Maker, bZx developments hurt lending sector’s returns as DEXs boomed in Q1 2020

Quarterly assessments in any industry are a necessary enterprise to understand the growth and development of a sector. The beginning of April 2020 affords the crypto-market and the larger industry one such opportunity, with many projects and platforms now analyzing performances over the course of Q1 2020.

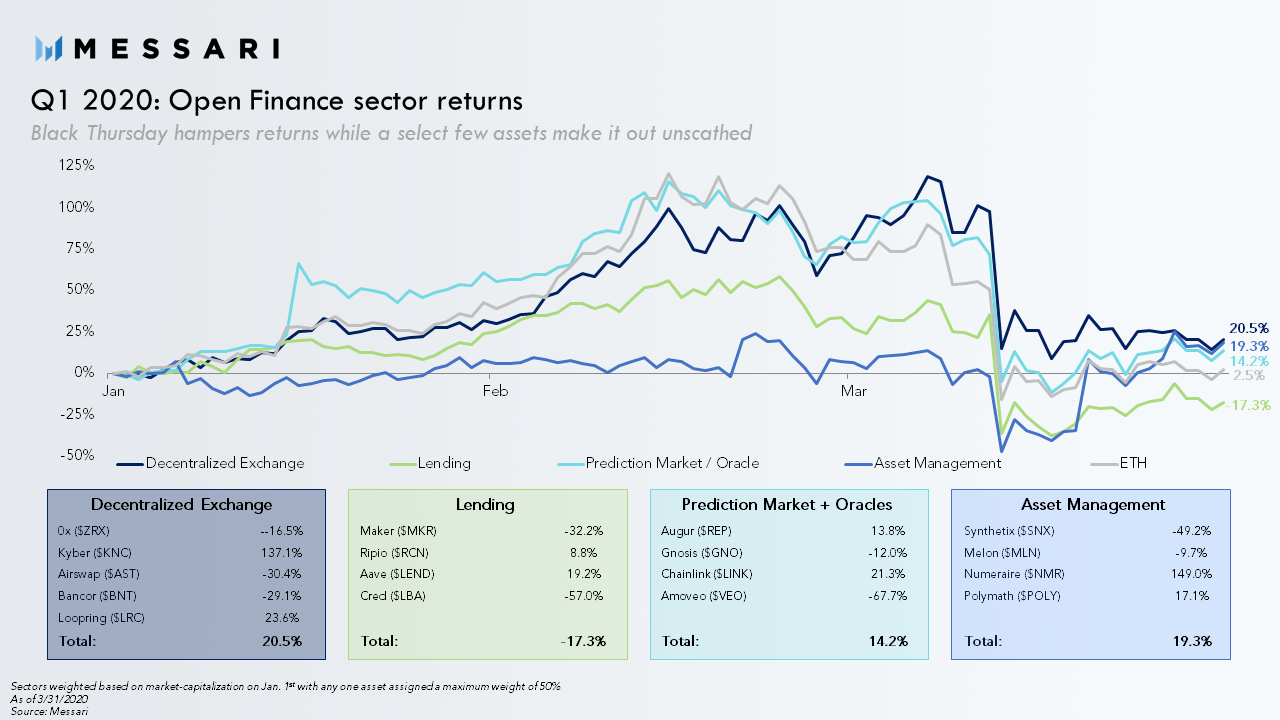

Messari is one of them, with the platform recently releasing an assessment of the price performances of Open finance for Q1 2020. According to the same, certain trends have emerged over the course of the past three months.

Source: Messari

The four sectors of Open Finance under assessment included Decentralized Exchanges (DEX), Lending, Prediction Markets, and Asset Management.

According to the report, DEXs managed to accrue the highest returns of all the sectors, with Kyber’s hike of 137.1 percent making up for Ox, Bancor, and Airswap’s negative returns. Kyber was also the best performing DeFi asset in Q1. The network right now is awaiting a major protocol upgrade.

Overall, in spite of the volatile market in March, DEXs registered its best quarter ever in the industry. DEXs returns were higher than historical averages and volumes in the ecosystem, with the same picking up pace towards the end of 2019.

Out of all the sectors, Lending was the only department to record negative returns as Maker (MKR) registered losses and a series of failed liquidations and collateral auctions. The twin attacks of bZx led to the exploitation of millions of dollars, with the report stating that the total loan outstanding for Maker and Compound grew from $40 million to a new all-time high of $185 million, towards the end of February.

Finally, prediction markets+Oracles and Asset Management, collectively hiked by 14.2 and 19.3 percent, respectively. After the oracle issue with Maker, DeFi projects were looking forward to avoiding such complexities.

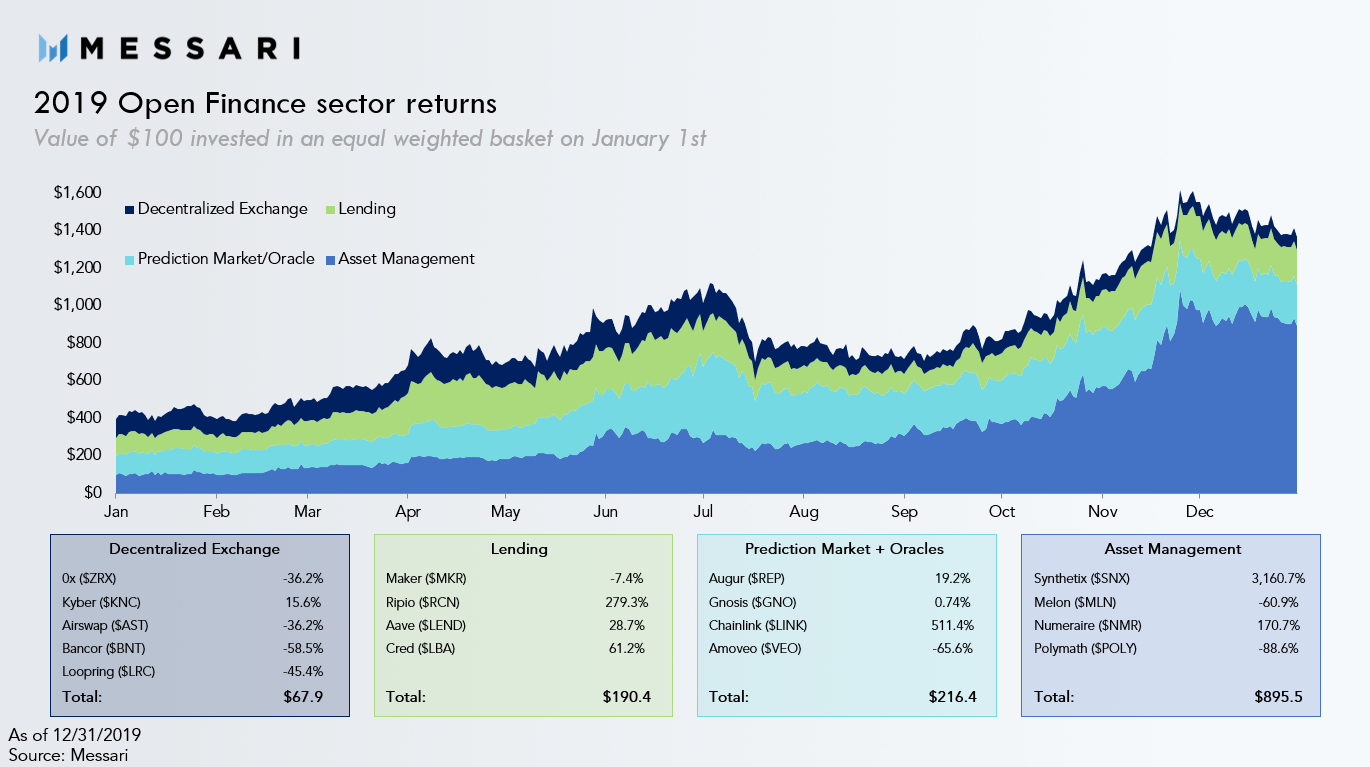

Source: Messari

If the growth of Open Finance in 2019 is also evaluated, it can be observed that DEXs are off to a good start, when compared to last year. Over the course of 2019, DEXs registered an overall loss of 32 percent. Hence, its jump of about 20 percent in Q1 2020 could be a sign of things to come for DEXs in 2020.

That being said, lending had a fairly good year in 2019 as well, but present returns are currently negative and many have speculated that if another sell-off period unfolds in the market, digital assets would not be able to hold their own amidst the liquidity crunch, something that will directly impact the lending sector.