Tether turns to Chainalysis in bid to regain trust with new AML tools

For stablecoins, regulatory compliance has been a challenge. While stablecoins project a simpler narrative regarding its utility as an on-ramp, recent incidents involving popular stablecoins and accusations regarding money laundering have been problematic.

Tether, the most dominant stablecoin in the market with a market cap of $4.6 billion, had to face damaging accusations of market manipulation, fraud, and money laundering in 2019. Such allegations have again highlighted the need for compliance solutions in the cryptocurrency market.

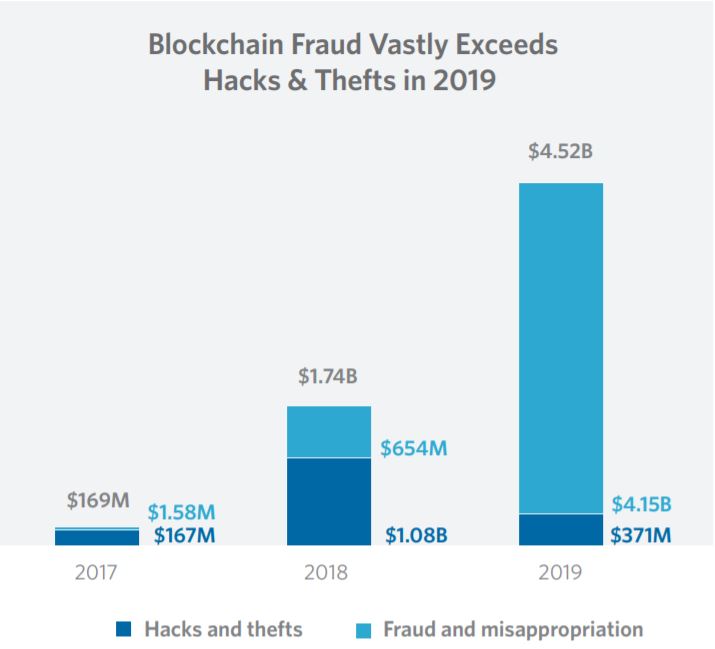

For many investors, fraudulent activities and an unregulated ecosystem still define the crypto-landscape. While this might not be entirely true and there is a lot of merit in the utility that stablecoins and cryptocurrencies in general offer, money laundering, and fraudulent transactions are still a reasonable concern for regulators and investors. In fact, a recent CipherTrace report highlighted that in 2019, losses worth $4.5 billion were incurred from fraud, misappropriation of funds, exchange hacks, and thefts. What is interesting to note here is that out of the total sum, a loss of $4.15 billion directly resulted from cases of fraud and misappropriation.

In 2019, Tether and Bitfinex were embroiled in a lawsuit where it was alleged that both parties were participants in market manipulation. The lawsuit accused Tether of creating artificial demand by printing un-backed USDT.

In a bid to make compliance a priority, blockchain analysis company Chainalysis launched a new real-time anti-money laundering (AML) compliance solution that monitors the Tether token’s full lifecycle, right from the time when it is issued. The Chainalysis Know-Your-Transaction (KYT) for token issuers will enable the Tether platform to track the token’s movement across the blockchain and flag any suspicious transactions.

Jonathan Levin, Co-Founder and Chief Strategy Officer at Chainalysis, highlighted that “by putting proper AML transaction monitoring in place, Tether is demonstrating its commitment to transparency and regulatory compliance, further building trust among its growing user base.”

Many speculate that the latest announcement by Tether regarding the implementation of KYT will address the problematic trust levels many in the ecosystem share regarding USDT. The Chainalysis KYT will be integrated via an API and will allow token-issuers to monitor large volume activity and be aware of high-risk transactions.

Regarding the added anti-money laundering compliance tool Tether has sought to implement, Tether’s Chief Technology Officer, Paolo Ardoino, said,

“As one of the largest cryptocurrencies by market capitalization, we have a responsibility not just to regulators but also to the cryptocurrency ecosystem to have transparent, automated compliance solutions in place to handle any amount of volume at any given time. This solution allows us to ensure a secure compliance program that fosters trust with regulators, law enforcement agencies and users.”