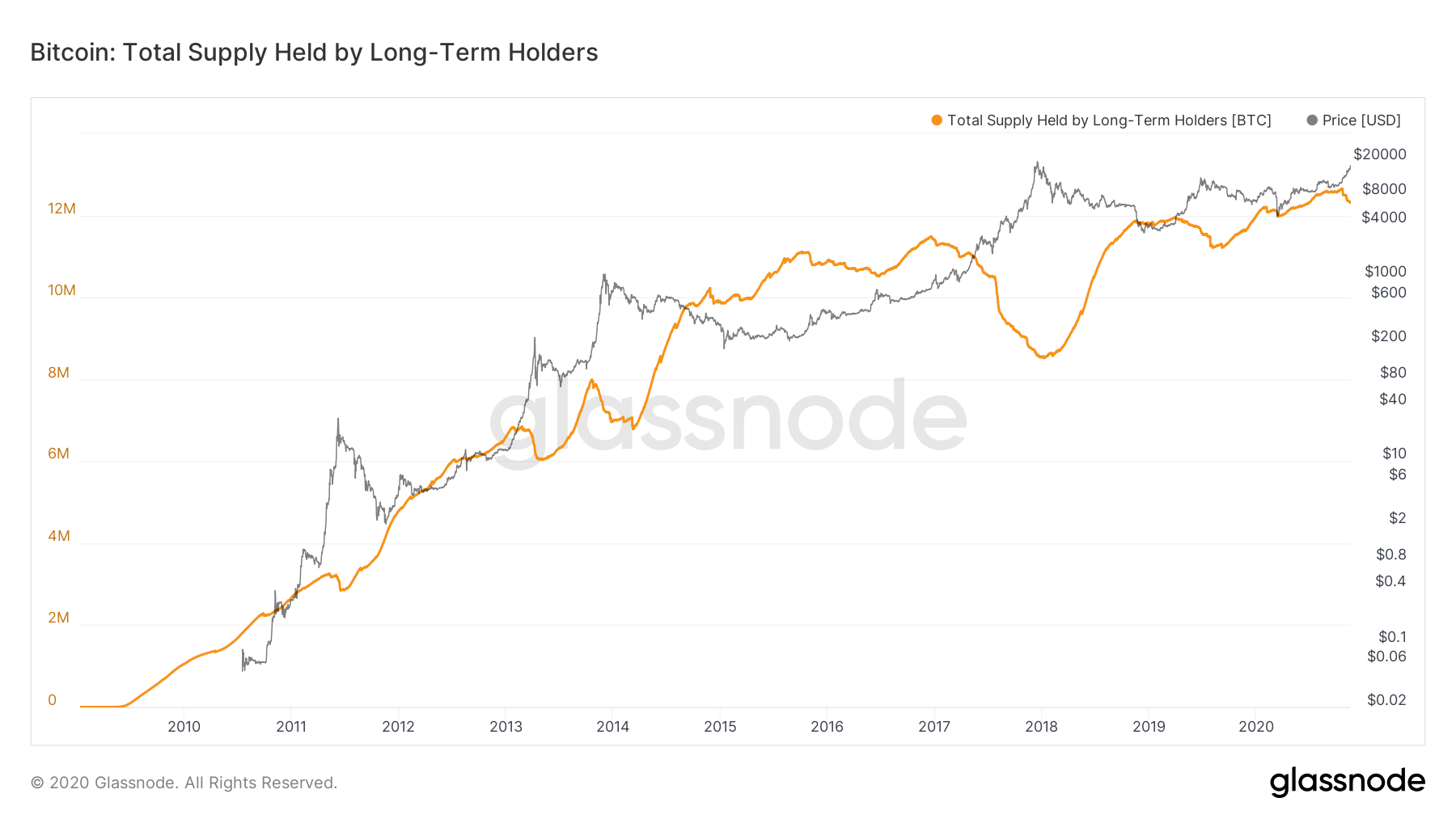

Bitcoin HODLing has definitely been a trend in 2020 and the numbers don’t lie. However, it was imperative to understand when these HODLers begin to shift gears. Classifying such a narrative depends on the difference between Long-Term HODLers and Short-Term HODLers, and Glassnode’s recent report indicated some striking developments.

Bitcoin registered another milestone in 2020 as it surpassed the $18,000 mark over the last few hours. While such a valuation should lead HODLers to further holding their grounds, the end-goal remains to “beat the market” and exploit higher price sentiments.

Source: Glassnode

According to a study by Rafael Schultze-Kraft, CEO of Glassnode, the Long-Term HODLers supply was declining as witnessed on 17th November. Surprisingly, such a shift in HODLing is common during the start of a bull run. Now, the common misconception with regards to Long-Term Hodlers has been that these are entities have been holding BTC for years. That is correct, but according to the calculation, anyone holding BTC for more than 155 days falls under this category.

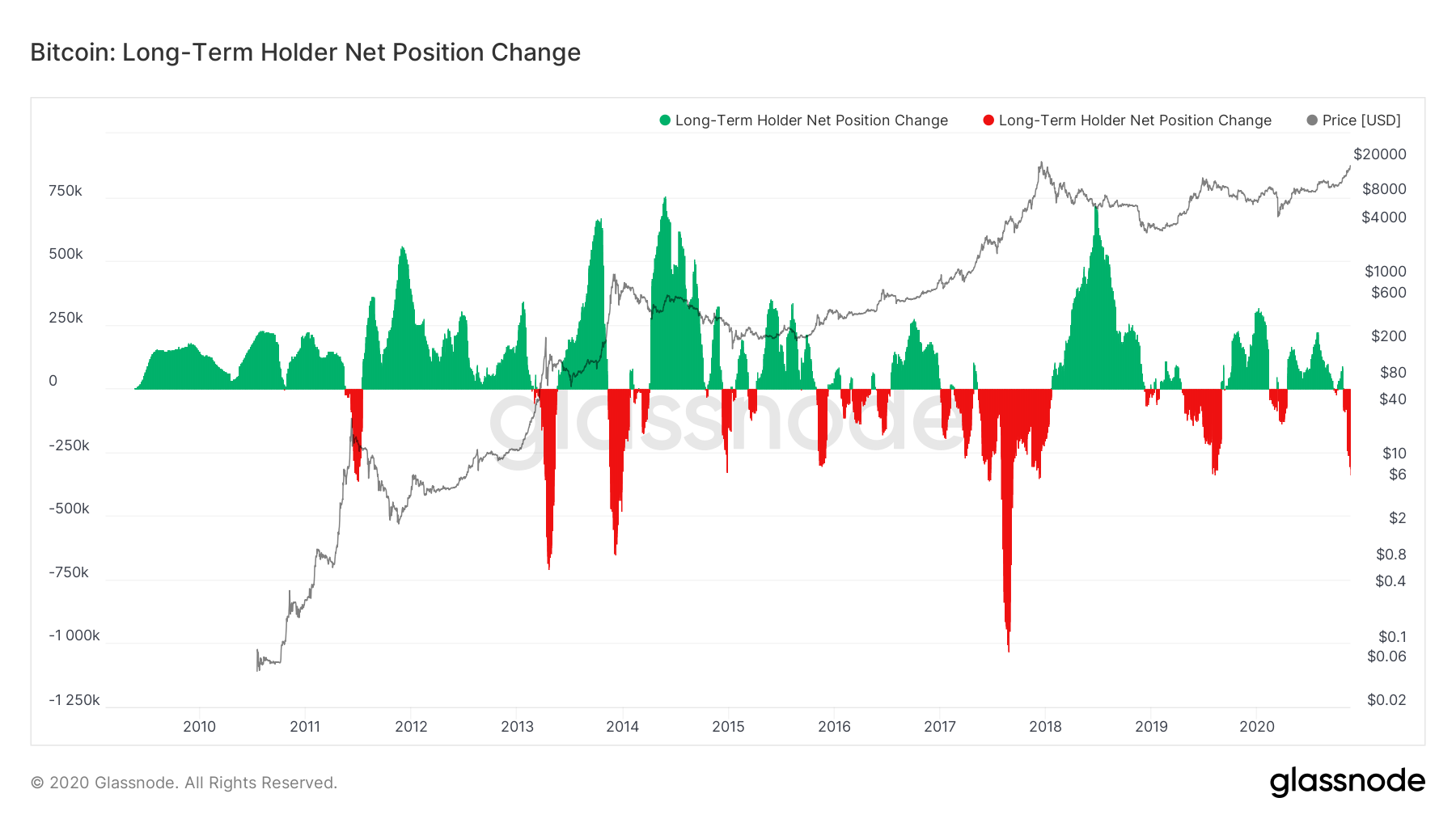

Source: Glassnode

The Long-Term Holder Net Position Change indicates the same decline.

This is in fact, what the community has failed to understand about HODLing till now. While 12 million BTC under Long-Term Hodlers are making a profit, Short-Term HODLers with 3.5 million were cutting a similar profit from the market. Both at 97%.

What difference does LTH or STH Bitcoin Hodling make then?

As mentioned earlier, the main objective of holding remains to beat the market during such rallies. Over the past 24-hours, more than 300K LTH Bitcoins exited the market at $17,800 but the price jumped right after few hours to $18.5k at press time. While the 300k BTC exited at profit, Short-Term Hodlers made a spike as illustrated in the chart below.

Source: Glassnode

Hence, the narrative all Long-Term Hodlers continue to hold position might not be completely accurate. It is just a fine balance between the entry and exit between STH and LTH supply during the present bullish rally.

The sentiment of Bitcoin HODLing will continue to rise in the markets but it is imperative to understand that profitability is what drives Hodling and not the price action itself. Although it might sound the same, the above difference between Short-Term and Long-Term HODlers explains the driving sentiment.