Altcoins

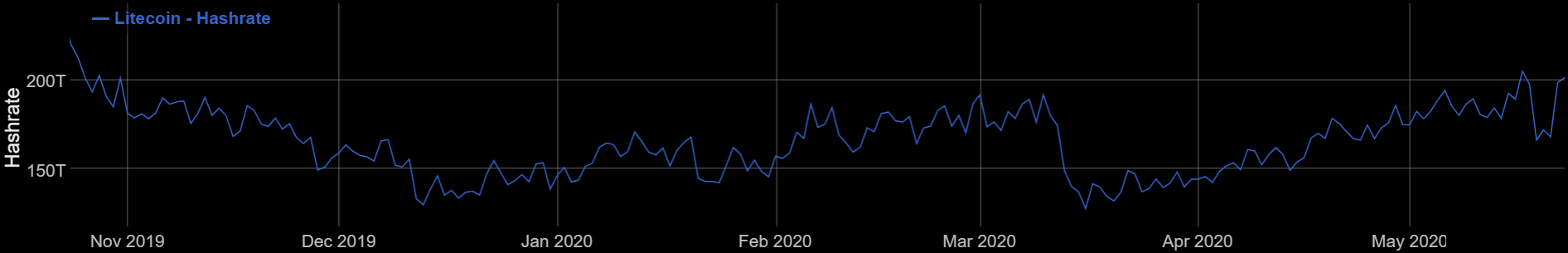

Litecoin’s increasing hashrate could indicate positive sentiment among miners

The seventh-largest cryptocurrency, Litecoin has seen a steady increase in its value over the last month, however, it was still down by over 46 percent since its 2020 high. It has been nine months since its second block reward halving, and its hash rate was down by 60% since then.

Source: BitInfoCharts

On the brighter side, as the price recovered, so did the hash rate. It climbed all the way to 205.21 TH/s on the 17th of May, meaning a six-month high figure. Closely mimicking the price action, Litecoin witnessed an increasing hash rate which currently stood at 201.60 TH/s. Notably, its hash rate dropped to a two-year low when it fell to 127.9 TH/s on 16 March following the Black Thursday crash.

The latest upward trend of an increasing hash rate may have a positive impact on the price and was also a sign of the miners’ return to the network.

Meanwhile, accompanying the latest rise in the hash rate, was its difficulty which also noted a six-month high climbing all the way to 6.675 M. The mining difficulty value saw a minor uptick in mid-January this year after a surge in the coin’s price. This trend, however, was short-lived as it soon went downward.

Source: BitInfocharts

Litecoin mining profitability, on the other hand, has failed to recover. After the halving, the mining profitability was also cut by half since the difficulty does not get adjusted immediately. While price fluctuations have been the largest determining factor and the decline in mining profitability is generally compensated by price surges. However, LTC’s price is yet to gain the necessary momentum to catapult its mining profitability as it continued to hover near its all-time lows.

Litecoin hash rate distribution

Source: LitecoinPool.org

Poolin and F2Pool continued to take the lead with 44.9 TH/s and 34.4 TH/s in terms of the hash rate distribution, followed by mining pools such as BTC.com with 22.7 TH/s and ViaBTC with 21.9TH/s.

![Reasons why Litecoin [LTC] investors should be concerned](https://engamb.b-cdn.net/wp-content/uploads/2023/12/ambcrypto_A_Litecoin-themed_scen-400x240.png)