Ethereum’s MVRV ends 2019 with 0.61; Bitcoin SV found more profitable

The year 2019 took most crypto-projects on a wild ride, one filled with a mix of volatility, adoption, thefts, and expansion to and recognition in the mainstream. However, while some coins were occupied by the rough waves of price volatility, others sailed through. According to recent research by CoinMetrics, 50% of the top 18 coins managed to end the year with an uptrend.

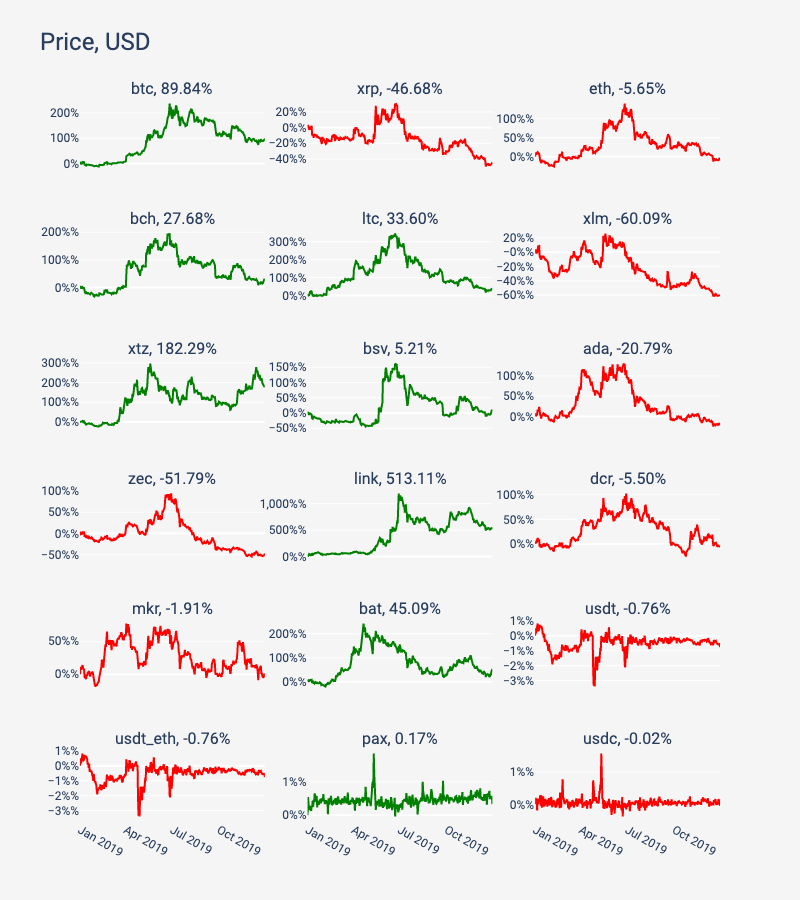

Source: Coin Metrics

Out of the top 18 cryptos, Tezos [XTZ] took the cake for being the most profitable investment for investors as the coin finished the year with gains of 182% after experiencing a late surge. Among the top three coins, only Bitcoin managed to end the year in the green by noting an almost 90% rise. Ethereum was down by 6% and XRP was down by 47%.

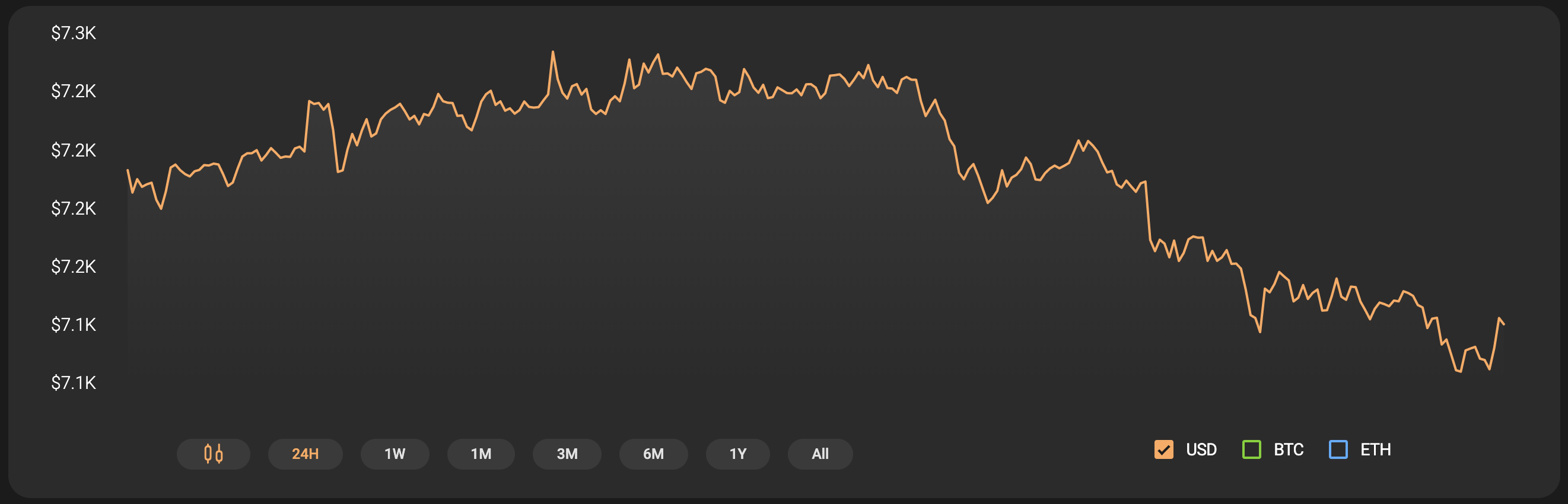

At press time, Bitcoin was priced at $7153 with a 24-hour trading volume of $19.01 billion.

Source: Coinstats

The report added,

“A few mid-cap assets also had a strong year, including Chainlink (LINK), up 513%, and Basic Attention Token (BAT), up 45%. XRP, Stellar (XLM), and Zcash (ZEC) on the other hand all finished in the red, down 47%, 60%, and 52% respectively.”

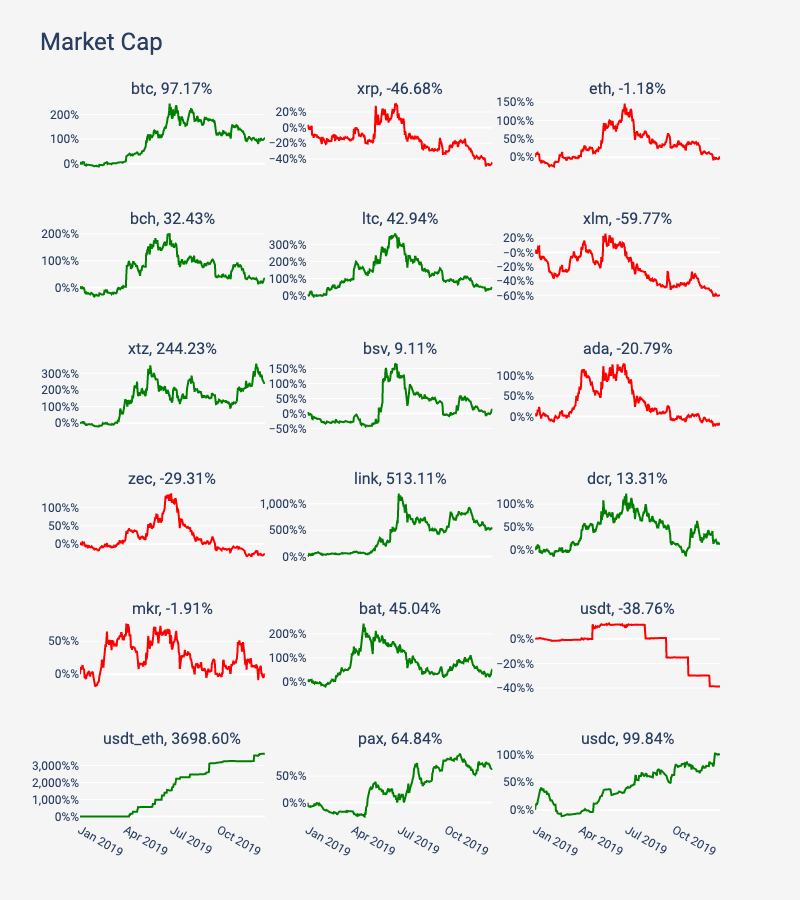

On the other hand, stablecoin Tether on Etheruem [USDT_ETH] had a big year. USDT_ETH overtook Tether on Omni [USDT] in terms of market cap and grew by almost 3700% to a total of $2.3 billion. However, USDT Omni’s market cap fell by 39% to a total of $11.6 billion. Along with USDT_ETH, PAX and USDC too grew by 65% and 100%, respectively.

Source: Coin Metrics

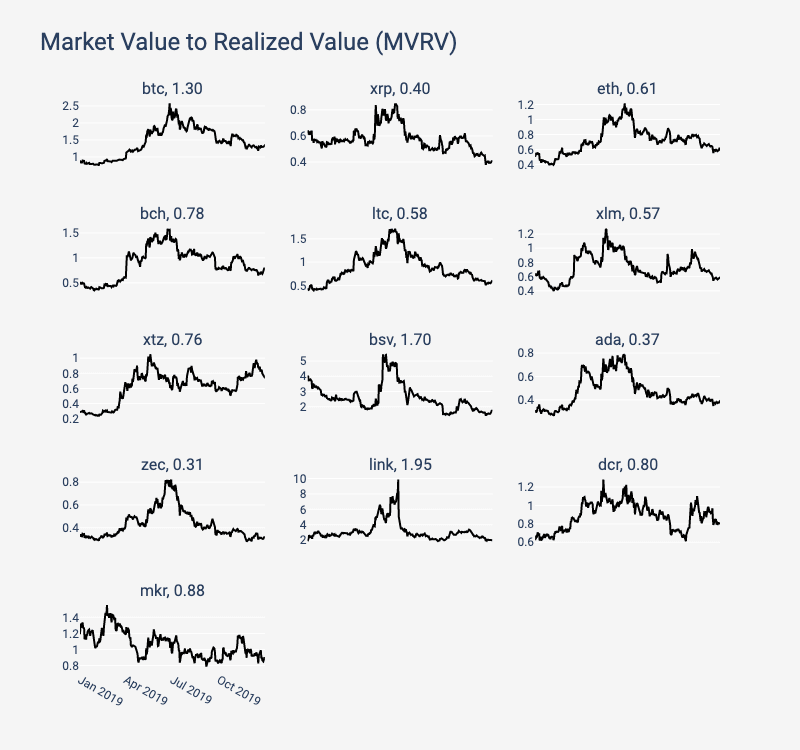

The MVRV [Market Value to realized value] calculated by dividing the market cap by the realized cap has been marked as a potential signal to gauge whether the market participants are in profit or not. BTC MVRV increased over 2019 and finished at 1.33, indicating that “BTC holders were increasingly in profit since the start of 2019 and remained in profit by the end of the year.” Ethereum‘s MVRV grew gradually, but ended at 0.61, indicating that the holders were at a loss by the end of 2019. BSV, which dropped considerably, finished the year at 1.70, well into profit.

Source: Coin Metrics

The MVRV is not indicative of future price rise and the opposite may hold true as the holders in profit are more likely to sell, as seen with most bullish coins post-BTC bull run.