Here’s why SushiSwap is pumping?

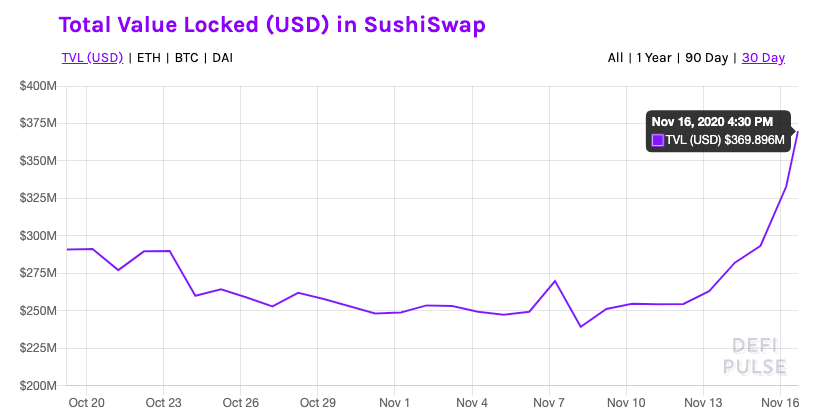

In the past 24 hours apart from making headlines, SushiSwap gained 9.25% based on data from DeFiPulse. The project that earned a reputation as the dead $UNI fork that got hacked by the founder 2 months ago is now working on a strong comeback. The Sushi team has been working in the background. The token’s price was relatively stable for the past 30 days and the recent bullish trend has brought it back to the mainstream.

SushiSwap TVL Chart || Source: DefiPulse

Based on @Wangarian1’s tweet, Sushi’s dark horse narrative comprises of 3 main elements:

- Market proven product yielding stable cashflow

Since its ATH 3 months ago, and the hacking incident, the price has been relatively stable. Post-mid-September of 2020, the volatility is low relative to other DeFi Projects

- Product releases with a strong USP factor

Community governance is heavily ingrained in DeFi and Sushi holders “own” the protocol since they have governance rights and a portion of fees is paid to the protocol. This differentiates Sushi from Uni and this is a USP

- Near term catalyst

The SUSHI-ETH pool pays out double rewards to users to incentivize the provision of liquidity for Sushi. Turning a quick profit cannot be a trader’s only end goal when parking funds in Sushi and guaranteeing it liquidity

Source: Twitter

After the initial Sushi hype faded (when 10x rewards expired in mid-Sep), TVL and the daily traded volume on SushiSwap collapsed considerably. Very few in the community believed that a fork from UNI could last. However, since the hack, Sushi has made a strong case for a comeback.

What’s surprising is that despite being a fork, SushiSwap has already implemented the target business model of UniSwap. 5bps of all traded volume go to Sushi stakers generating ~14% APY. Soon enough these incentives may be paid to stakers in DAI. These incentives are non-subsidized and they are actual dividends to be paid out in DAI, a stablecoin. This reduces the volatility of returns in the long-run. The SushiSwap team has new products in the pipeline for the coming months, and this may possibly ensure steady growth of the token’s price and returns for stakers. The top 3 new products in the pipeline are Bentobox, Gusoku, and MISO, the Sushi Launchpad.

The new products may incentivize more customers to stake on Sushi and as customers pay and use Sushi services, the fees generated count as profits. Due to decentralized governance, profits will be distributed among the stakeholders somewhat like a regular company pays dividends to its stockholders. This may be the closest a DeFi project gets to a company’s business model. Though this wasn’t anticipated by most in the DeFi space, SushiSwap is undead, thriving, and currently pumping.