Tether may be well-positioned to see use-cases diversify

The cryptocurrency ecosystem has evolved substantially over the past decade. While Bitcoin remains the most recognizable flag bearer, the industry’s adoption rates would look quite different if it were not for handy stablecoins. In this regard, Tether has been god-sent for the cryptocurrency market and the larger ecosystem. However, with stablecoins growing, the distribution and ownership of Tether may shed further light on the direction the stablecoin market might be taking.

During a recent conversation, Nate Maddrey, Senior Research Analyst at CoinMetrics, highlighted the changing dynamic with respect to the kind of accounts that own significant portions of stablecoins like USDT. Maddrey noted that whales accounts owning substantial stablecoins are on the rise. He said,

“This shows that over 4 billion Tether right now is held by addresses that hold at least a million dollars worth of Tether. So basically whale addresses hold a large majority of the overall Tether supply and this suggests to me that most Tether is being held on exchanges right now.”

Earlier in the year, Bitcoin’s price fell by half in less than an hour’s time during the infamous Black Thursday price crash. Subsequently, stablecoins saw their premiums go up. According to Maddrey, more addresses have since then stored money on exchanges in the form of stablecoins.

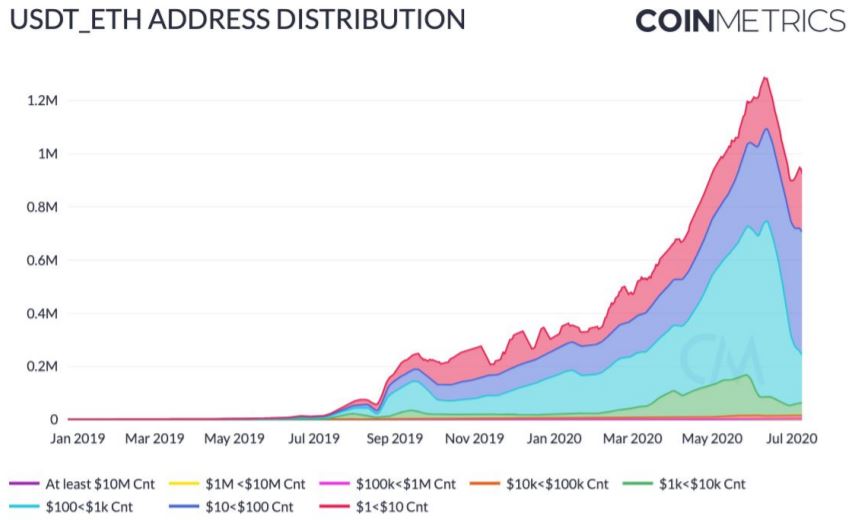

While addresses holding huge amounts of USDT noted a rise over the past few months, there has been a similar surge at the other end of the spectrum too. The analyst highlighted,

“There was an explosion in smaller addresses too, following March 12. So we kind of saw two things happening at once. We saw a large growth in small addresses, holding a thousand dollars or less worth of Tether. And we also saw a large growth in the supply held by whale addresses.”

Source: The Rise of Stablecoins, CoinMetrics/Bitstamp

Interestingly, according to a recent report by CoinMetrics, since 12 March, there was a rapid growth in addresses with $1k or less. However, that trend has reversed over the last two months,

“There are over 750K USDT_ETH addresses that hold at least $10, and about 325K that hold at least $100. But there are less than 55K addressees that hold at least $1K worth of USDT_ETH, which means a large majority of addresses hold relatively small amounts.”

Source: The Rise of Stablecoins, CoinMetrics/Bitstamp

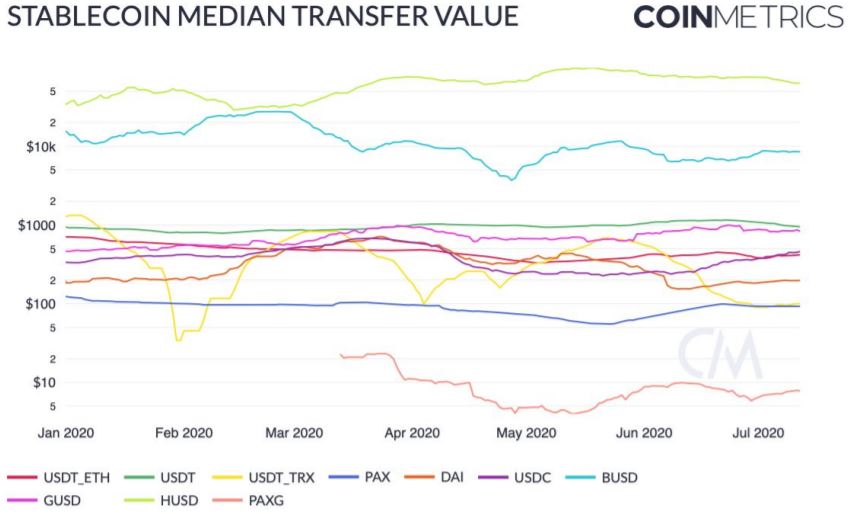

Maddrey went on to note that USDT remains cheaper to trade primarily because of its high liquidity. He pointed out that the increase in smaller addresses can also be a sign that people are now warming up to the idea of using stablecoins as a medium of exchange, and not just to store funds on exchanges.

While the median transfer value of Tether remains relatively low at around $1000, in contrast to that of BUSD and HUSD, it does open up more use-cases.