Is Bitcoin back in the lead? Falling ETH IV suggests so

The cryptocurrency market has never been averse to volatility. Bitcoin and Ethereum, the two major crypto assets’ relationships have spelled the future of most alts in the market, and currently, the Ethereum’s lead has been challenged by the largest crypto, Bitcoin.

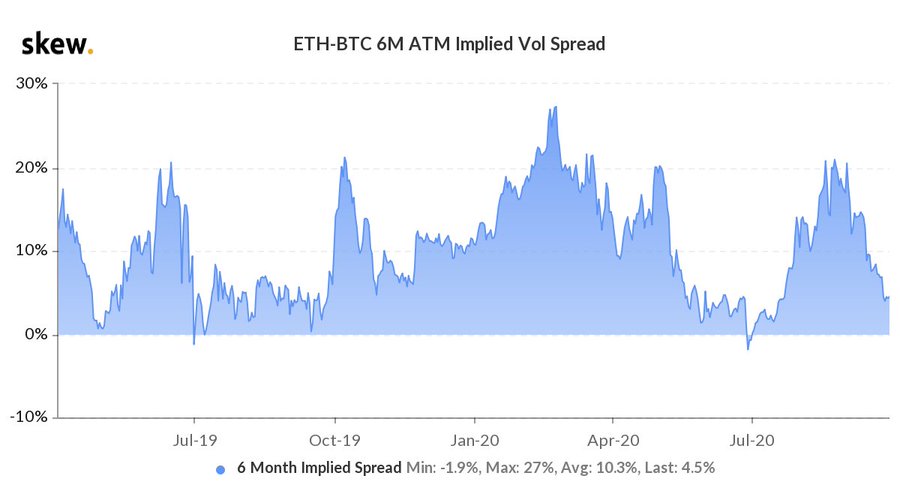

The spread between the six-month-at-the-money implied volatility for Ether and Bitcoin, a measure of expected relative volatility between the two assets declined to 4.3% on 28 September, as per the crypto data provider Skew. This level was unseen since July.

Source: Skew

Implied volatility suggested the market’s volatility expectations and risks involved with a certain asset over a specific period and is calculated using the prices of an option, time of expiration of the underlying assets, and others. The ETH-BTC implied volatility differential had topped on 22 February and has been seeing a constant push and pull ever since. ETH and other alts were outperforming BTC in February, May, and August, as the largest asset – BTC went under a period of consolidation.

Due to this, the market was expecting a higher Ether price volatility in comparison to Bitcoin. The volatility and growth were driven by the DeFi hype, but currently, DeFi has been facing a down period as top projects were falling and the volume was retracting. This clubbed with the latest expiry of 460k ETH options, may have caused the IV for ETH to slip lower. While BTC was breaking away from a consolidating price and the dominance was once again noting a rise.

Source: TradingView

Bitcoin dominance has been growing over the past couple of weeks and has seen the formation of a double bottom noting a surge from 59% to 61%. If the dominance index continues to rise, the growth of the altcoin will be limited along with Ethereun, while BTC surges in the short-term.