Bitcoin: If $44K is here, can $50K be far behind?

- On the 6th of December, Bitcoin touched prices last seen in April 2022.

- Optimism around spot ETFs could help propel BTC towards $50k.

Bitcoin [BTC] rose 4.88% in the past 24 hours, sitting at $43,522 at press time, per CoinMarketCap. This rally, supported by a multitude of factors, helped the king coin cross $44,408 in the early hours of the 6th of December.

The king coin stayed true to its moniker and rose 16% in the first five days of December, igniting the market and causing a flurry of activity. Keeping these numbers in mind, will BTC reach $50k before 2024 rolls around?

Is panic-buying behind BTC’s rise?

According to most crypto experts, panic-buying could be a major reason why Bitcoin’s price continued to rise. Notably, there could be an element of FOMO and FUD in the market, spurring investors to buy more in anticipation of further price increases.

As a report by Matrixport puts it,

“Traders do not have enough upside leverage, this is the conclusion from the elevated premium that perpetual futures are trading at. This shows panic buying from traders who are closing out shorts or increasing leveraged longs.”

However, panic buying is not the best idea when it comes to cryptocurrencies, given their extremely volatile nature.

Price increases brought on by these methods have historically been temporary, and this is not a good strategy for long-term investors.

Thus, Matrixport’s above report, which talks about traders “closing out shorts,” could be an indicator of a major plummet in the days to come.

Regardless, do not consider this as investment advice, and remember to DYOR before investing in the king coin at this time.

This panic-buying behavior helped the overall crypto market cap hit $1.5 trillion on the 5th of December, which sat at $1.59 trillion at press time, according to CoinMarketCap.

How spot ETFs played a part

One cannot discount the connection between spot ETFs and Bitcoin’s price.

As the market continues to bet on the SEC approving spot ETFs for both Bitcoin and Ethereum, investors have been hopping on the “first-mover advantage” train, hoping to secure some king coins before prices rise further.

Inasmuch, on the 5th of December, Bloomberg analyst James Seyffart noted that Swiss firm Pando had entered the race to launch a BTC-spot ETF.

Before this, on the 1st of December, finance lawyer Scott Johnsson confirmed that the SEC’s deadline to approve the first batch of spot ETFs fell between the 5th of January to the 10th of January.

Now official. https://t.co/NONkklEJq2 pic.twitter.com/V2Q2L3u5o9

— Scott Johnsson (@SGJohnsson) December 1, 2023

Seyffart also affirmed:

“Window is officially Jan 5th to Jan 10th. Really this means that any potential approval orders are going to come on either Monday Jan 8, Tuesday Jan 9, or Wednesday Jan 10. Mark your calendars people.”

If the SEC sticks to its proposed timeline, it would help take Bitcoin’s prices even higher. Increased market bullishness could not only take BTC to $50k, but even $60k by January 2024.

However, we must clarify that this is mere speculation, what-about-isms if you please — a potential look at what Bitcoin can achieve. Regardless of whether BTC reaches $60k, it seems like optimism is enough to sustain the market for now.

In its earlier report, AMBCrypto noted that the market optimism around ETF approvals was helping not only BTC, but Ethereum [ETH] as well.

Notably, the king of altcoins saw a price rise of 3.76% in the last 24 hours, sitting at $2,274.99 at press time.

Will Bitcoin’s rally continue?

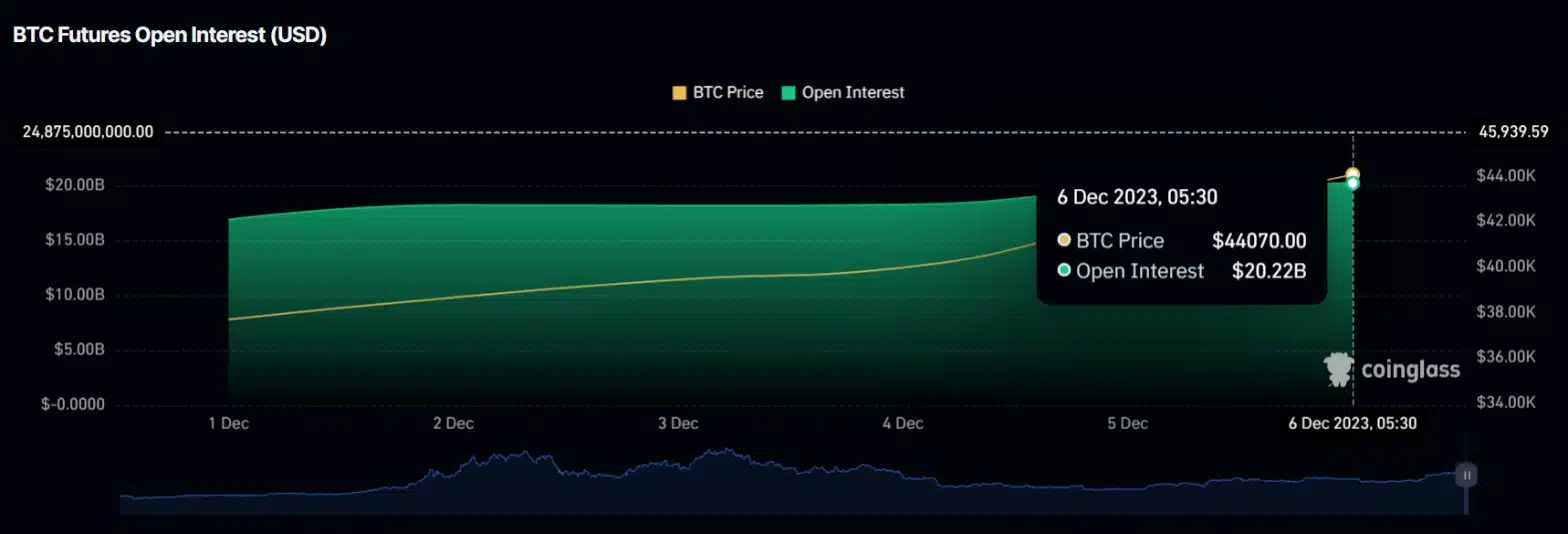

Bitcoin’s metrics showed positive signs about its price trajectory over the coming few days. Notably, its Open Interest crossed $20 billion as of the 6th of December, a number it reached for the first time since December 2021.

Traders often use Open Interest as an indicator to confirm trends and trend reversals. The rising Open Interest and price indicated that new positions were being established at press time, and there was strong demand for BTC.

Thus, BTC could be poised to climb higher. But to reach $50k, the king coin has to flip the levels around $47k into support.

As per AMBCrypto’s analysis of the chart above, BTC’s RSI stood at 78.42 at press time — an overbought zone. The metric showcased the possibility of rising sell pressure.

This notion was supported by the MFI, which showed a slight decline during press time.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, BTC held above the 50-day and 200-day EMAs at press time, displaying the possibility of a continued price rise.

Thus, if investors continue to HODL and not give in to panic selling, Bitcoin may catapult towards the $50k mark before the advent of 2024.