RUNE prices cross $5 – Can the bulls hold on?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- RUNE saw a short-term shift in sentiment after the rejection at $5.38.

- Its higher timeframe market structure and the recent breakout past $2 meant swing traders could retain their bullish bias.

THORChain [RUNE] saw a huge amount of Bitcoin [BTC] traded on its market. The decentralized liquidity protocol allows users to swap one asset for another without the need for order books to secure liquidity.

This led to BTC maxis calling for it to be the only intermediary on which to trade BTC. This could further enhance the bullish sentiment behind RUNE.

The break above $2 was decisive for the bulls

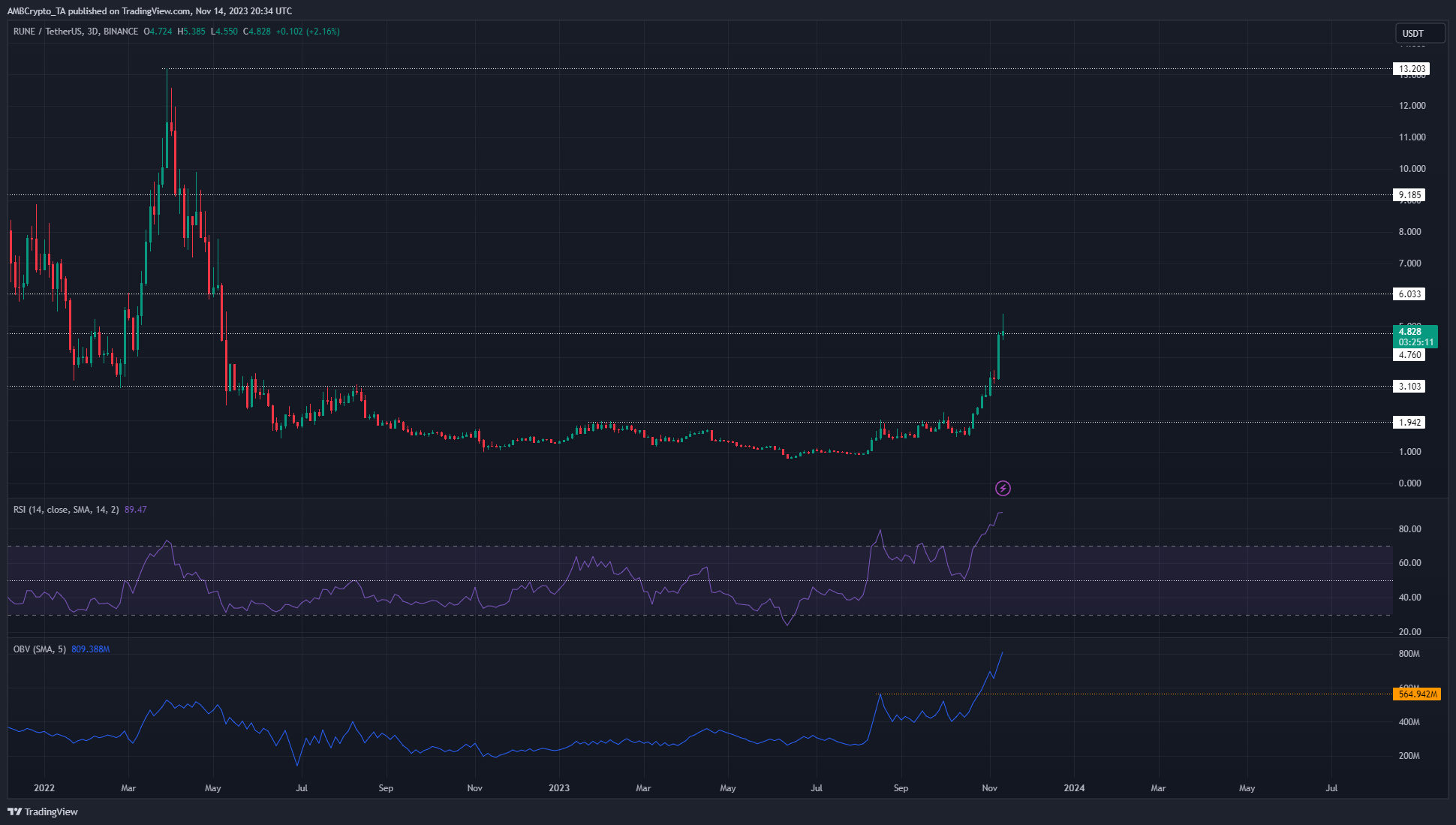

The capital flow into the altcoin market saw many assets surge almost straight past strong higher timeframe resistance zones. RUNE was no different and it saw an uptrend established after beating the $1.94 resistance level.

This level has served well throughout 2023 but since the breakout, RUNE has gained an additional 180%. The On-Balance Volume indicator also broke out past a local resistance to reflect the enormous bullish dominance.

The buying volume saw RUNE reach $5.38 but a pullback to $4.82 was observed in recent hours. The RSI was at 89 to reflect huge upward momentum. If the $4.8-$5 zone is retested as support, $6 and $7.6 would be the next targets.

The lower timeframe price charts showed that the $4.6-$4.8 region was a good place to buy RUNE. However, a fall below $4.6 could take it to $3.9 and $3.5, meaning buyers must manage risk accordingly.

Has the short-term sentiment shifted against RUNE?

Source: Coinalyze

The Open Interest (OI) saw a decline in the past 48 hours after RUNE faced rejection at $5.38.

Is your portfolio green? Check the THORChain Profit Calculator

The fall in prices and OI reflected bearish sentiment in the market in the short term. However, the spot CVD continued to trend higher.

This meant demand was still present in the spot market. The funding rate was also highly positive and indicated that a majority of the market was on the bullish side of the fence.