For Bitcoin and crypto deep liquidity to drive institutional interest

2020 has turned out to be quite a turbulent year. Globally markets are in a slump as a result of the pandemic and the lockdown measures imposed in most parts of the world. While governments try to revive the economy with fiscal stimulus packages and increased fiat printing, this may be the right time for many investors to consider decentralized digital assets more seriously.

In a recent episode of the Block Stars podcast, Ripple’s VP, Head of Global Institutional Markets – Breanne Madigan discussed what the future of institutional investment in digital assets is going to look like and what impact will today’s macro-economic situation is likely to have on the crypto markets in terms of adoption. Madigan highlighted the differences between traditional and digital assets market and note that,

“In terms of similarities, in general, investor demand is really driven by speculation. So similar to traditional finance, and we see a lot of interest in yield based products. So you will notice over the last 12 to 18 months, a lot of interest in things like staking and lending are really taking off.”

Madigan highlighted how there has been development in reverse for the crypto markets in comparison to traditional markets. In the case of crypto, it was retail users who were dominant for the longest time and are now seeing institutional investors come in. She noted,

“Retail investors really created crypto and then slowly, institutional investors are coming in. So it was kind of backwards in that way. And also in crypto, we’ve seen the development of things like leverage derivatives before things like index funds and margin trading. So I think the ecosystems have been developed in reverse order.”

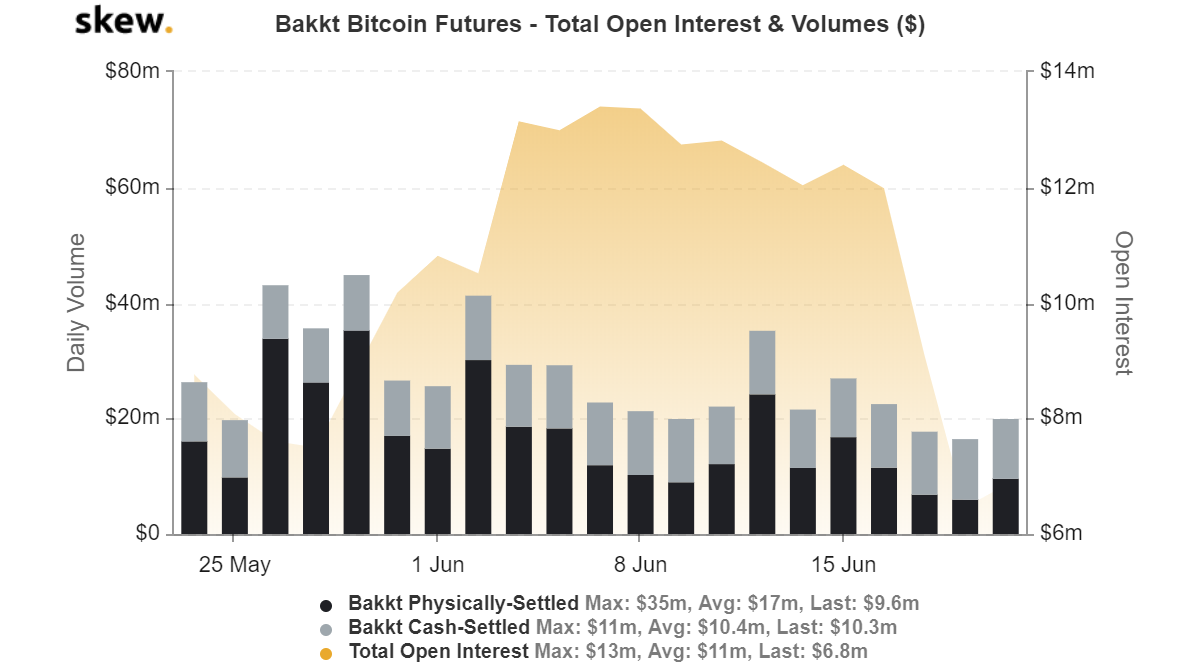

Source: skew

While Bakkt’s launch was considered to be a major turning point for the crypto markets in terms of institutional adoption, in the past month, OI for Bitcoin Futures has taken a substantial hit.

While crypto adoption seems likes quite a promising narrative at the moment, Madigan noted that mainstream institutional adoption of digital assets in the coming years will require greater liquidity. She noted that assets with deep liquidity,

“tend to trade with greater frequency and investors have an easier time getting over the hurdle of taking liquidity risk”

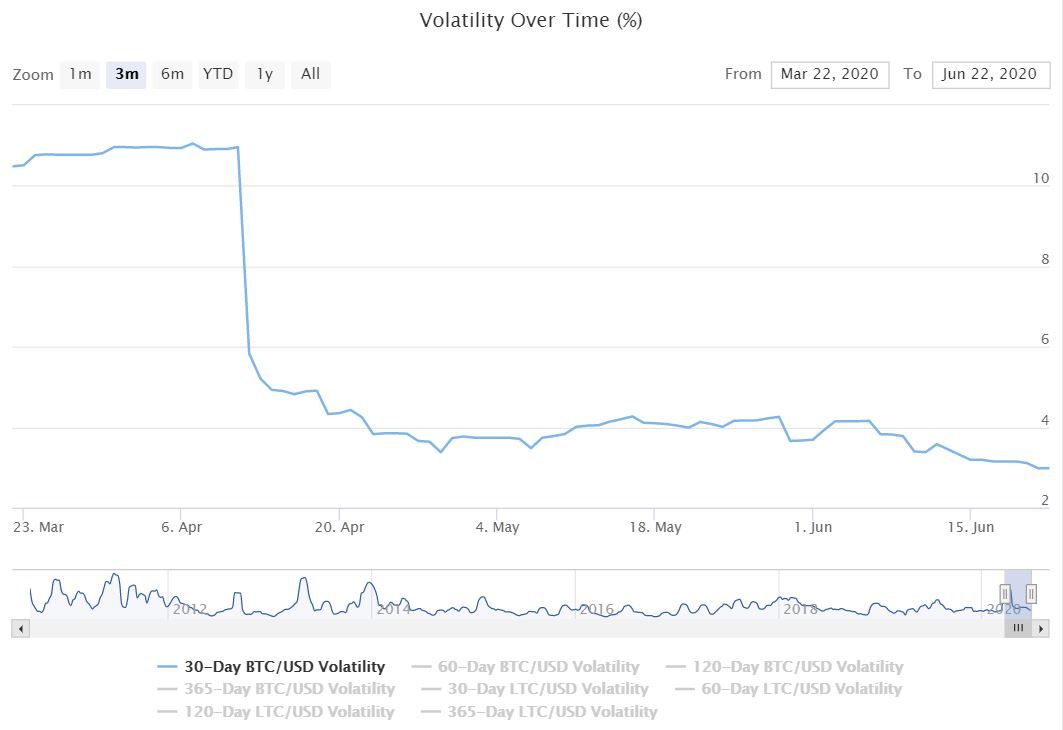

Source: BitPremier

Interestingly for the world’s oldest and largest cryptocurrency, the past few months saw its volatility drop significantly. Bitcoin’s volatile nature has been cited as a major concern for investors that are used to the relative stability of traditional markets. According to data from BitPremier, the king coin’s volatility fell to under 3 percent.