Here’s why Bitcoin at $487,000 might not be a pipe dream

Bitcoin has emerged to become synonymous with cryptocurrencies, especially to people who are new to the field. Often on introduction to Bitcoin, there have been many direct comparisons with traditional assets and precious metals. After nearly a decade of existence, Bitcoin seems to be proving itself to be a safe-haven asset. However, shouldn’t it be priced as one as well?

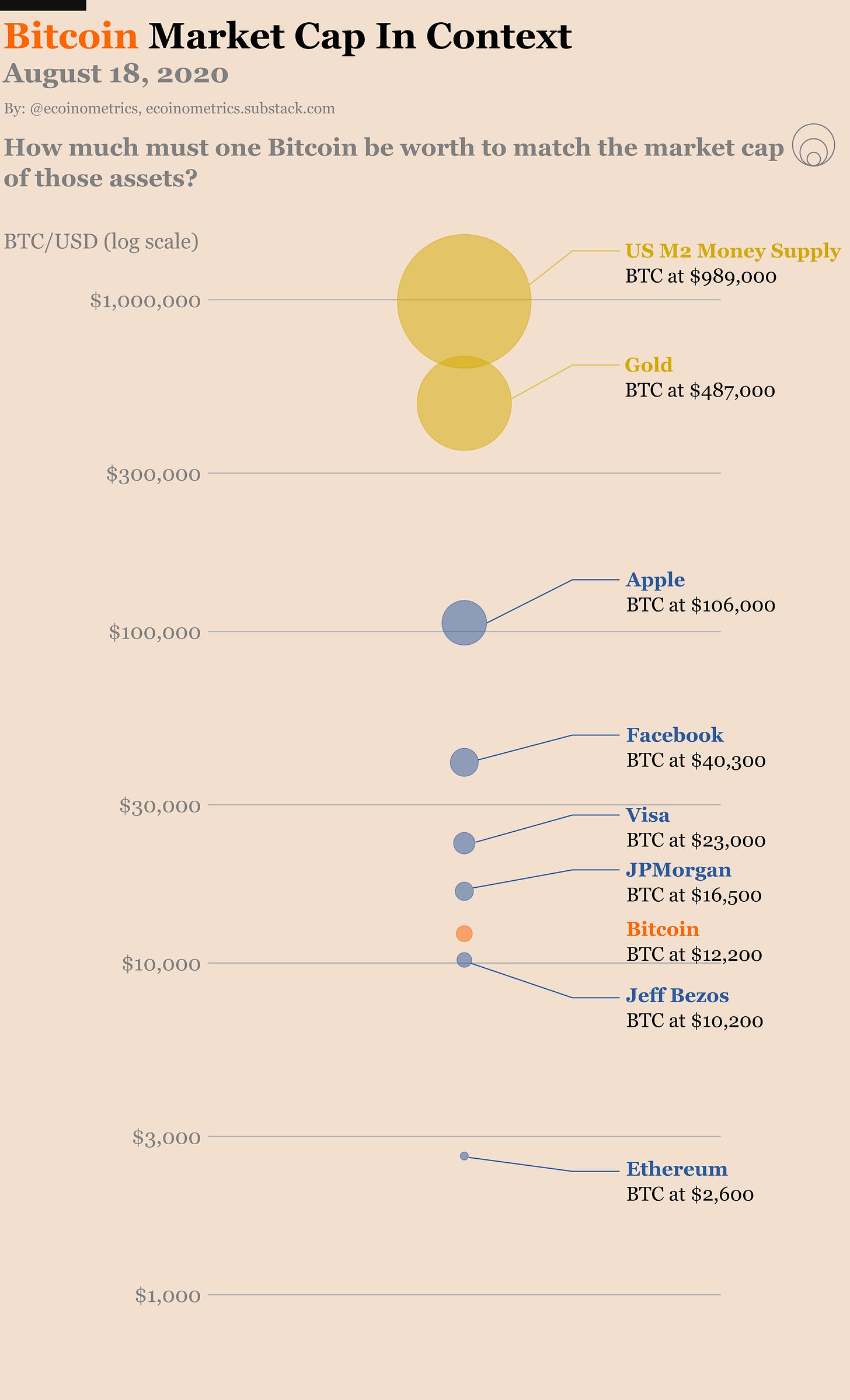

Many traders have been speculating about BTC’s value, how it might climb to a certain value by the end of the year, or even by the next halving. Along the same lines, if BTC were to replace gold as a safe-haven asset, it must climb to a value of $400k, one that will push its market cap to $8 trillion, on par with gold’s, according to the data provided by Ecoinometrics.

With Bitcoin’s present-day market cap noted to be $217.63 billion, the aforementioned value seems ginormous. However, when compared to the market cap of giants like JPMorgan and US M2 money supply, an $8 trillion market cap seems very, very possible.

Source: Ecoinometrics

At the time of writing, Bitcoin’s value was close to $12,000, a finding that put its net worth above that of Amazon founder Jeff Bezos and close to JPM’s market cap. The present-day market outlook is very bullish and if BTC retraces on the charts towards its 2017 glory, close to $20,000, its market cap will be on equal footing with Visa. Doubling this value will put it just $1 trillion short of Facebook’s value.

According to Ecoinmetrics’ calculations, if Bitcoin’s cycle growth follows the average path, the coin’s value might be pushed to $40,000 by the end of the year. On the contrary, slower growth may require a year’s time for Bitcoin to realize this value.

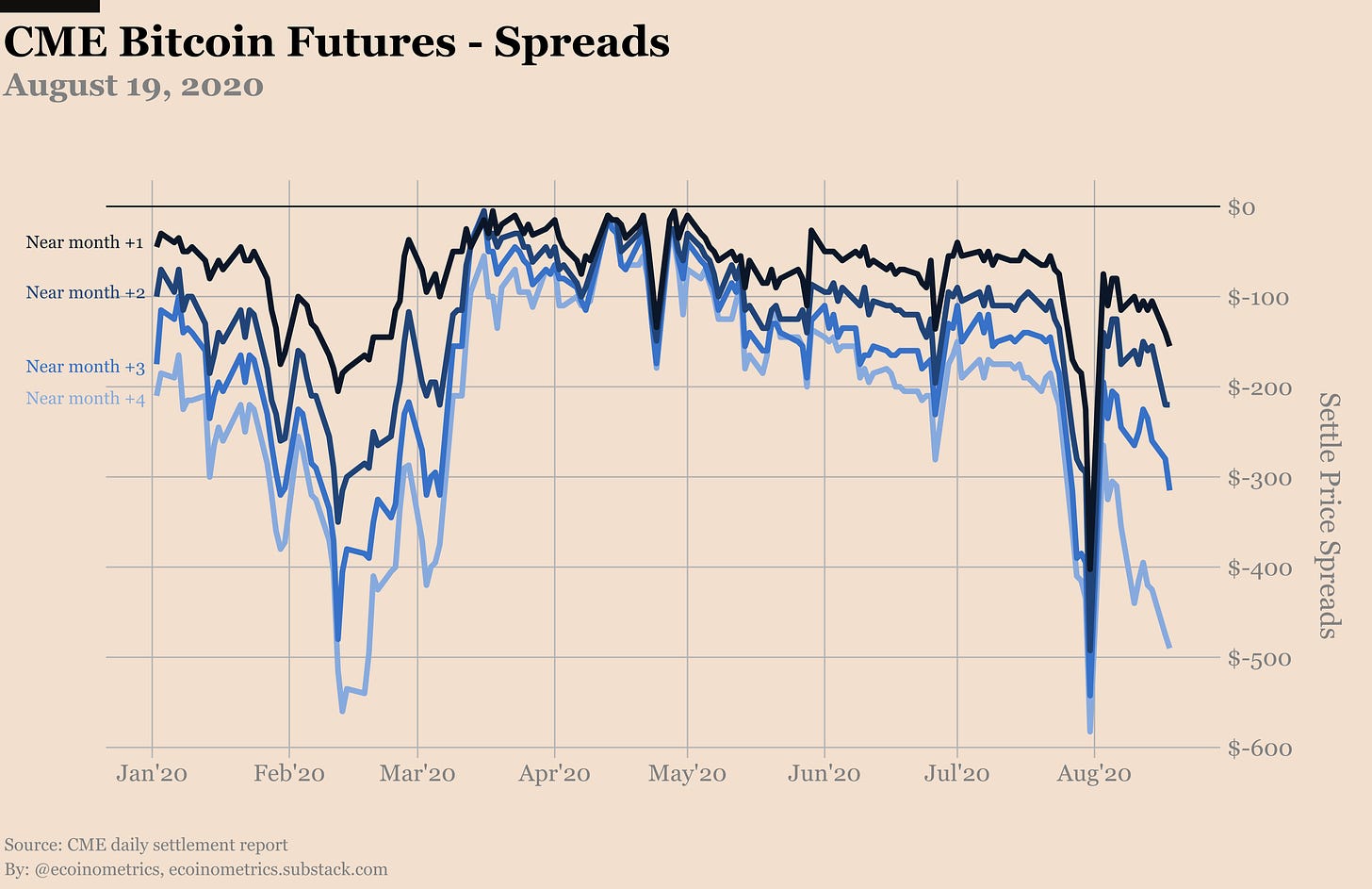

In fact, CME Bitcoin Futures pointed to positive momentum in the market and large spreads that were trading above the 4-month average – A sign of the bullishness of CME traders to trade the digital asset.

Source: Ecoinometrics

Interestingly, the next stop for Bitcoin’s value after $40,000 will be $100,000, a level that also happens to be the target value expected by PlanB’s stock-to-flow model until the next halving in 2024. However, in order to be considered a store of value like gold, BTC needs to be valued at higher than $100,000.

If the present price trends are taken into account, BTC needs to be worth $487,000 to register a market cap of $9 trillion. This would be the top of the range in terms of expected growth for this halving cycle. However, if the digital gold needs to replace actual gold, it has to meet the yellow metal’s market cap.

Right now, it is possible for BTC to achieve a market cap that is equivalent to Apple’s since it is just 10x from now. However, for it to replace gold, there will have to be a great wealth transfer from Boomers to Millenials. This trend, alas, is only expected to play out over the next decade or so.