Is the SEC attempting to draw parallels between Binance and FTX?

- SEC continued its search for fraud at Binance.

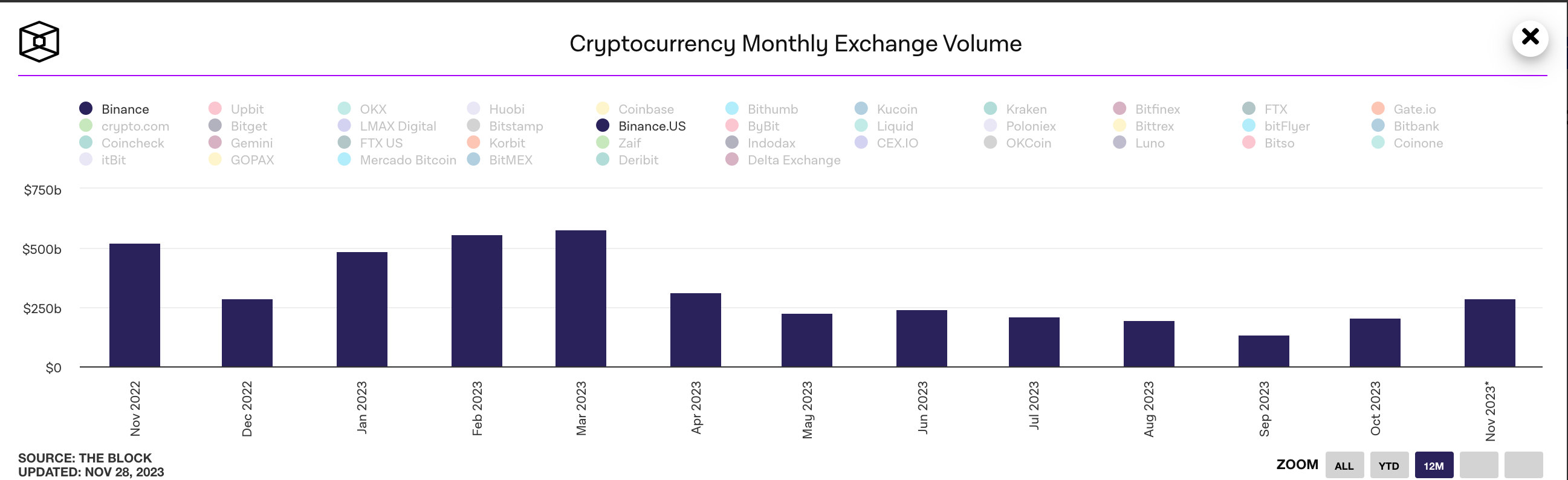

- Global exchange volumes remained unchanged; however, the BNB token took a hit.

US regulatory bodies were on a roll in the past year. With multiple legal battles in the crypto sector, these agencies seem like they are going all-in on their scrutiny of the crypto sector.

The SEC won’t stop

The SEC intensified its search for potential fraud at Binance US following charges brought by the DOJ against Binance and its ex-CEO Changpeng Zhao.

The ongoing SEC lawsuit alleges endangerment of client funds. In the aftermath of Binance’s DOJ settlement, the SEC aims to strengthen its case, seeking parallels with the FTX investigation.

Specifically, the SEC is exploring evidence of Binance US granting CZ a backdoor for asset control, mirroring concerns raised about Sam Bankman-Fried at FTX.

While the SEC’s lawsuit hinted at potential fraud, concrete proof remains elusive. The recent DOJ investigation into Binance may catalyze the SEC’s efforts.

Binance settled with the US government, agreeing to a $4.3 billion payment, and CZ stepped down as CEO as well.

Current state of affairs

The SEC’s intensified search for potential fraud at Binance US poses a significant negative impact. If the SEC uncovers evidence supporting allegations, it could lead to legal consequences and financial penalties for Binance.

The ongoing scrutiny may erode trust among users and investors. It could potentially result in a decline in the platform’s user base.

Additionally, negative publicity and legal challenges may hinder Binance’s reputation. It could also affect the regulatory environment in the larger scheme of things.

At press time, the volumes on the Binance US exchange had fallen materially and could not recover. However, volumes on Binance exchange globally were not impacted.

Source: The Block

BNB holders get impacted

However, the BNB token, which is closely associated with Binance, was affected greatly. At press time, BNB was trading at $227.59.

The price of the token fell materially in the last few days. This resulted in the BNB token pushing past its previous high lows. If this momentum is sustained, it could establish a bearish trend going forward.

Realistic or not, here’s BNB’s market cap in BTC terms

The chatter around Binance allowed for the social volume of BNB to rise. However, the weighted sentiment around the token plummeted.

This meant that a lot of people were losing faith in the BNB token. It remains to be seen whether the BNB token will be able to get back on its feet going forward.