Polygon’s Q3 recap springs one key surprise for the ecosystem

- Polygon PoS’s daily transactions fell by 2% QoQ

- Defying the NFT winter, Polygon’s average weekly trading volumes surged by 131% QoQ

Polygon’s ecosystem had an exciting Q3, with a lot to talk about in terms of advancements, new features, and overall network activity.

Read MATIC’s Price Prediction 2023-2024

Polygon’s network activity remained stable

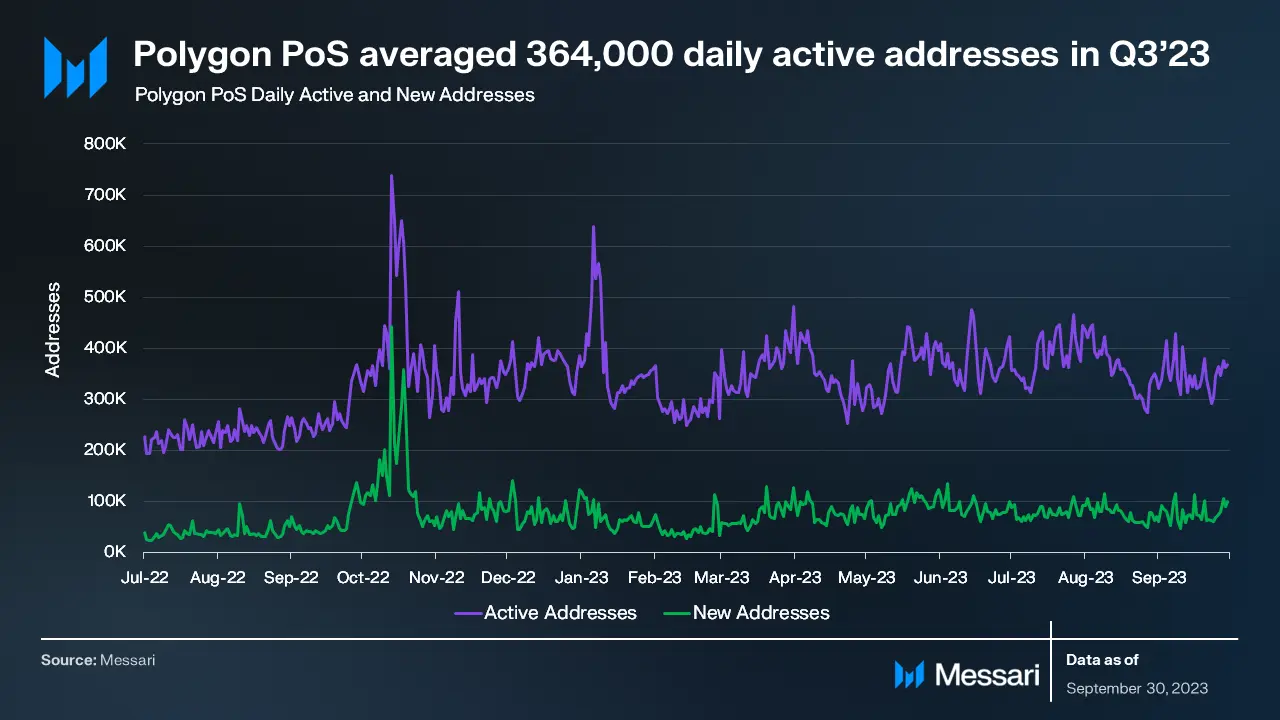

According to on-chain analytics firm Messari’s new report, the Polygon proof-of-stake (PoS) chain recorded a 1.4% hike in daily active addresses over the last quarter. A majority of the addresses were linked to decentralized finance (DeFi) activities, while the gaming sector saw a considerable drop in the overall share since Q1.

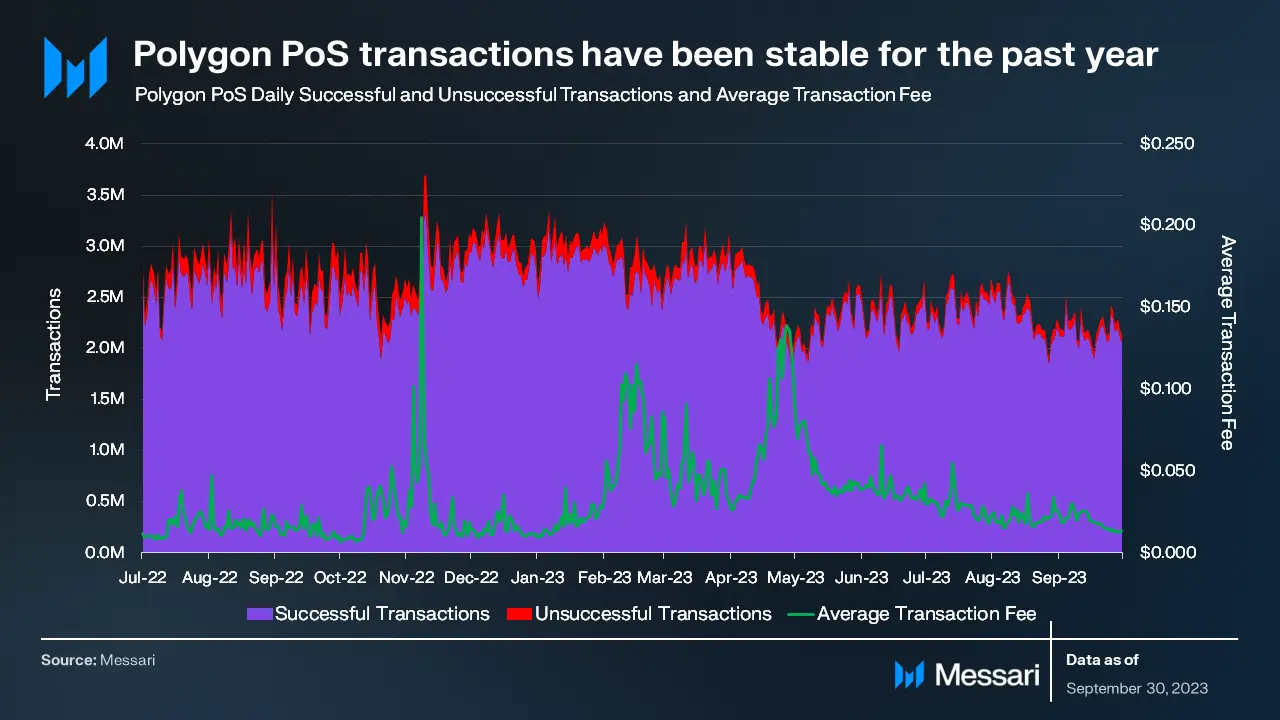

On the other hand, a marginal dip in network traffic was seen. Polygon PoS logged a daily average of 2.3 million successful transactions in Q3, down 2% quarter-over-quarter (QoQ). However, the trajectory has been relatively stable over the past two quarters of 2023.

Unlike active addresses, the gaming industry accounted for a bulk of the transactions.

DeFi sector disappoints, NFT uplifts

Polygon’s total value locked (TVL) in DeFi protocols plunged by 16%, compared to the previous quarter. Additionally, the report attributed this to the broader market decline in crypto-asset values since the highs of mid-2022.

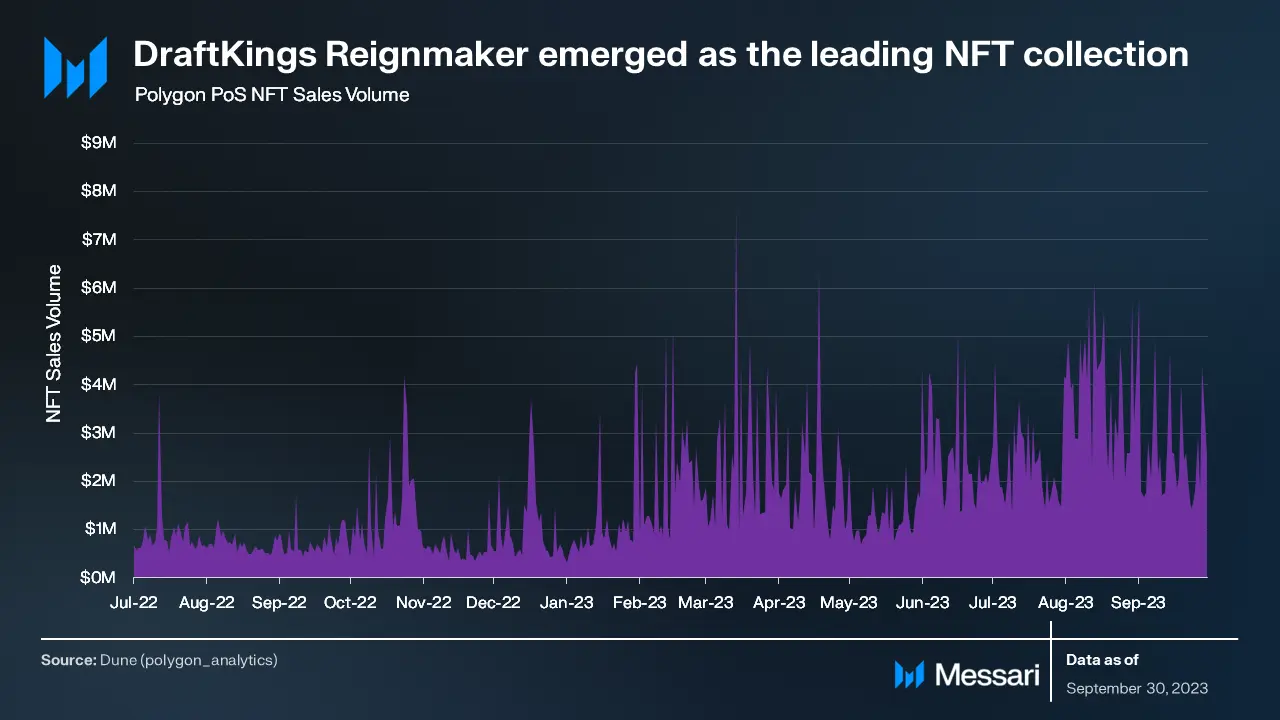

While Polygon’s DeFi growth went into the negatives, a bright spot emerged in the non-fungible token (NFT) industry. Defying the NFT winter, Polygon’s average weekly trading volumes surged by 131% QoQ.

Notably, the surge was powered by DraftKings, the leading NFT collection on Polygon. Indeed, it was the fourth-largest collection overall in terms of sales volume over the last month, according to Cryptoslam.

MATIC endured big losses

MATIC, the network’s native token, lost a big chunk of its value in Q3. A significant 16% fall was seen in MATIC’s market cap when compared to Q2. The fall was more precipitous, especially when compared to major cryptos like Bitcoin [BTC] and Ethereum [ETH].

Realistic or not, here’s MATIC’s market cap in BTC terms

Polygon’s community is eagerly looking forward to the realization of Polygon 2.0 vision. The proposed upgrades include upgrading the existing PoS network to a zkEVM validium network and transitioning the primary gas token from MATIC to POL. At the time of writing, the POL token had been activated on the mainnet.

Polygon’s proof-of-stake (PoS) network activity remained stable throughout Q3, However, significant volatility was seen across its DeFi and NFT markets. Only time will tell whether this changes over the next few months.