Polygon: Reasons behind the massive hike in daily transactions

- Polygon has reached a new high in daily transactions count.

- This was due to the activity around the Ordinals-inspired token standard on the network.

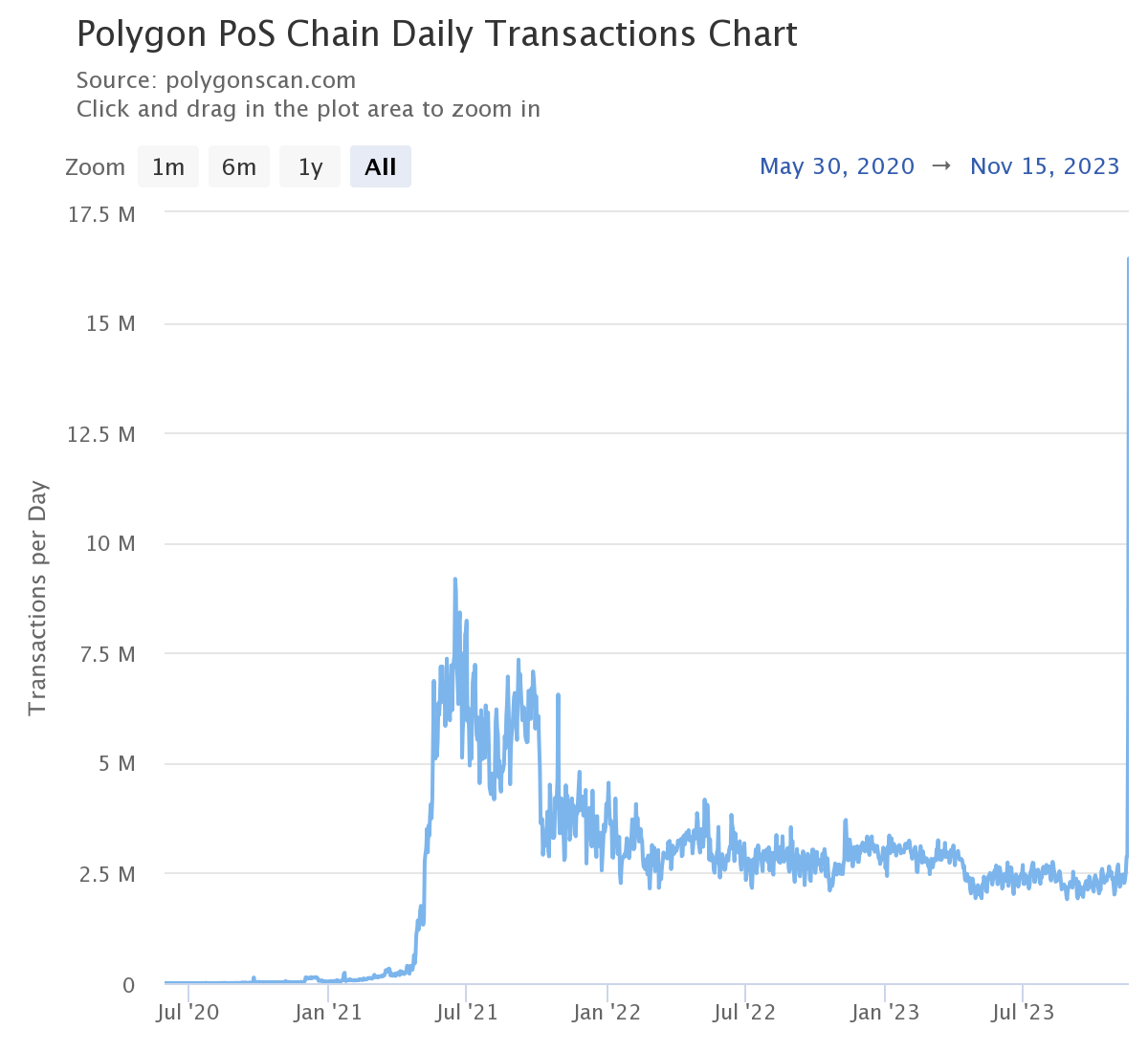

Daily transactions count on leading Ethereum [ETH] sidechain Polygon [MATIC] rallied to an all-time high of 16.4 million on 16th November, data from Polygonscan showed.

Information retrieved from the data provider showed that the daily count of transactions on the network grew by 166% between 15th and 16th November, growing from 6.17 million to over 16 million within a 24-hour period.

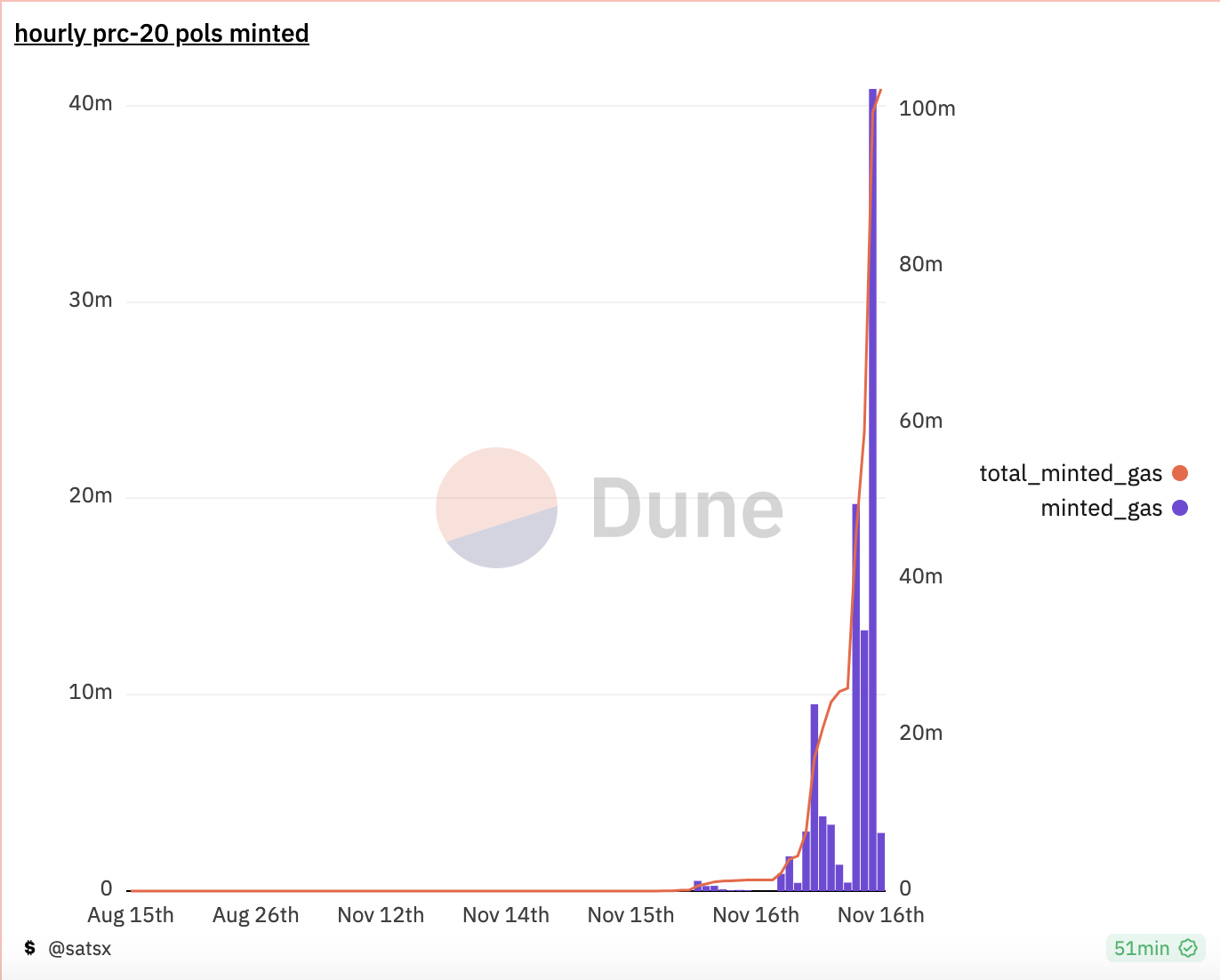

This unprecedented spike was attributed to the influx of users who flocked to the network to mint the new Polygon-based non-fungible token (NFT) collection POLS, an Ordinals-inspired token standard on the network.

According to data from Dune Analytics, since POLS minting began, a total of 102.79 million MATIC tokens, worth around $88 million, have been spent as gas fees. The uptick in user activity on the Polygon network sent average gas fees to new highs.

On 16th November, the average fee paid to execute transactions on the sidechain climbed to a high of 700 GWEI from just 100 GWEI the previous day.

With a decline in POLS minting in the past 24 hours, the average transaction fee on Polygon was less than 200 GWEI at press time.

MATIC saw increased demand as well

As POLS minting gained momentum, the demand for Polygon’s native token MATIC soared. This was because users sought the altcoin to settle transactions on the sidechain.

AMBCrypto’s assessment of MATIC’s on-chain performance revealed high demand for the altcoin.

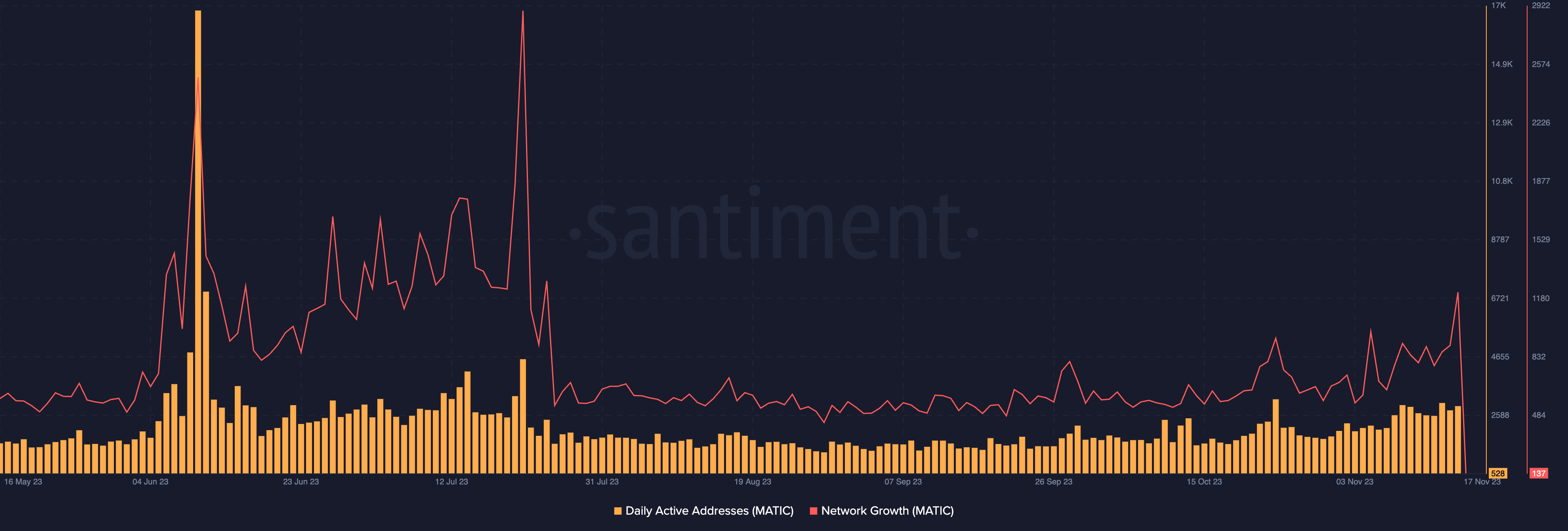

The number of new addresses created on the Polygon network totaled 1217, increasing by 26% from the 900 recorded the previous day

Likewise, the daily count of active addresses on Polygon witnessed growth. Between 15 and 16 November, this went up by almost 10%, according to data from Santiment.

During the intraday trading session on 16th November, MATIC exchanged hands as high as $0.93. As its demand cratered when POLS activity began to decrease, the alt’s price initiated a decline.

At press time, MATIC traded for $0.86, seeing a mere 2% price hike in the past 24 hours, according to CoinMarketCap.

The position of the token’s key momentum indicators observed on a 12-hour chart confirmed the drop in MATIC accumulation.

Read Polygon’s [MATIC] Price Prediction 2023-24

As of this writing, its Money Flow Index (MFI) rested below the center line. Its Relative Strength Index (RSI) was in a downtrend, poised to cross below the line as well.

This showed that MATIC traders favored selling over buying within the period under review.