Altcoins

Tezos, Bitcoin SV, Chainlink should thank ‘idiosyncratic factors’ for positive Q1 returns

Q1 of 2020 was an unusual quarterly period for Bitcoin and the rest of the crypto-industry.

After hiking consecutively for a period of 6 weeks, much of the community speculated that Bitcoin could be on its way to registering its best quarterly returns in 8 years. However, things took a major turn after the king coin fell and Bitcoin ended up incurring its 2nd worst returns since 2016.

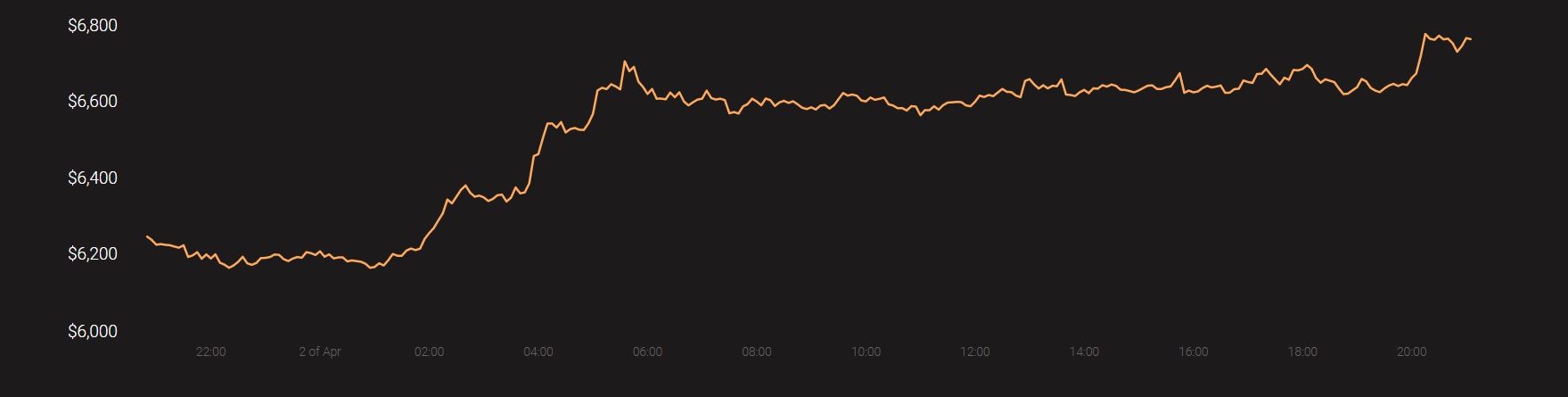

Source: Coinstats

According to Binance Research, assets such as Bitcoin and Ethereum, among other large market-cap coins, while noting a record-high correlation over the previous quarter, contributed significantly to the March collapse. The correlation factor of Bitcoin with respect to Ethereum, Litecoin, and Bitcoin Cash was substantially high, something that led to massive sell-offs on all sides after Bitcoin declined by 38 percent on 12 March.

With the COVID-19 pandemic and the associated global economic crisis, many have suggested that the collective crypto-asset market would not be able to sustain recovery, unless Bitcoin is able to undergo another bullish rally.

However, the report argued that despite high correlation and price volatility, certain major crypto-assets have come out of Q1 of 2020 with relatively good positive returns. Major coins such as Chainlink, Tezos, and Bitcoin SV all registered an overall hike in Q1, and these assets maintained low correlations with other assets as well.

Source: Trading View

On analyzing the aforementioned tokens, it can be observed that the quarterly returns for Tezos, Bitcoin SV, and Chainlink were significantly higher than the rest of the industry. BSV was up by 76.77 percent in Q1, whereas Tezos and Chainlink registered an increase of 28.92 and 24.48 percent, respectively.

The report stated that these assets displayed higher positive gains due to idiosyncratic factors such as project-specific elements like community development, mainnet launches, hardforks, etc.

With such idiosyncratic coming into play, correlation with other crypto-assets did not synchronize and the index fell on the charts. BSV, XTZ, and LINK highlighted the lowest correlation with Bitcoin, as these coins were positive movers for the major part of Q1.

Such a situation highlights the uncorrelated nature of digital assets, something that was recently criticized by traditional market proponents. With crypto-assets recovering better than traditional assets at the moment, its uncorrelated narrative is getting another breather as well.