Looking for a first-mover advantage in Defi? Everything you need to know

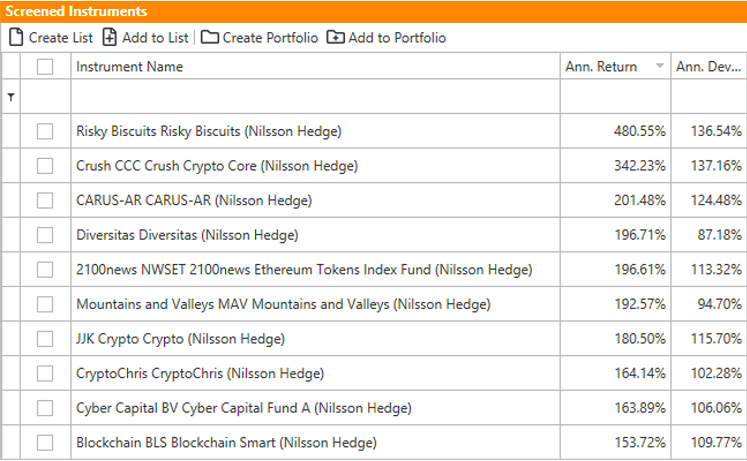

The $3 Trillion Hedge Fund industry is likely to suffer more blow-ups than the 2008 financial crisis in the next few quarters. In the midst of the pandemic, hedge funds lost 7-8% in a month in March 2020. This drop left the 2008 crisis behind. The resulting dynamics have affected Bitcoin’s price and traders’ portfolios. Many investment styles have changed and fund managers realize that generally, a fund’s performance is lower than the underlying asset. Based on the hedge funds listed in NilssonHedge Database, several crypto funds had impressive triple-digit returns.

Top Hedgefund Performance || Source: NilssonHedge Database

Hedge funds on the other end of the spectrum have lost over 30% YTD. In the list shared above, the top 10 funds have invested in cryptocurrencies. However, the triple-digit returns need to be taken with caution as there is high volatility in Bitcoin and top altcoin markets. Based on data from PWC Hedge Fund Report, 97% of crypto hedge funds trade Bitcoin. With an incentive war in DeFi, there are exciting opportunities to lure hedge funds to invest in DeFi projects. Returns on DeFi projects were less rewarding in the past 7 days and 30 days. Top DeFi Projects have negative returns of -40 to -60% ranging in the short term. Long-term or YTD returns continue to be three-digit for most DeFi projects. This suggests that it’s likely that the Crypto Hedge fund industry may get revolutionized by investing in a basket of DeFi projects.

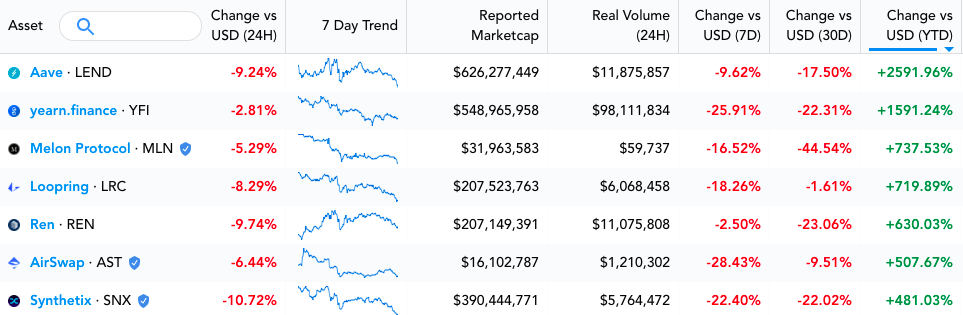

There is high volatility due to high TVL in DeFi and this poses as an untapped opportunity for Hedge Fund Managers. The average crypto fund may outperform its underlying asset- if the asset was a DeFi Project. Panxora’s announcement of seeking $50 M for investing in DeFi projects is one of the first steps in this direction. As a retail trader, one could leverage this and route investments to DeFi projects with high YTD.

Top DeFi Projects based on YTD returns || Source: Messari Screener

Based on data from Messari’s DeFi screener, top projects like Aave, Yearn.Finance and Melon Protocol have high YTD ranging from 2591% to 507%. Parking funds in such projects could possibly give a retail trader an edge over institutions, as they are still in the early stages of experimenting with DeFi as an investment instrument from a long-term perspective.