Solana reaches highest price since May 2022: What’s next?

- SOL started trading at its highest point in 18 months.

- It logged a 20% intraday rally on the 15th of November, following Cathie Wood’s comments.

Solana [SOL] has emerged as a top performer in the altcoins market, with its native token SOL now trading at its highest price point since May 2022.

At press time, the Layer 1 coin exchanged hands at $65.52. The last time the alt traded for this high was on 10 May 2022, data from CoinMarketCap showed.

SOL’s price has been consistently rising since the 15th of October. The coin experienced a further 20% intraday surge on the 15th of November, spurred by remarks from ARK Invest CEO Cathie Wood in an interview with CNBC.

According to Wood:

“Ether was faster and cheaper than Bitcoin in the day — that’s how we got Ether. Solana is even faster and cost-effective than Ether.”

2022 was rough for Solana

Touted as an “Ethereum [ETH] killer” due to its transaction speed and scalability, Solana’s performance in 2022 was significantly impacted by the series of outages it experienced during that year.

Between January and September, the network experienced eight outages. According to the status reports from the network’s developers, the outages were primarily caused by congestion, occurring when the network became overwhelmed with transaction volume.

So far this year, the chain has performed optimally, recording only one outage on the 20th of July, which lasted approximately four hours. The cause of the outage was a bug in the network’s software, which the developers promptly fixed.

Another major setback for Solana in 2022 was the unexpected collapse of FTX, a cryptocurrency exchange founded by Sam Bankman-Fried, a prominent figure in the Solana ecosystem.

FTX had been a strong supporter of Solana, providing liquidity and promoting the network’s adoption.

When the exchange collapsed in November 2022, this had a ripple effect on SOL’s value and how the general crypto ecosystem perceived the chain. Between the 10th of November to the 31st of December 2022, SOL’s value plummeted by 41%.

This metric is one to look out for

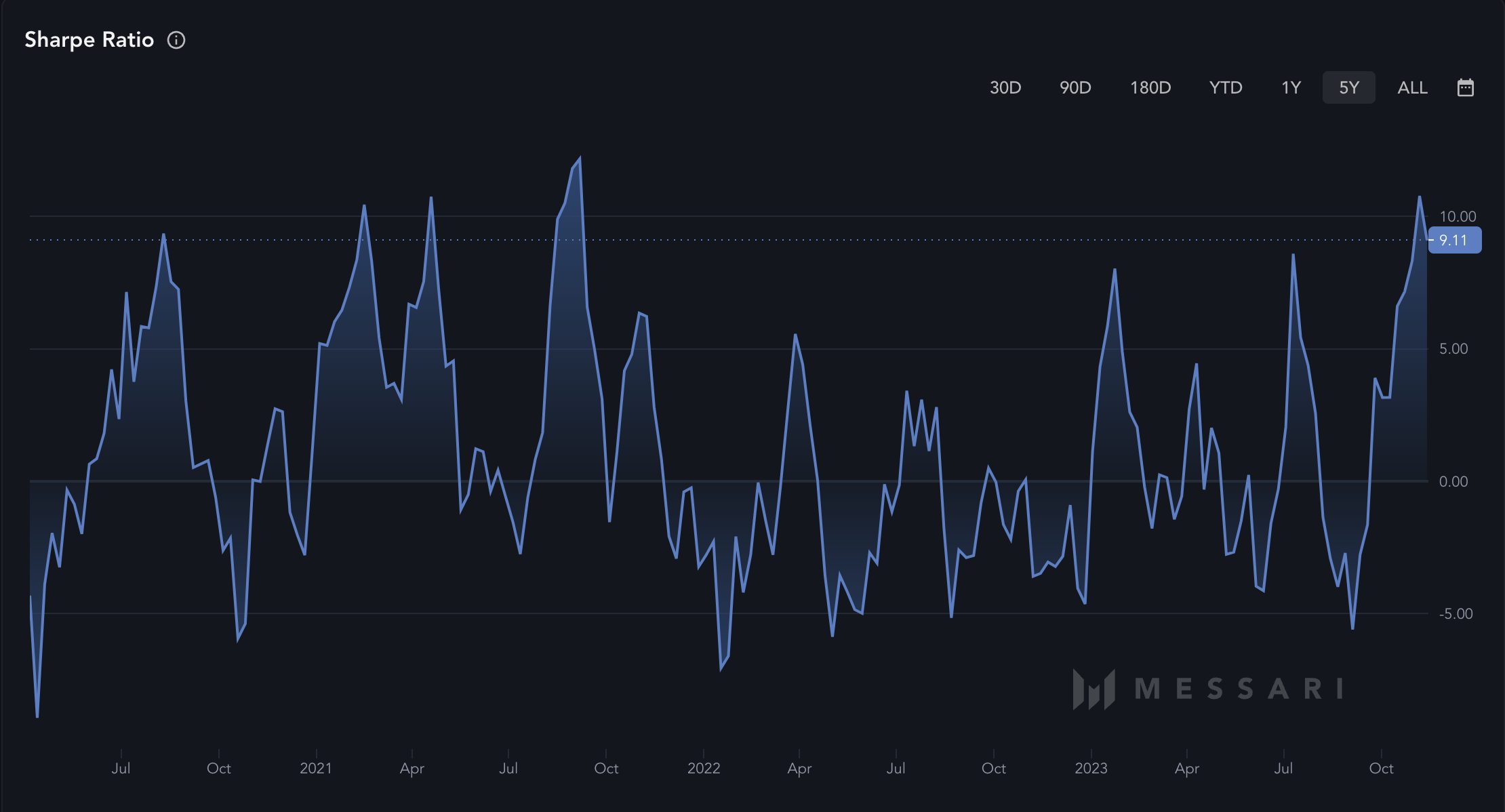

An on-chain assessment of SOL’s performance conducted by AMBCrypto revealed a steady uptick in its Sharpe ratio since September.

This metric is used to compare the returns that would be generated from investing in an asset with its associated risks. When an asset’s Sharpe ratio rises, it generates higher returns relative to the amount of risk it takes.

Is your portfolio green? Check out the SOL Profit Calculator

Investors often take this as a bullish sign, making them accumulate more.

At press time, SOL’s Sharpe ratio was 9.11, growing by 262% since the 4th of September, according to data from Messari. At its press time value, SOL’s Sharpe ratio sat at its highest since September 2021.