GMX trading volume explodes amidst crypto market rally

- Trading activity has surged on GMX.

- This was because of the general market rally in the past few days.

Leading on-chain derivatives protocol GMX [GMX] achieved a single-day trading volume of $652 million on 4th December, marking its fourth highest trading volume since the year began, AMBCrypto found.

This surge in trading activity on the protocol coincides with the ongoing rally of major cryptocurrencies, as Bitcoin [BTC] and Ethereum [ETH] continue to trade at yearly highs.

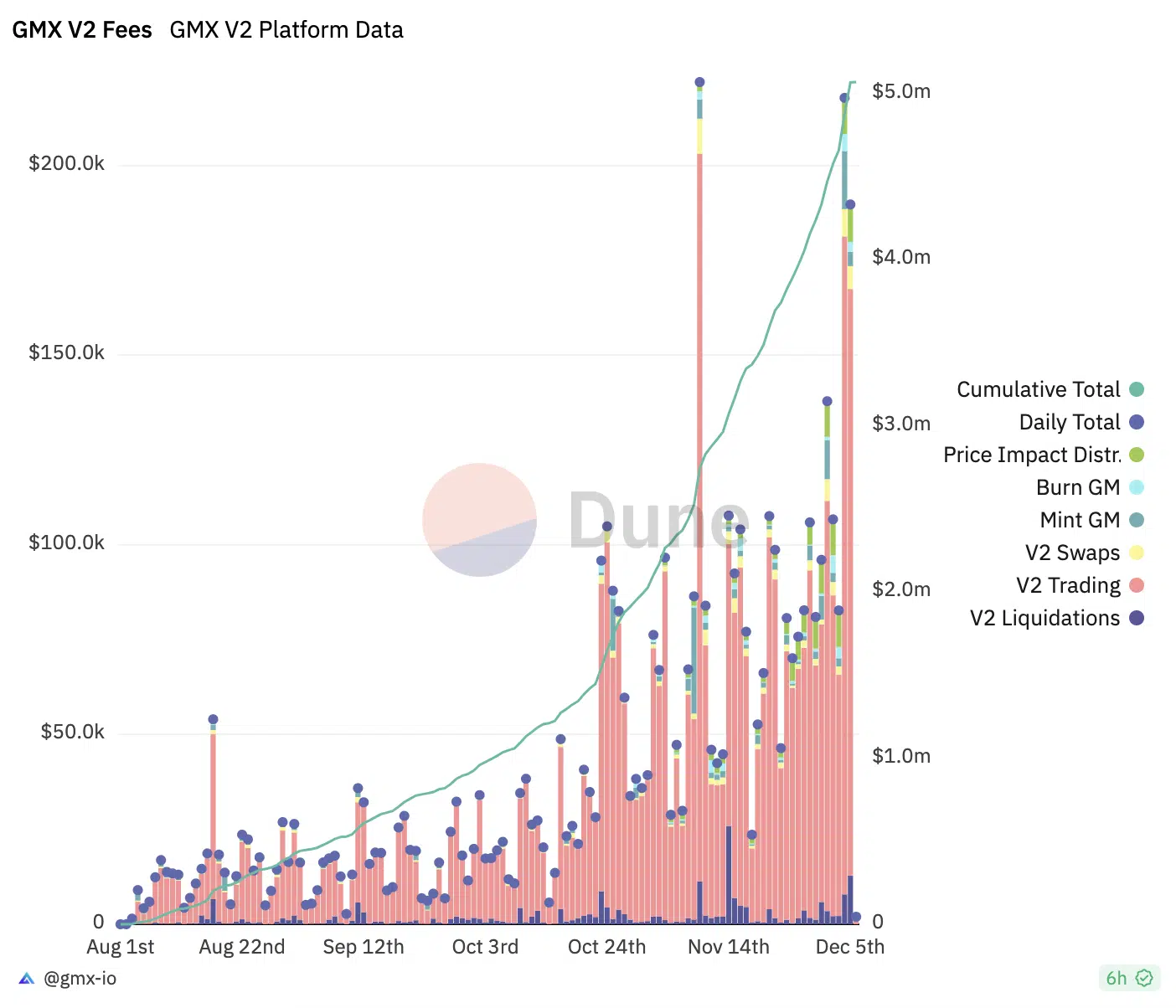

Data obtained from Dune Analytics revealed that the V2 iteration of the trading protocol accounted for $260 million of this volume while generating $218,000 in single-day fees.

This marked the second-highest single-day fee generated by GMX V2 since January. The first one was on 9th November, when the protocol’s fees totaled $222,000.

State of GMX

So far this month, GMX’s total value locked (TVL) has risen by 4%. As of this writing, the protocol’s TVL was $578 million, its highest level since August.

With the increased trading activity recorded in the last week, the value of all derivatives contracts traded on GMX in December has totaled $1.02 billion.

GMX recorded a derivatives volume of $5 billion in November, representing its monthly highest since June, according to DefiLlama.

Regarding protocol fees, GMX has seen a sum of $1.61 million paid in total fees by traders to use the platform in the last week.

The exchange’s monthly fees, which had trended downward since April, rebounded in November to end the 30-day period above $10 million.

Revenue derived so far from this month’s fees is $524,000. In November, GMX saw a monthly revenue of $4 million.

The exchange recorded its highest monthly revenue in March when it pocketed $6 million from the $19 million it received as transaction fees.

GMX’s price action

The exchange’s native token GMX has seen severe price swings in the last month.

Although it has managed to record an 11% uptick during that period, the price growth is likely due to the general bullish sentiments in the crypto market.

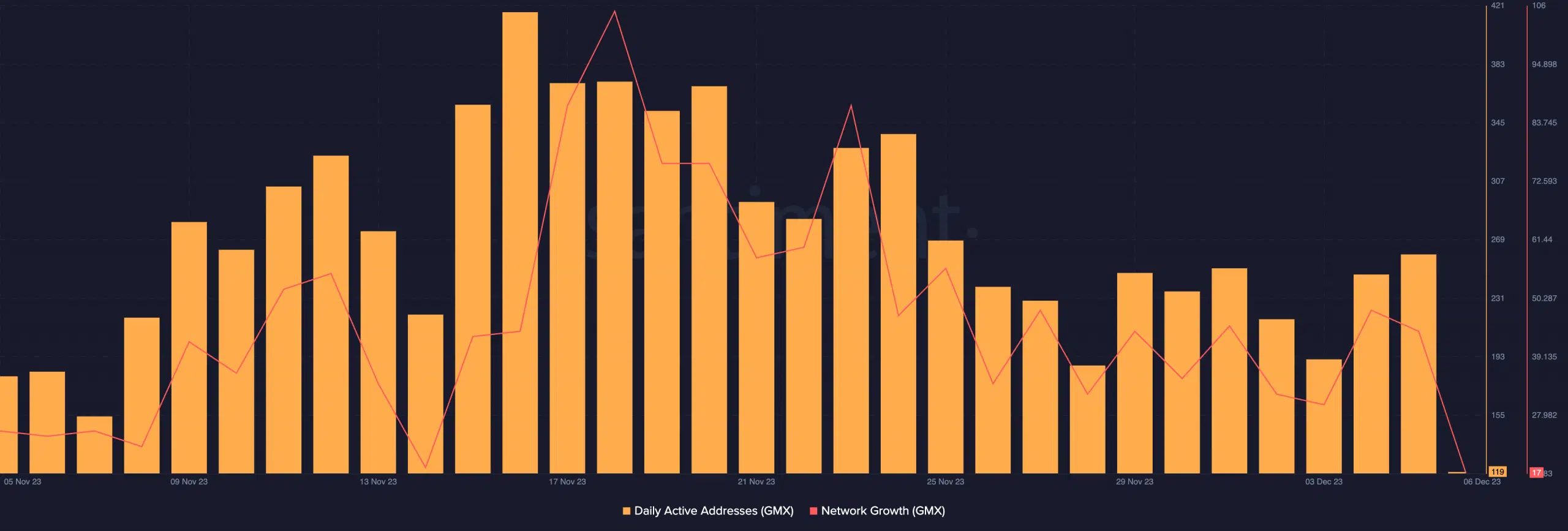

For context, new demand for GMX has trended downward since 18 November, according to data from Santiment. It has since dropped by 55%.

Realistic or not, here’s GMX’s market cap in ARB’s terms

Likewise, the daily count of unique addresses involved in GMX transactions has fallen within the same period.

At 260 as of 5th December, the count of GMX’s daily active addresses has plummeted by 30% since 18th November. At press time, the altcoin traded at $52.