Only Bitcoin-inclusive investment portfolio can endure financial collapse, suggests Grayscale report

The payment system, although permanent to our society, has witnessed a change in the definition of assets and its providers. Same can be said for today’s fiat industry that is currently being challenged by the era of cryptocurrency. While people have claimed Bitcoin’s prowess over government-issued currencies owing to numerous limitations, the ongoing U.S.-China trade war has sent alarms of an incoming financial collapse.

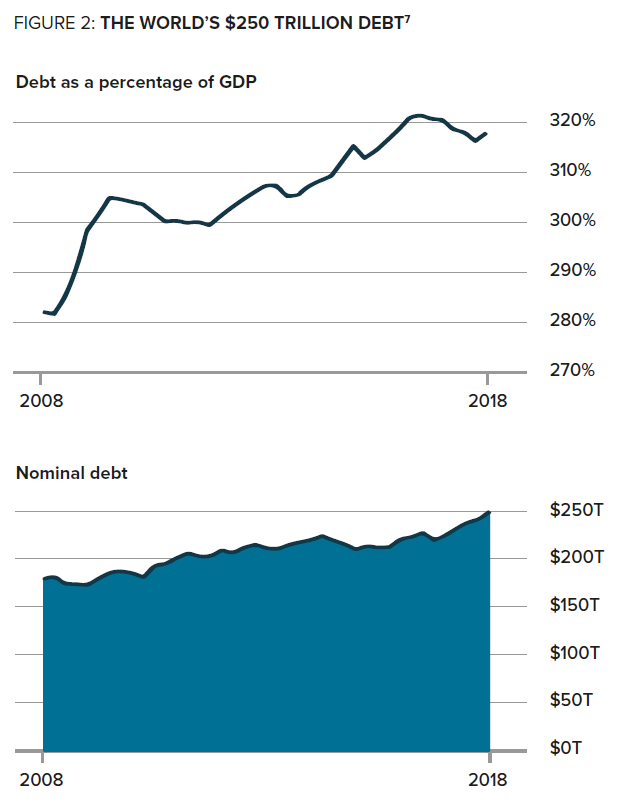

Grayscale’s latest research focused on the “liquidity risk,” which provided insight into how the all-time-high global debt and rising liquidity risk can serve as a perfect mix for Bitcoin’s rise into mainstream.

Source: Grayscale

While highlighting the debt figure as above, Grayscale argued over Bitcoin’s position owing to its “distinct set of properties unlike any other asset.” It read,

“Through this unique mix of properties, Bitcoin has the potential to perform well

over the course of normal economic cycles as well as liquidity crises, especially

those involving currency devaluations.”

Bitcoin’s foundational properties – store of value, spending and growth – arguably stand a better chance than traditional fiat currency, primarily during the liquidity crisis and economic cycles. As a result, the study suggested BTC as an asset that “deserves a steady strategic position within many long-term investment portfolios.”

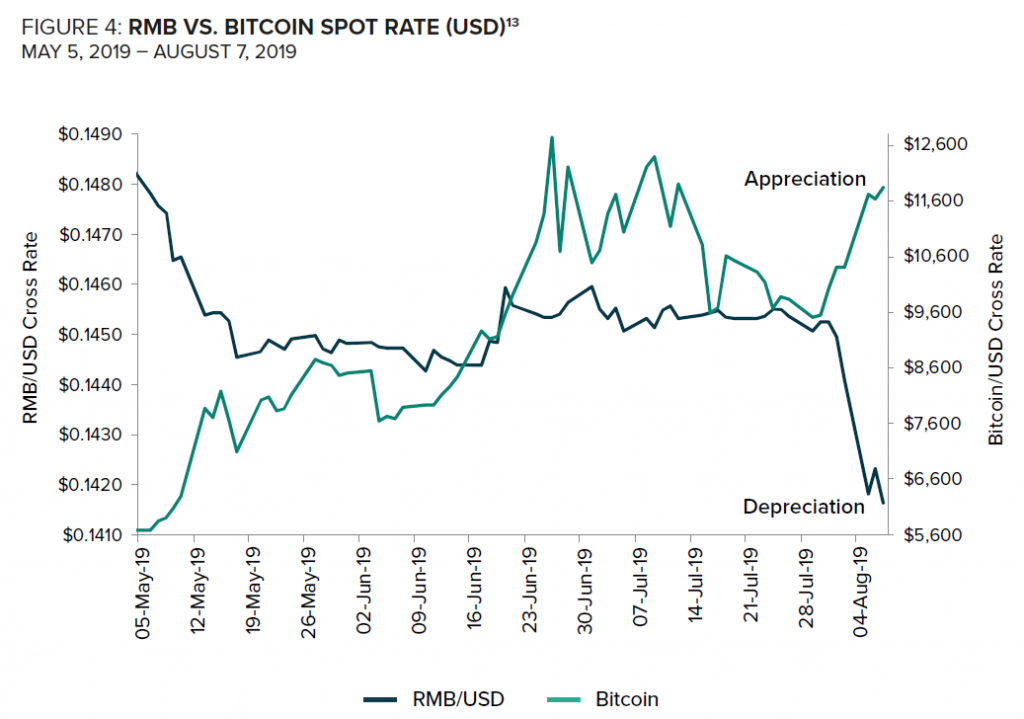

Source: Grayscale

Moreover, a one-on-one comparison between Chinese Yuan (Renminbi) and Bitcoin shows the recent depreciation of RMB while Bitcoin maintained its roller-coaster like upward trajectory. On an end note, the report read,

“While we don’t know when or at what levels the current drawdown will end, it is

clear that the challenges faced by politicians and policymakers will be difficult

to manage given the complexity of our global financial system.”

Considering the totality of the situation, traditional investors may be going through a very short window of time to diversify and insulate their portfolios from any financial collapse.