If (or when) DeFi’s bubble pops, DEXes will go down too

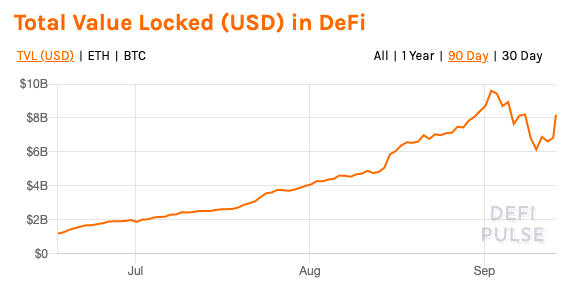

September hasn’t been a great month for the DeFi space. While the space isn’t unfamiliar to sharp falls in TVL in the near-term, the sheer scale of recent developments has taken many by surprise. For example, just check out DeFi Pulse’s charts for 8 September 2020. The figures for Total Value Locked dropped by over $2B from $8.20B to $6.14B.

Source: DeFi Pulse

In fact, the aforementioned drop in TVL was just one in a series of them over a week, a week that saw the same figures drop by over 36%. Such a development was especially alarming for DeFi proponents and ETH maximalists in the market as ETH’s price dropped by 27.4% at the same time. While both TVL and ETH’s prices had recovered from the initial drop at the time of writing, the SushiSwap incident was still able to wipe out millions in market capitalization.

This drop in ETH’s price had a cascading effect, however, with the trading volume on DEXs dropping rapidly after the SushiSwap incident too. For instance, on Uniswap, a popular DEX, the figures had dropped by nearly $1B, until some recovery saw the same climbing again.

This loss of market capitalization on Uniswap is an alarming concern for DEX traders. DEXes gained short-term traction in 2018 owing to their non-custodial nature. However, that was nothing compared to the hype surrounding DeFi since the latter gave a boost to low trading volumes on DEX. In fact, it was because of DeFi that trade volume on Uniswap crossed $1B for the first time since launch.

However, on the flipside, as DeFi may be the sole provider of volume on such DEXes, incidents like SushiSwap and loss of market capitalization in DeFi have a direct impact on the fortune of DEXes.

When the DeFi bubble bursts, DEX will be the first to go back to pre-DeFi boom levels, with trading volumes below $500M on most exchanges. While there are other advantages of using DEXes, apart from DeFi tokens, they are few, and the shortfalls outweigh the benefits.

Moreover, it is challenging for day traders, institutional investors, and arbitrageurs to trade on a DEX. The trading volume is low and the spread is high across most DEX order books. Day Traders steer clear of DEXes and this further deprives it of higher trading volumes. On the other hand, CEXes have the first-mover advantage and are more than adequate to absorb increasing demand from traders.

Some of these issues extend to the DeFi network too. The user interface is one such issue. While this is not an obvious concern for all traders, ease-of-use matters to day traders and institutional investors. The UI on CEXes have evolved to fit the bill for traders, and beside UI, these exchanges offer features and functions that attract traders and generate volumes on the exchange.

As of now, DEXes do not have enough features or trade volume to sustain on their own in the crypto-ecosystem. Recent incidents have given insight into DeFi’s key role in the growth of DEXes. The popping of the DeFi bubble may take down DEXes with it.