Everything you need to know about Chainlink’s buy opportunity

Since the final quarter of the year 2020 began a few days ago, the cryptocurrency market has been dealing with high volatility and some unexpected losses. While the altcoin Chainlink [LINK] was recording YTD returns of 373% for its investors at press time, LINK has been noting significant losses for its traders over the past few days. This, despite LINK managing to push through the market’s low volatility periods over the past few months.

Source: LINK/USD on TradingView

The attached chart illustrates the changes in LINK’s valuation over the past month. While the low correlation between LINK and major crypto-assets like Bitcoin and Ethereum may have saved it from the previous market-wide depreciation, it has not saved it from the impact of a consolidating market. In fact, LINK’s value has fallen by over 40% in the past 30 days, hurting its traders considerably.

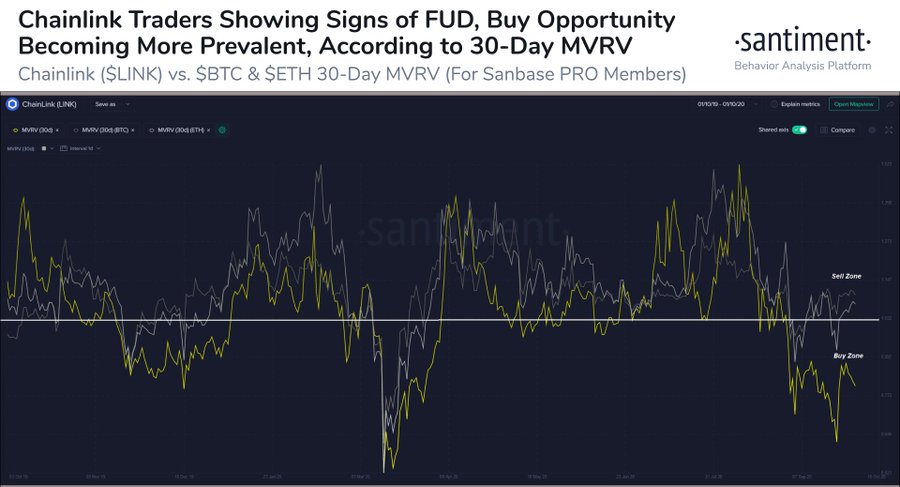

Source: Santiment

Given its low correlation with BTC and ETH, LINK’s Market-Value-to-Realized-Value [MVRV] Ratio entered the low-buy zone. This low value has been hurting traders over the previous 30-day trading span, with most incurring -20% in returns. On the contrary, BTC and ETH traders were breaking-even over the same timeframe.

LINK was able to reap great returns in YTD and noted a peak of $20.71 in August. However, it has fallen considerably since, with skeptics of the project believing that the value of the digital asset shot well beyond its intrinsic value through DeFi hype and greed. In fact, Cryptowhale on Twitter had predicted the fall in the crypto-asset’s value, with the crypto on a downward slope ever since.

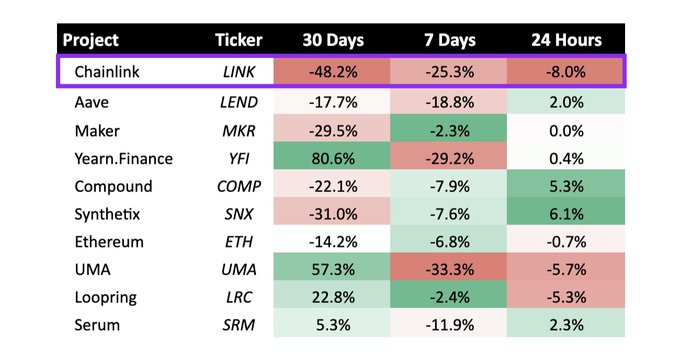

Cryptowhale had said that there was no way to know the top, predicting that panic would take over as soon as the hype settled down. This panic was visible in Chainlink’s market as compared to other DeFi projects, the value of LINK dropped by a greater magnitude, hinting at a possible dump on the charts.

Zeus Capital on Twitter highlighted the difference in the fall of DeFi tokens back in September.

Source: Twitter

With LINK falling down the charts, Chainlink integrators have also been losing market share on decentralized exchanges. In fact, DEX market share for Chainlink integrators plummeted from 54.3% in Q1 of 2020 to 8.5% in Q3 of 2020, as noted by Zeus Capital.

Traders have been most hurt by the falling value of the crypto-asset. Given the volatility in the market, it is now difficult for market participants to predict the way forward.