Ethereum’s long-term set up almost complete; 42% surge likely

Ethereum has successfully completed another hardfork, Muir Glacier and awaits another major update, Ice Age. With respect to its price, Ethereum has set up a long term bullish pattern, falling wedge. Falling wedges have a tendency to break out, causing a surge in price.

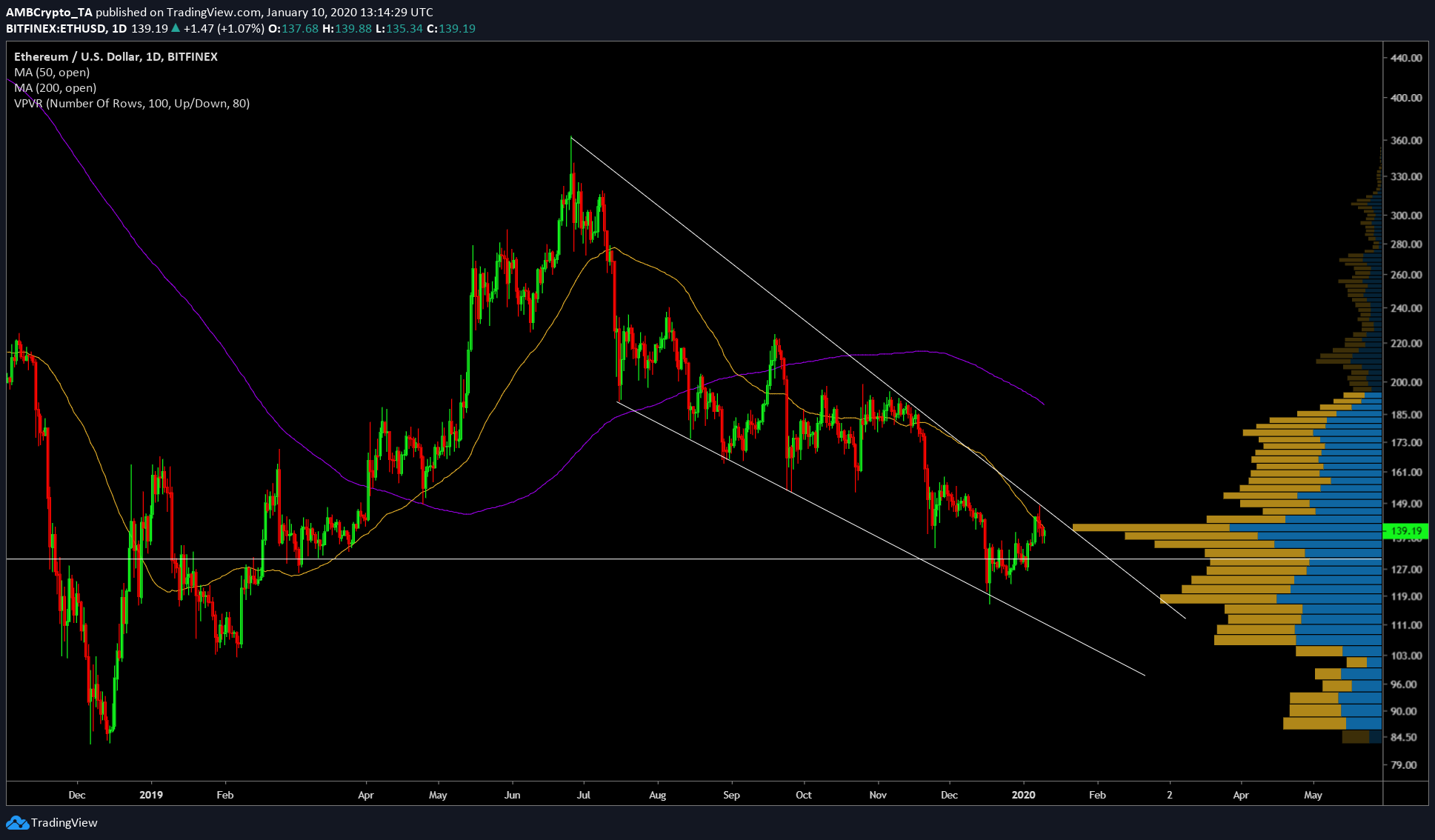

Daily Chart

Source: ETH/USD TradingView

With the price almost nearing the end of the falling wedge pattern, Ethereum has space to drop by 4 to 5%. The price is likely to find support at this range; bouncing off this support might just complete the pattern and allow for a bullish breakout.

Supporting this will be the 50-day MA, which is currently right above the price. A minor surge of the daily candle up to $141 and close above this would be extremely bullish for the second-largest cryptocurrency. The price has been trying to capture this MA for over 3 days. However, the price’s bullish scenario depends on the daily close.

Assuming that the daily close will happen in the next few days, the price has the following resistance levels to overcome to reach that massive 40% surge.

Targets

$142, the first resistance ETH will encounter and is clearly seen in the above chart with an extending yellow bar from the VPVR indicator. The subsequent resistance zones include $152, which might happen in the next month, possibly towards the end of February 2020. A retracement here can be expected, which will push the price back near the $140 zone.

From $152, Ethereum’s journey will be a tough one as it will encounter the 200-day MA, which is a trend-setter. ETH crossing above this MA would be wildly bullish, further causing a golden cross, indicating the start of a bull rally. The 42% surge could be accomplished when Ethereum hits $185, which will put the price very close, yet still below the $200 day MA.

Conclusion

There is a high chance that Ethereum and other altcoins might pump in the coming months. The reason for the pump would be Bitcoin’s halving and dominance. The high correlation of BTC with altcoins will cause a similar surge. So, a 42% rise in Ethereum, up to $185 seems more likely, provided, the daily candle closes above the 50-day MA in the next week.