Rise in Bitcoin’s trading volume undercuts fall in price correlation over Q1 2020

2020 will go down in the history books as a year of immense financial importance. However, it has been an equally important year for the digital asset industry.

Not only has the digital asset space faced a meltdown of such proportions for the first time in its history, but the nascent asset class has also done fairly well in the charts, alongside traditional stocks and equities.

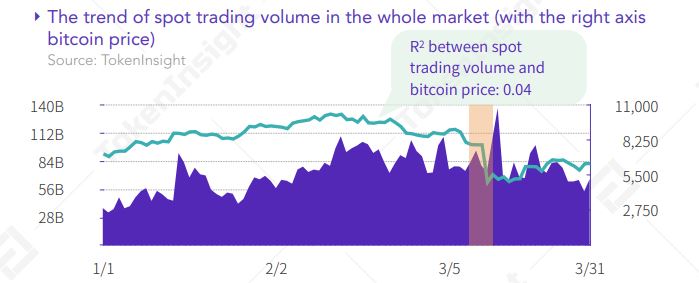

According to a recent report by TokenInsight, the trading volume of the digital asset spot market in Q1 of 2020 has been impressive, with a recorded increase of 104 percent over the last quarter. In fact, the entire market registered a trading volume close to $6.6 trillion with a confidence level of 60-70 percent.

However, the industry also faced its fair share of shortcomings, especially the market collapse in mid-March.

Source: Token Insight

The report suggested that market fluctuations were a major problem during the economic collapse, a time when Bitcoin plunged by 38 percent. The significant market anomalies led to an increasing divergence between market trading volume and Bitcoin’s price. It stated,

“In the First quarter of 2020, it is extremely low: 0.04, was 0.78 in 2019, and there are apparent faults around 312: 0.6 before, and -0.21 afterward.”

During the price decline, the global financial market contributed to a severe liquidity crunch and dried up the cryptocurrency market. A state of de-leveraging was observed and Bitcoin’s value dropped. The drop in spot prices was simultaneously replicated in the derivatives market, resulting in a Futures price drop with strong de-levering market sentiment.

A majority of this took place on BitMEX. BitMEX recorded a drop in Bitcoin accumulation, one that was caused by traders depositing coins to either trade the very high volatility or add a margin to existing positions to avoid liquidation. The deleveraging part, aggregate Open Interest fell by 50% in a single day, with the same yet to recover, at the time of writing.

Such irregularities in extreme market conditions and abnormal investor behavior, with investors moving in and out of certain exchanges, may have led to an increase in the amount of wash trading.

The report added,

“There are still plenty of fake volumes in the emerging centralized exchanges. The whole industry still needs a more authentic voice.”

Silvering Lining amidst the chaos?

After accounting for these drawbacks, it is important to take note that this was the first time Bitcoin and the rest of the asset class faced a financial meltdown and in hindsight, it fared relatively well. The market on-chain fundamentals remain healthy and with time, trading volume limitations would likely be reduced and better transparency will be attained over the next quarter.

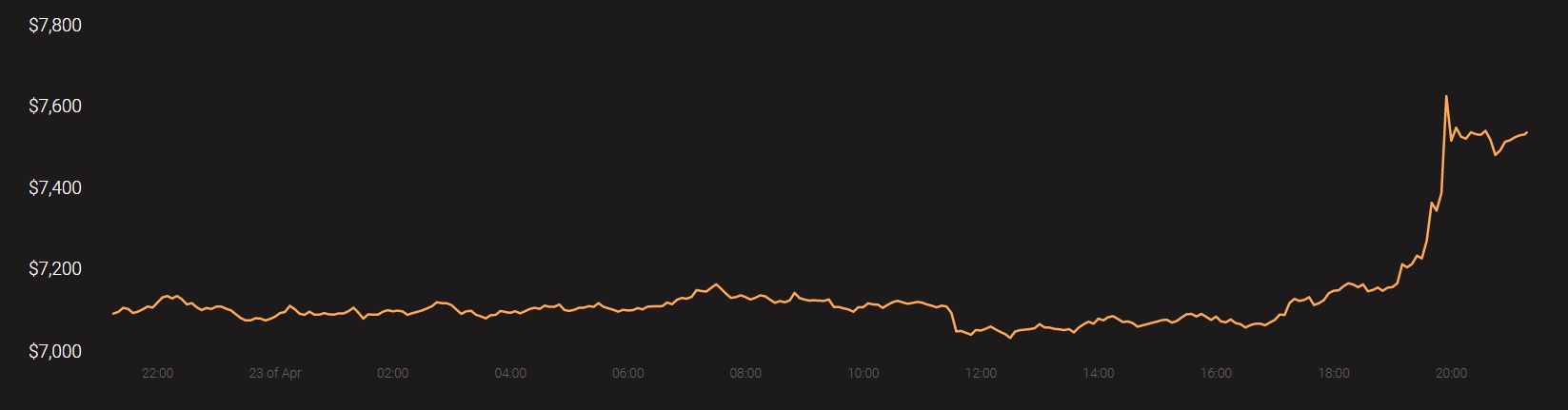

At the time of writing, Bitcoin was priced at $7544, with a 24-hour trading volume of $20.5B.

Source: Coinstats