MATIC slows down momentarily, but the bulls are not giving up

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC is likely to continue its uptrend past $1.

- The on-chain metrics showed whales continued to accumulate the token.

Polygon [MATIC] saw a transfer of $55 million worth of tokens to the Coinbase exchange. This occurred on the 12th of November and investors and traders alike had reason to anticipate a spike in selling pressure that could drag MATIC prices down.

However, a dip to $0.7719 occurred before this particular event. Instead of a wave of selling, MATIC witnessed a continuation of its previous rally and was trading at $0.89 at press time.

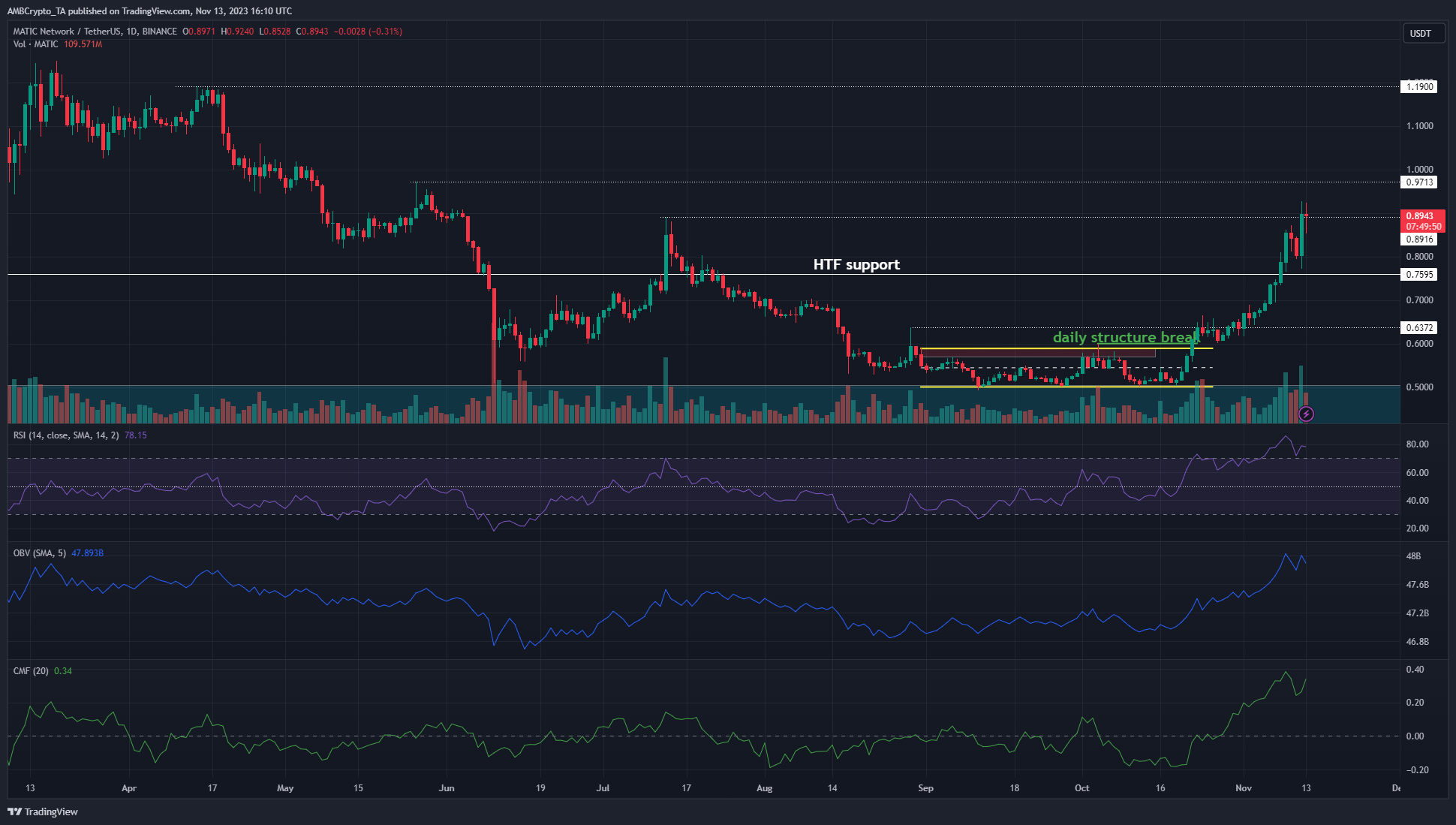

The higher timeframe price chart remained healthily bullish

The market structure on the one-day chart was bullish. The weekend’s dip saw prices revisit the $0.77 region, which was highlighted as HTF support. Monday’s trading saw MATIC hurtle northward and attempt to breach the $0.8916 resistance level.

The technical indicators were sound. The RSI complemented the daily structure with a reading of 78 to reflect powerful bullish sentiment. The On-Balance Volume (OBV) has trended higher since October to indicate steady buying volume.

The Chaikin Money Flow (CMF) was at +0.34 to signal a high capital influx as well. The next resistance zone sat at $0.97 (close to the $1 psychological level) and at $1.19. Hence these are the next bullish targets.

Should the heightened whale transaction count worry long-term holders?

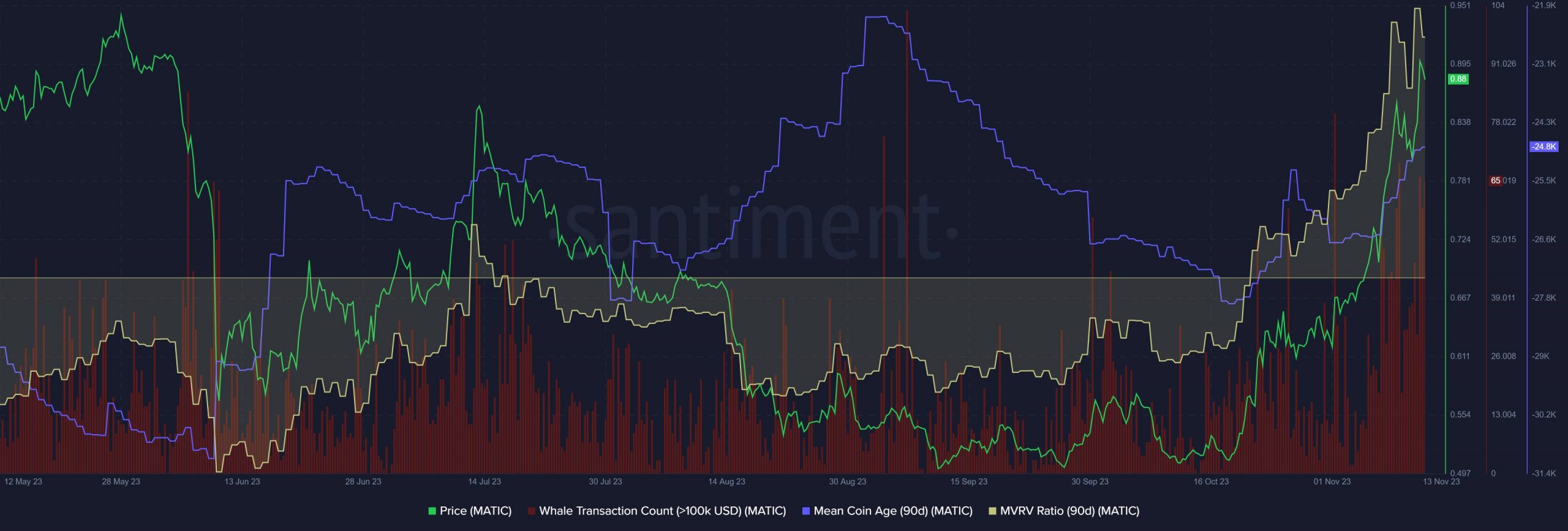

Source: Santiment

The whale transaction count metric has trended higher over the past month. The implications of this can be discussed in more detail after taking a look at the balance of addresses. Meanwhile, the mean coin age was also in an uptrend.

This meant accumulation was ongoing and that the uptrend still had strength. However, the MVRV ratio (90-day) touched a high not seen for more than a year.

This could prompt long-term MATIC holders to liquidate a part of their possessions to secure profits. In turn, that could see the prices take a hit.

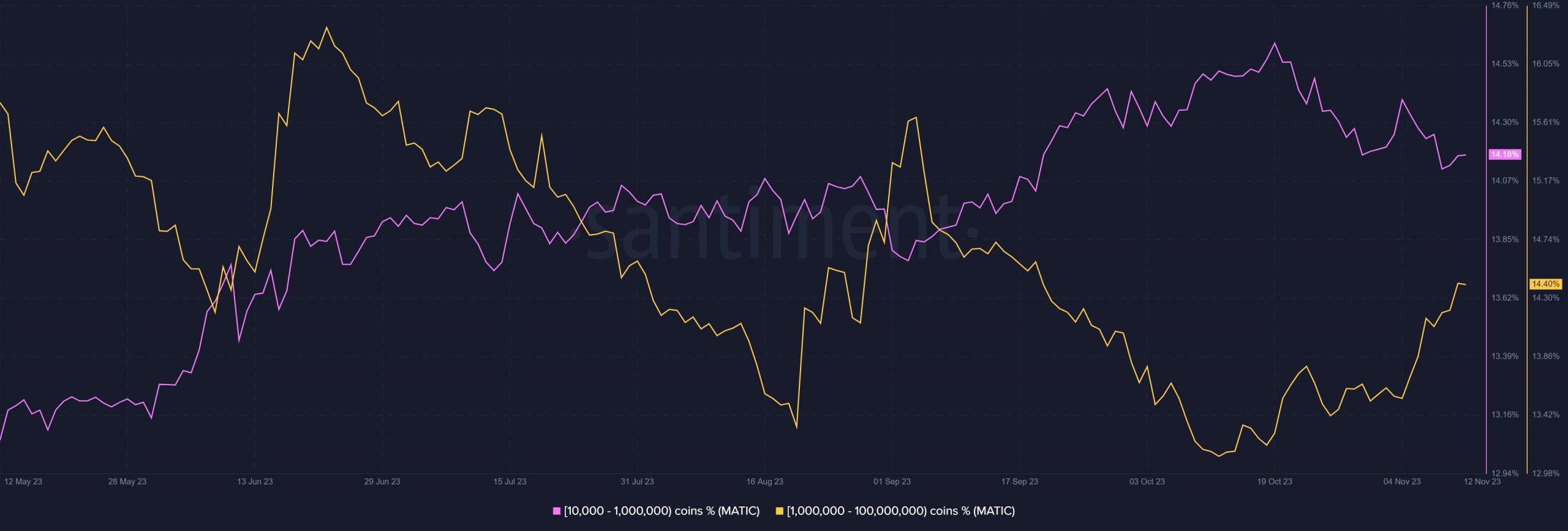

Source: Santiment

The 10k-1M MATIC sharks saw a slight decline in their holdings since 19 October. On the other hand, the whales with 1M-100M in their wallets continued to accumulate. Additionally, the mean coin age was also trending higher.

Is your portfolio green? Check the MATIC Profit Calculator

The conclusion was that the uptrend of MATIC was more likely to continue to $1 than not. Combined with the price action, a move to $1 and $1.2 remain reasonable expectations.

A short-term dip to the $0.85 and $0.79 support levels would present a buying opportunity.