An ultimate test of why a Bitcoin, crypto-only portfolio is better

“A portfolio built completely with cryptocurrencies” – to a traditional portfolio manager, is a nightmare in terms of risk and drawdowns. However, to a person that has been in crypto over the last 3-4 years, this seems like a cakewalk.

While the traditional portfolio does include Emerging Markets, that, in a way, is similar to cryptocurrencies with respect to volatility or drawdowns but it is nothing close to what crypto offers, especially when it comes to risk.

This article is a continuation of the article – “Can crypto end the already dead 60/40 portfolio standard“.

The answer to the question is a straight Yes. There is no doubt, that cryptocurrencies can end the 60/40 passé. The examples of including a bit of bitcoin in a traditional portfolio are many, however, the results are a strong resounding Yes.

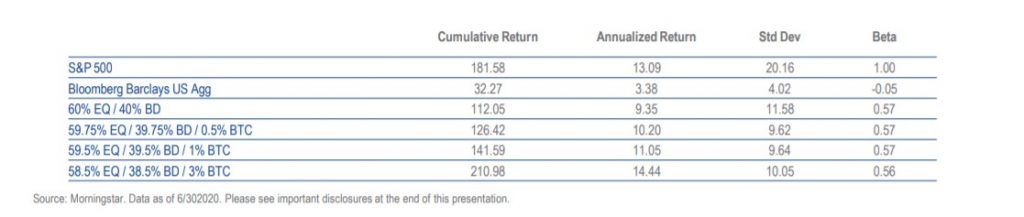

Case 1 – The Investment Case for Bitcoin

VanEck published a research paper that takes a look into the addition of bitcoin to a traditional portfolio and its effects. The supporting facts that help bitcoin’s case are:

Returns

VanEck proves Bitcoin’s case by showing how the latter outperforms the traditional market by a long shot. From 2012 to 2020, bitcoin’s return is in triple digits while the traditional market is in double digits.

Correlation

Apart from returns, the correlation of bitcoin to the traditional assets is low or non-existential. Hence, this makes bitcoin a good portfolio diversification asset.

Results

Clearly, the result isn’t surprising that bitcoin outperforms anything thrown at it. The reason for this are many – bitcoin is scarce, decentralized, pseudonymous, etc. All of which are in demand and help bitcoin’s case.

Source: Vaneck

Case 2 – Safe haven or risky hazard? Bitcoin during the Covid-19 bear market

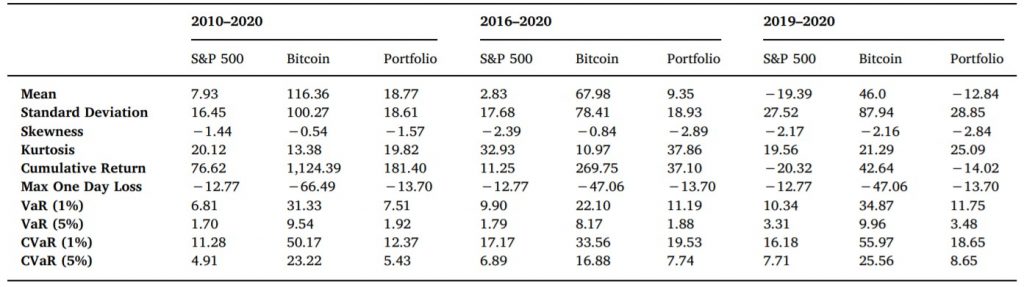

In a research paper published by Thomas Conlon and Richard McGee, bitcoin’s performance against various traditional assets are compared from 2010 to 2020.

The paper’s intention was to identify if bitcoin acts as a safe haven asset and it does so by allocating a portfolio with S&P 500 relative to bitcoin. From the paper, we identify that CVaR [Conditional value at risk] is higher for higher bitcoin allocation to the portfolio.

The research states that both, CVaR and VaR increase with increasing bitcoin allocation.

“Any allocation greater than 28% results in at least a 50% increase in the baseline level of downside risk an S&P 500 investor is exposed to over this period.”

While the research focuses mostly on the downside risk to identify if bitcoin can act as a safe haven asset, it does overlook the fact that that bitcoin would have increased the wealth by 11 times relative to their initial investment.

It should also be noted that bitcoin does provide the required diversification, however, that comes with risk. Bitcoin’s one-day loss stood at a massive 66.49% and that of S&P’s was 12.77%.

Results

While bitcoin may have not acted as a safe haven asset for the considered time period, it still provides high returns to a traditional portfolio with minute allocations. This is in addition to bitcoin outperforming traditional competitors.

Case 3 – Blockchain, digital currency, and cryptocurrency: Moving into the mainstream?

In this research published by J. P. Morgan in Q1 of 2020, an important topic was “Cryptocurrencies for portfolio diversification”. The approach for using cryptocurrencies, bitcoin for portfolios is the same as VanEck’s – low correlation to traditional assets, higher returns, etc.

“The model’s positive allocation is primarily motivated by cryptos’ correlation with conventional asset classes being close to zero, thereby resulting in a significant diversification advantage.”

One pain point that the paper talks about is bitcoin’s drawdowns.

As for portfolio allocations, there are two cases that the paper looked into – the first is the addition of bitcoin to a portfolio containing equities, treasuries, and gold; the second is the same, however, with a decreased weights for the US treasuries.

The conclusion from the financial giant is that the experiment supports the inclusion of BTC to an Equity and Bond portfolio.

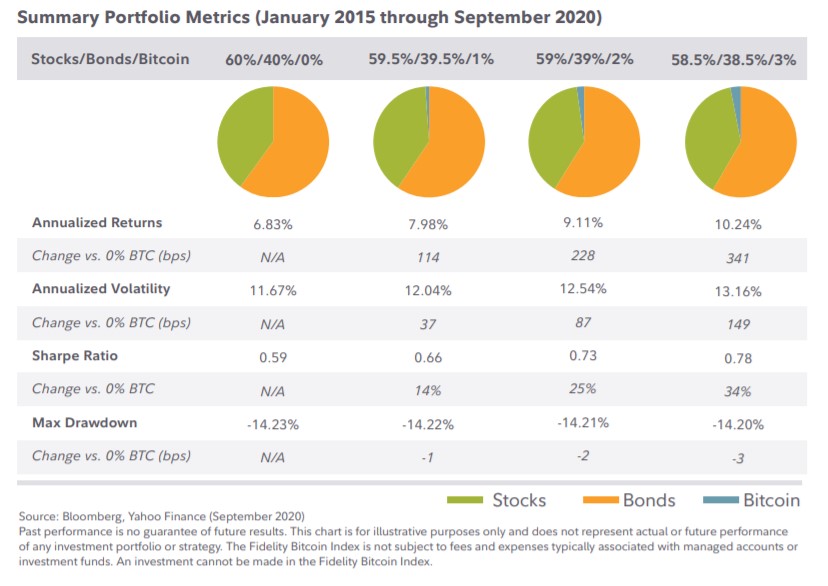

Case 4 – Bitcoin Investment Thesis

In a recent paper published by Fidelity, bitcoin’s role as an alternative investment is explored. The rationale for including bitcoin in a portfolio remains the same – portfolio diversification, return enhancement, income generation, etc. The paper brings a fresh perspective on how bitcoin is retail-driven, which largely explains the negative correlation of bitcoin.

Source: Fidelity

The summary, like the above cases, is similar –

“The annualized returns of portfolios with an incrementing allocation to bitcoin outperformed a portfolio with no allocation to bitcoin over all time horizons displayed here…”

While papers/research that helps bitcoin’s case are many, we have to understand that it is backed by data spanning over a decade. However, most of these talk about including small amounts of bitcoin in a traditional portfolio.

Let’s take a look at some of the portfolios created exclusively by including cryptocurrencies.

Crypto-only portfolios

Like traditional portfolios, we can classify crypto-only portfolio into different types, here are a few,

Crypto Starter Pack

This portfolio consists of bitcoin, ethereum, and the top 10 cryptocurrencies. To assess the performance, we can use the Bletchley 10 Index or Bitwise 10 Index.

Source: Bitwise

Bitwise 10 Index has returns of 1.7% in the last month, 25.3% in the last 3 months, and about 1140% Since January 1, 2017. This index includes the top 10 cryptocurrencies based on market cap – BTC, ETH, XRP, BCH, LTC, LINK, ADA, EOS, XTZ, and XLM in that particular order.

While the above returns are theoretical and obtained via models based on weightings, we have to consider depreciation of returns after including fees and other deductions.

An important observation here is that bitcoin’s returns since January 1, 2017, is 1078%, which is slightly less than the index itself. Hence, we can conclude that bitcoin is the best starter pack and having funds invested in bitcoin alone is more than sufficient.

The Degen

This portfolio contains bitcoin and the shitcoin index. For comparing results, daily close for both bitcoin and the shitcoin index is considered. It should be noted that the shitcoin index can’t hodled like bitcoin or other assets, instead, it can be traded. Also, the shitcoin index is a basket of 50 low market cap altcoins.

Since the shitcoin index is a recent development, the data for it starts on July 23, 2019. Clearly, the shitcoins is correlated to bitcoin, however, it has higher returns than bitcoin at press time with Shitperp returning 10.15% and BTC 7.35%.

Defi coins

Instead of including different defi coins manually, one can use the defi index developed by FTX or Binance to leverage the whole of the defi ecosystem’s performance or downfall.

The FTX Defi index contains – KNC, LEND, MKR, KAVA, ZRX, LRC, REN, REP, BNT, SNX, and COMP while Binance’s defi index includes BAND, COMP, KAVA, KNC, LEND, LINK, MKR, SNX, SXP, and ZRX. Though there are overlaps, the returns are varying.

Binance’s defi index has a negative 50.43% since August 28 [date of inception], however, FTX’s defi index is at negative 39.83%.

Clearly, the defi craze has died down, and hence, the coins related have also started to drop in price. However, the Defi TVL has managed to hold above $10 billion.

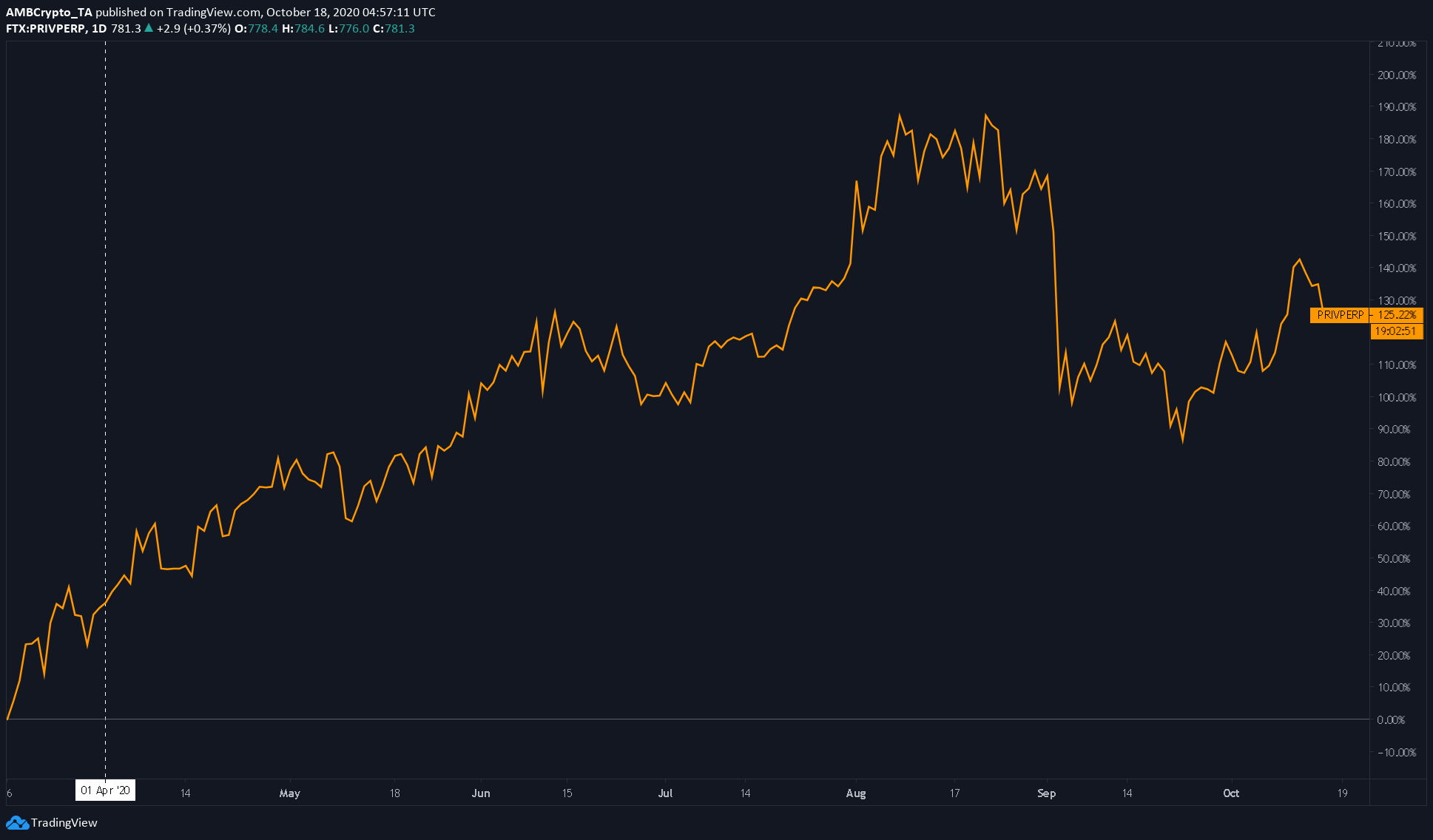

Privacy coins

Ever since DoJ’s letter about including a backdoor in encrypted software, the privacy coins have seen a surge in price and perhaps demand too. Since Q2, the privacy index has done exceptionally well for itself. As of this writing, the Privacy coin index is up by 65.39% since Q2 of 2020.

Since DoJ’s announcement on October 11, the privacy coin index has dropped in value and now shows a return of -6.22%.

Result

From the above, we can clearly see there is ‘variety’ to crypto, there are mainstream high market cap coins that are highly correlated and then there is another ecosystem built on ETH -defi, which had its own cycle in a small time period; then, there are privacy coins and shitcoins [low cap altcoins] that serve different purposes. Hence, creating a portfolio with this variety should yield good results.

The final boss: A balanced crypto portfolio

Leveraging this diversity in crypto, here is a crypto-only portfolio and its performance.

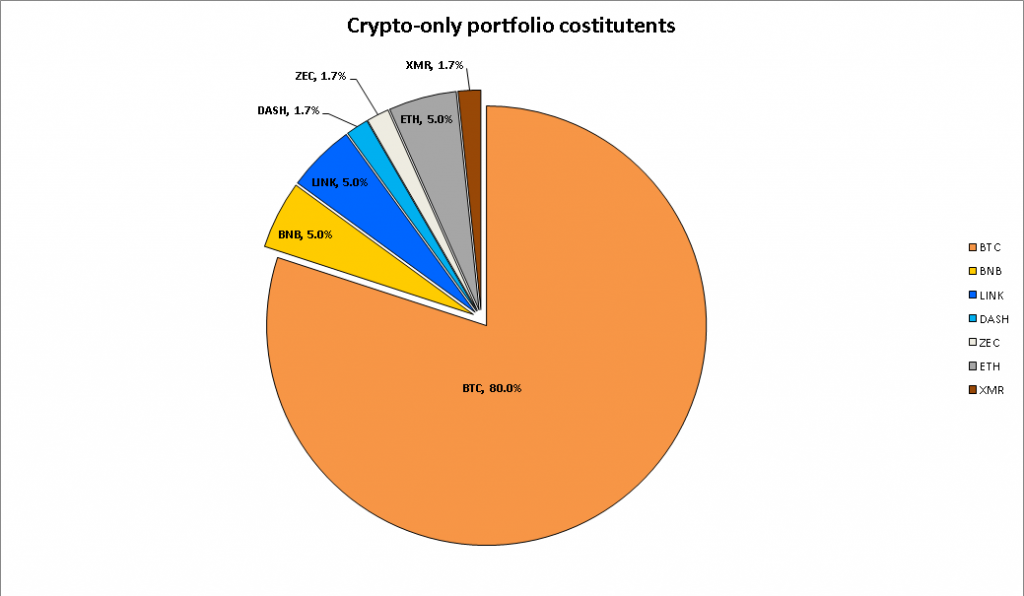

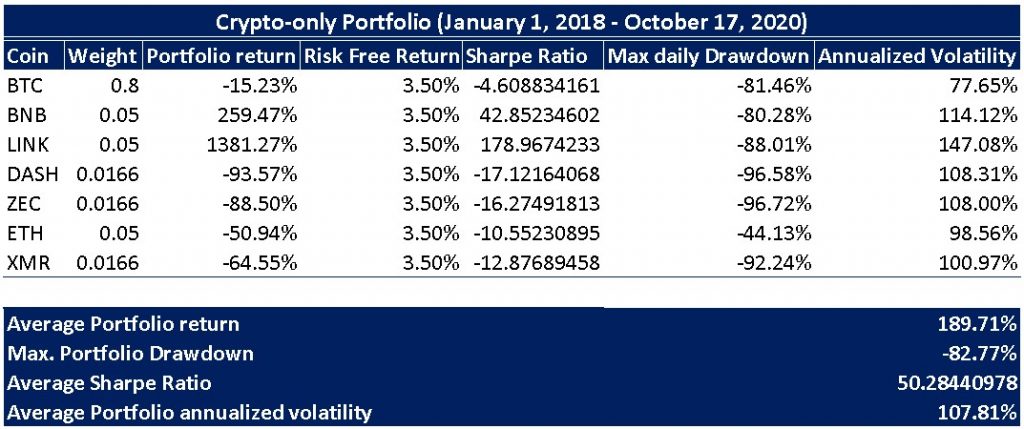

Coins: BTC, BNB, LINK, DASH, ZEC, ETH, XMR.

The above list of coins includes almost all of the variety out there -Bitcoin is the portal to crypto, LINK, BNB and ETH represent the defi part of the crypto ecosystem, ZEC, DASH, and XMR represent the privacy coins.

This research takes a look at how this portfolio performed.

Bitcoin is given the most weight in this portfolio, followed by defi coins, all of which are given equal weights and the rest is assigned equally to privacy coins.

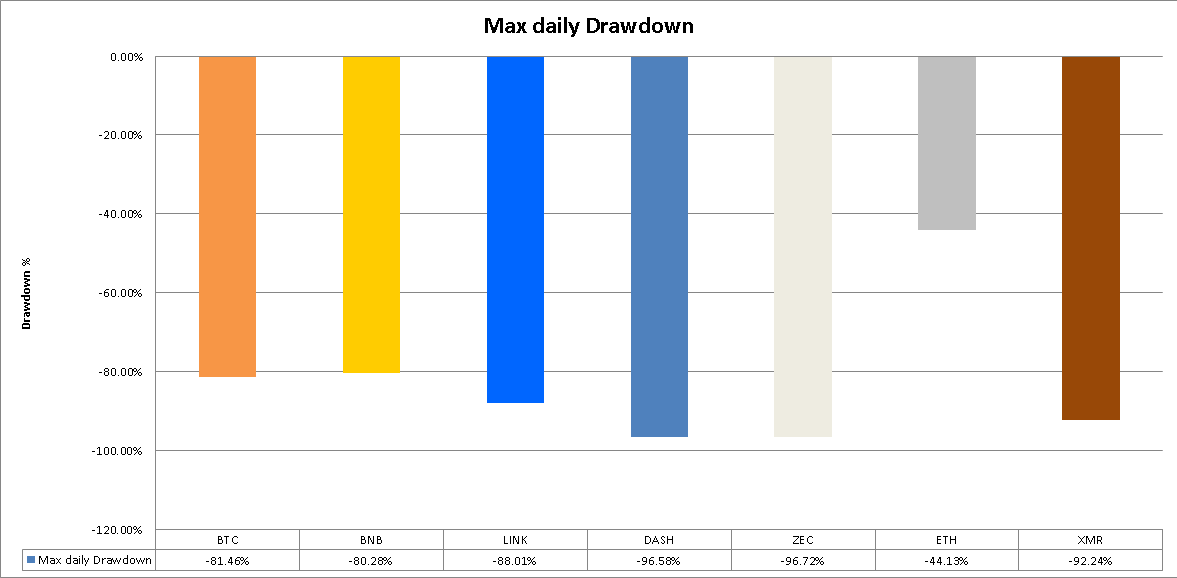

Based on the data collected from January 1, 2018, to October 17, 2020, this is how a crypto-only portfolio performed even if you invested at the peak of 2018.

One interesting thing that was noticed is that the coins underwent drawdowns that were 95+% yet, the portfolio displayed a positive performance.

The portfolio performed remarkably better than the standard portfolio that contains a 60/40 allocation to equities and bonds. Also, this is despite the enormous drawdowns of 95+% seen during the last 2+ years.

While the standard portfolio provided returns in the single to double digits, the crypto-only portfolio provides returns that are in the triple digits. However, this is only for the people that are willing to take risks of their portfolio performance being down a gut-wrenching 95% at some point in time.

The conclusion is simple and staring at you in the face. A crypto-only portfolio despite including large caps, do provide a good return, however, the catch is that the investment should happen at the right time in the crypto-cycle. If it doesn’t then the best thing to do is to wait for a new cycle and stomach the massive drawdowns and volatility.