How will dropping ETH-BTC spread affect Ethereum price?

With the latest updates, of Digital Yuan’s testing and launch, and the US Presidential elections coming closer, retail traders’ attention is now on Bitcoin. In the previous price rallies, the trend was that Bitcoin led the altcoins, and ETH, XRP, and other altcoins from the top 10, based on market capitalization, followed closely.

However, this time around, Bitcoin’s gains are pushing it ahead from the rest of the pack. This is the top reason why the ETH-BTC correlation is dropping.

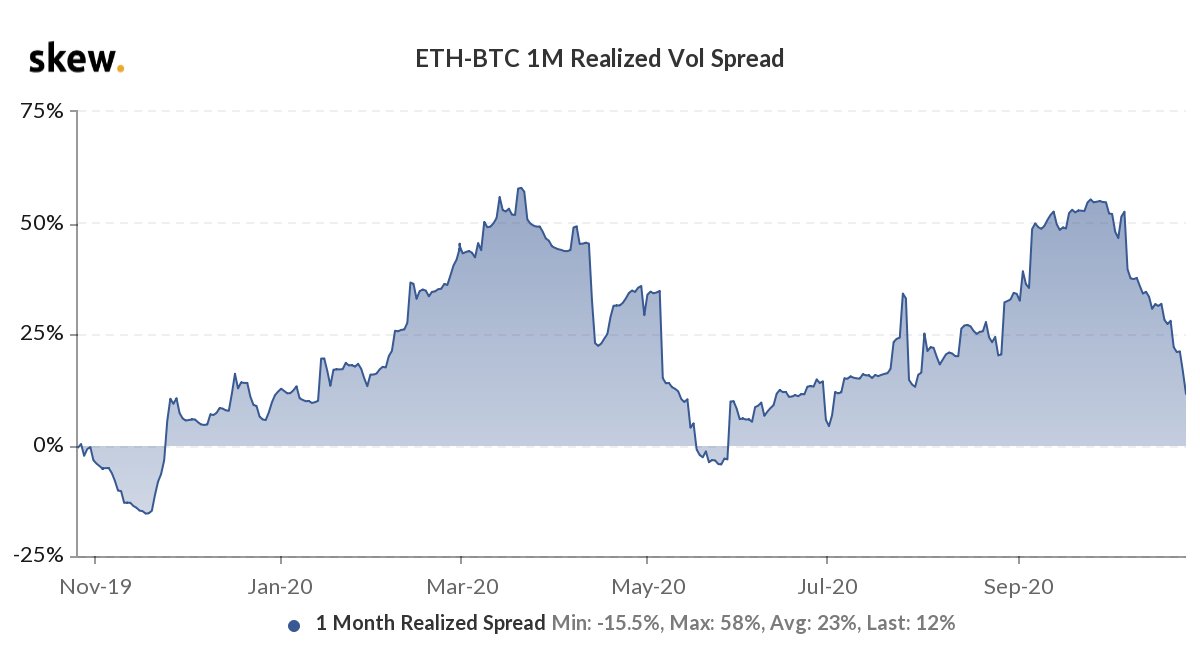

Realized volatility spread || Source: Skew

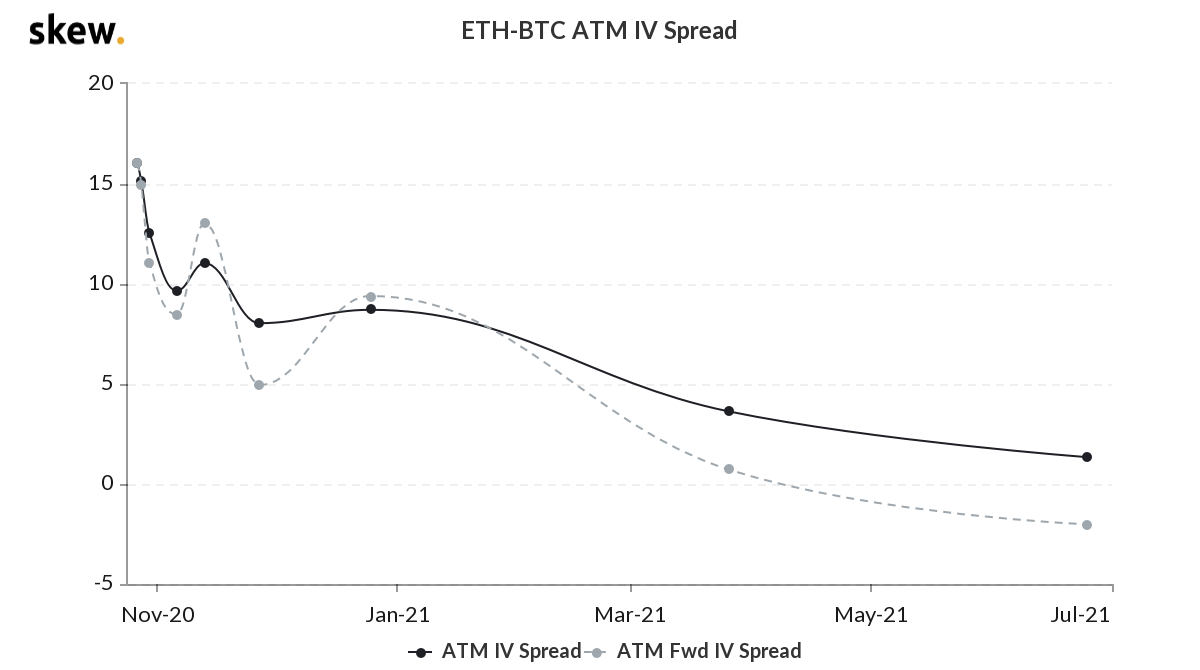

Based on realized volatility spread data from Skew, ETH-BTC spread is dropping, and this signals that ETH’s price may increasingly trend like Bitcoin’s. However, the spread was nearly 50% in mid-September. Bitcoin’s price action hints at an increase in this spread in the near future. The price has already crossed $13k after hitting a high of $13k four days in a row. The implied volatility chart suggests that the spread will continue dropping and the trend won’t change. The Implied volatility for November, December, and 2021 is dropping closer to zero. However, Bitcoin’s rally may surprise retail traders and change the trends in these charts.

Implied Volatility Spread || Source: Skew

The narrative of dropping ETH reserves has no influence on the volatility spread currently. However, interestingly ETH reserves on spot exchanges have dropped just like Bitcoin and Tether.

ETH reserves || Source: Cryptoquant

So reserves for both ETH and BTC are low, and this signals towards scarcity and price hike. However, since ETH has higher volatility, the price may rally higher and within a shorter period of time as compared to Bitcoin. So dropping correlation would possibly have a positive impact on ETH prices in the short-run.

In the past 7 days, Bitcoin’s price is up 12.5% and it’s trading above $13k, for ETH the weekly growth is 5.27%, and it’s trading above $390. As the launch of ETH 2.0 draws closer, ETH’s price may move up faster than the correlation with Bitcoin would. The deposit contract is set to launch by November 6, and if this materializes, ETH’s bull run may precede BTC’s. For BTC, the factors driving prices are different than for ETH. Bitcoin’s price is mostly driven by scarcity, HODLing, Miner’s Position Index. But in the case of ETH, the price is still driven by developments in the launch of ETH 2.0 and actual utility. This makes ETH more similar to XRP than BTC. However, it’s market capitalization and trade volume, maximalist sentiment leads to an increased correlation between ETH and BTC.