MKR pumps 53% in 30 days as long positions rise

- About 32,759 MKR tokens were withdrawn from exchanges in the past month.

- A higher number of bullish bets were taken for MKR since the start of the year.

MKR, the governance token of the leading stablecoin lending protocol MakerDAO [MKR], was one of the hottest cryptos in the market over the past month.

MKR records 50% monthly gains

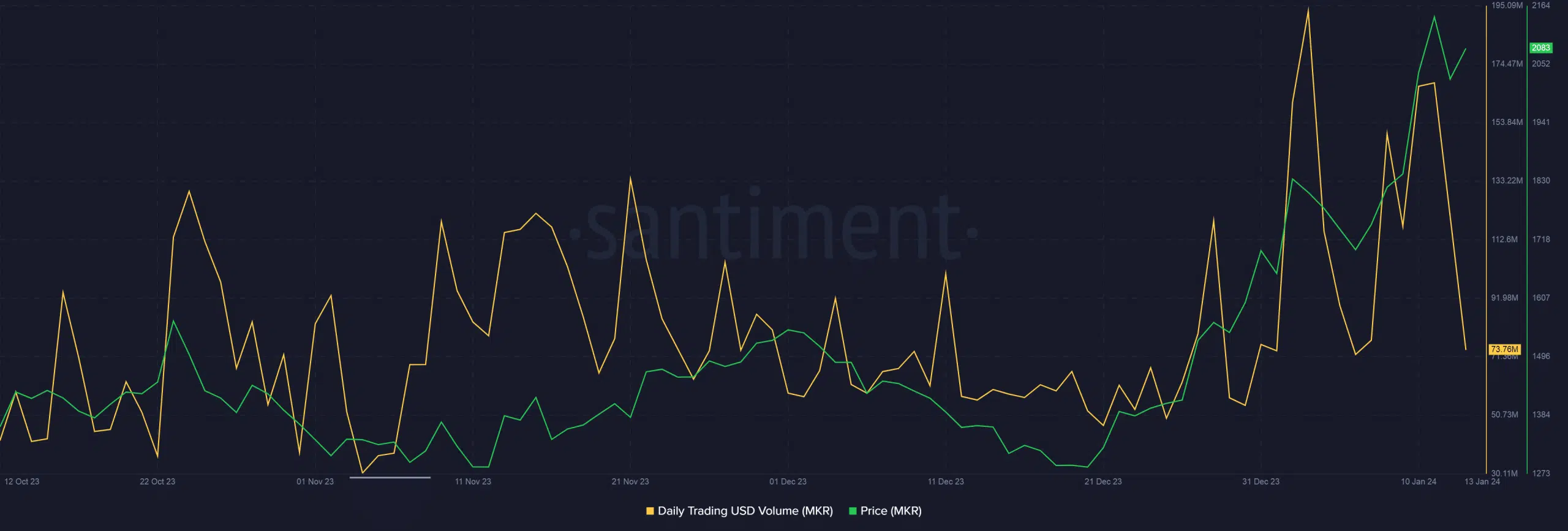

According to data scanned by AMBCrypto from CoinMarketCap, MKR jumped more than 53% in the past 30 days of trading.

Frantic trading activity accompanied the price rise. Since the start of 2024, the daily USD volumes have risen to levels not seen in the last six months.

With the price pump came steady accumulation activity.

Investors go on an accumulation spree

According to Lookonchain, 10 wallets pulled out 32,759 MKR tokens from exchanges in the past month, equating to about $66 million at prevailing market prices.

Moreover, the withdrawn amount made up 3.55% of MKR’s total circulating supply.

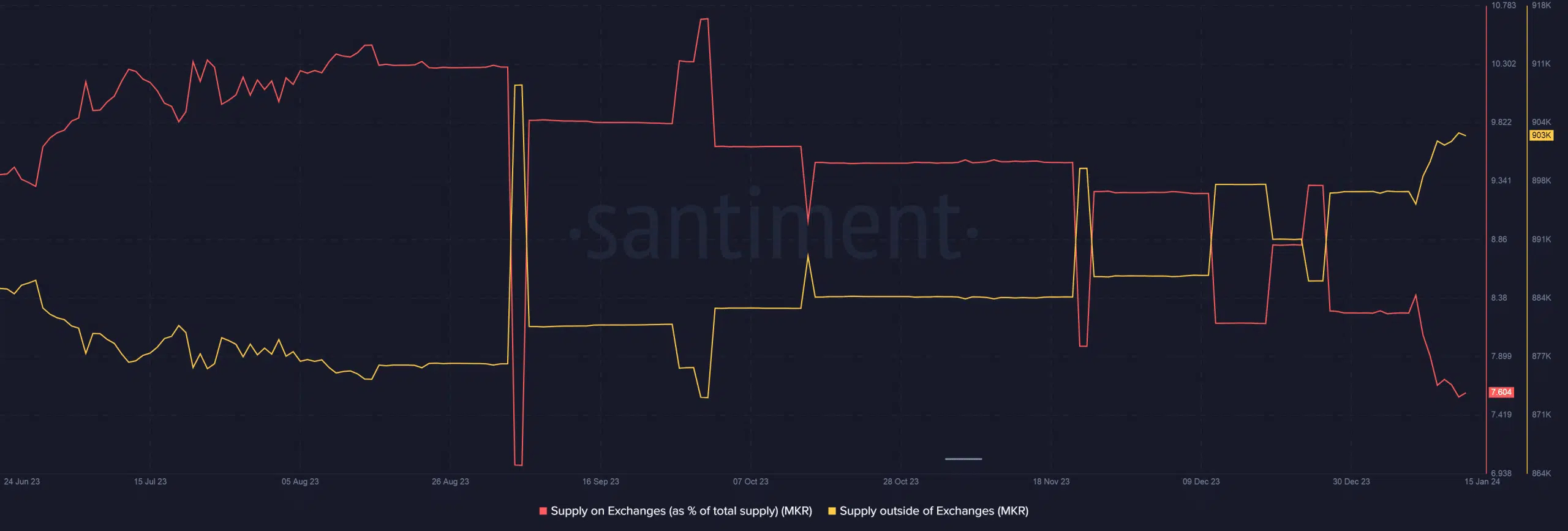

This trend was also backed up by on-chain data fetched from Santiment, AMBCrypto noticed a significant drop in MKR’s exchange supply over the last three weeks.

Indeed, MKR’s exchange reserves were 9.31% of the total circulating supply on the 26th of December. This plunged to 7.6% at the time of publication.

Unsurprisingly, the supply held in non-exchange wallets increased during this time.

However, contrary to the dominant narratives around such developments, the accumulation wasn’t driven by whale investors.

AMBCrypto observed a continued decline in the supply held by top N addresses that don’t belong to exchanges.

MKR sees an increase in long positions

MKR’s smashing performance in the spot market resulted in a higher number of bullish bets for the decentralized finance (DeFi) token.

The number of longs exceeded shorts for most days since the start of 2024, according to AMBCrypto’s examination of Coinglass’ data.

Is your portfolio green? Check out the MKR Profit Calculator

Moreover, the money invested in open MKR futures positions increased sharply as the rally took off. All these indicators painted a bullish narrative for the asset.

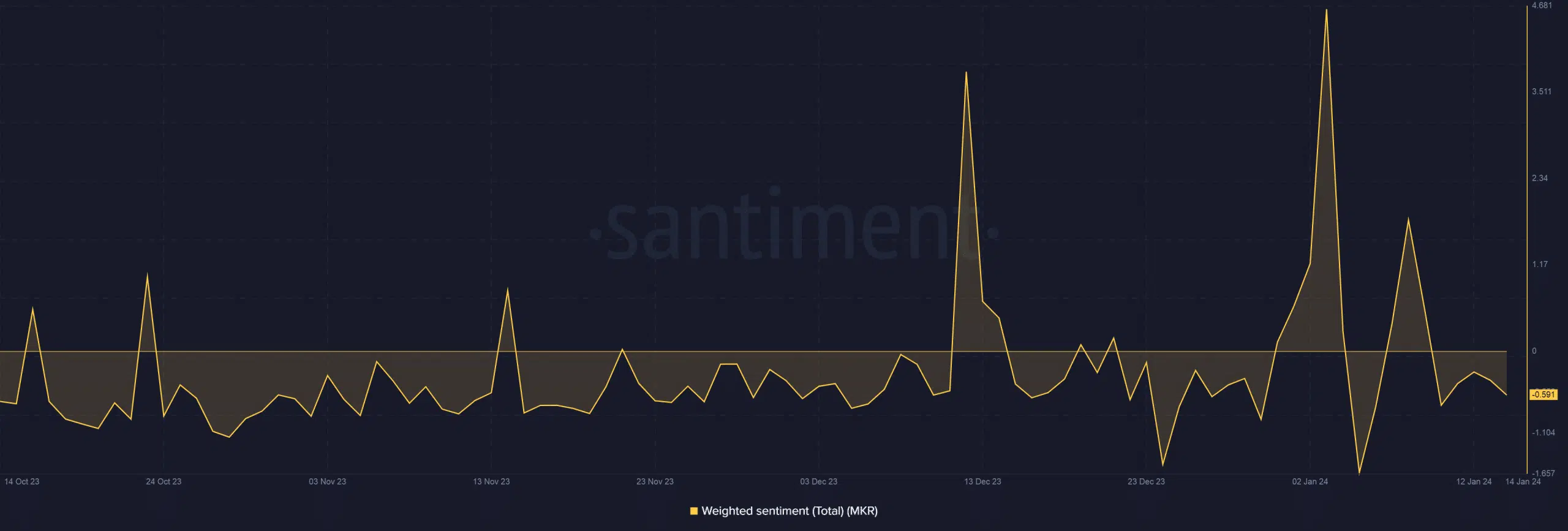

However, the latest pullback to $2,045 started to affect investors’ sentiment. As of this writing, the Weighted Sentiment trended in the negative territory.