The Templar Fund: Meet the Transparent Bitcoin Fund That Has Earned More than 75% Return Since 2018

It is a common error to think that Bitcoin is anonymous, when in fact, Bitcoin is completely transparent. Every transaction conducted since its inception can be found on the blockchain. Thanks to a largely ignorant media, the public has been misinformed to think that Bitcoin is the anonymous playground of criminals, nor has it helped that many well-known Bitcoin companies have been exposed as the work of criminals.

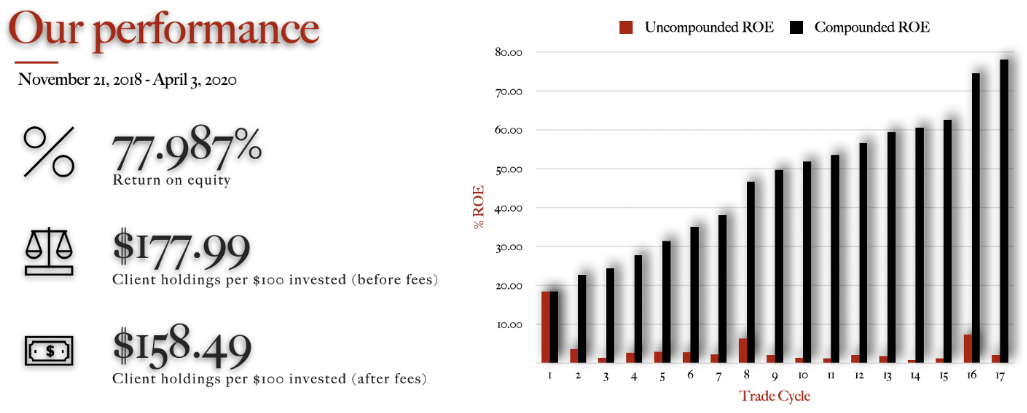

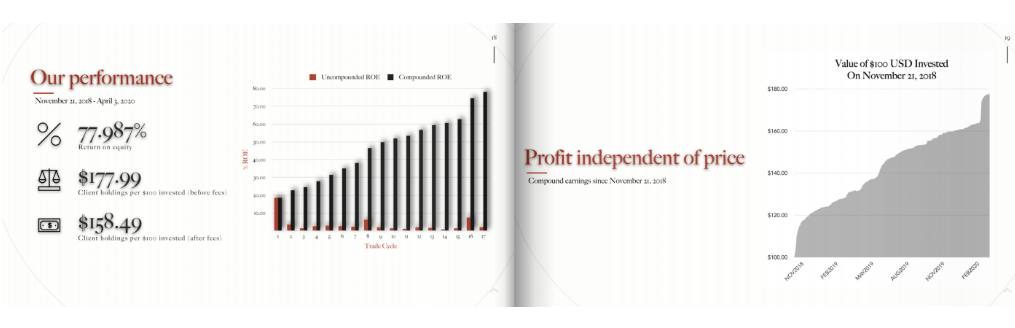

Standing in opposition to these dark enterprises is a public and transparent hedge fund known as the Templar Fund. The Templar Fund has earned more than a 75% return on equity since its launch in 2018.

From its inception, the Templar Fund has proudly published the entirety of its trade activities. Acting as a liquidity provider to the world’s largest Bitcoin futures market, the Templar Fund uses custom-built automated trade technology to earn market-making profits no matter the price action of Bitcoin. In other words, the Templar Fund earns profit no matter the price of Bitcoin.

As a demonstration of their commitment to complete transparency, the Templar Fund broadcasts a 24/7 live stream of their trading activities. Interested parties can use the historical library of live trade broadcasts to verify the accuracy of the published trade reports. For the first time in financial history, consumers simply do not need to rely on a third party to establish financial credibility; instead, they can investigate and verify the Templar Fund with their own eyes.

The Templar Fund trades in 30-day trade cycles, offering its clients liquidity at the close of each. During each 30-day cycle, the fund publishes three 10-day trade reports. Each report contains every trade made by the automated system, as well as balance verification data pulled directly from the BitMEX exchange. Each report is emailed to clients, along with a 2-minute how-to video explaining the results.

Another method the Templar Fund uses to educate and welcome new clients is their easy-to-understand webinar that takes a look behind the scenes of the Templar Fund. This webinar is presented in simple language, uses easy-to-grasp illustrations and is available on the fund’s website.

Additionally, the Templar Fund Manager makes himself available to chat with clients on their discord channel after each trade cycle.

Perhaps the best feature of the Templar Fund is that, like Bitcoin, it operates without the requirement of KYC (personal identification) documents. This allows investors from every country on earth and of every income bracket to participate. To further cement this fact, the Templar Fund does not require a minimum deposit to trade. A curious client could deposit as little as 0.0001 BTC to trade along with the fund.

In 2019 the Templar Fund earned its clients 56.580%. While these results may seem too good to be true, every trade completed to accomplish this performance is published in full detail on the Templar Fund’s website. Since 2018 the Templar Fund has earned more than 75% return on equity.

To learn more about the Templar Fund & to download the pitch deck visit here.

Disclaimer: This a paid post, and should not be treated as news/advice.